Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

According to their December research note, Steno Research not only paints bullish price projections for Ethereum in a 2025 altseason but also for Bitcoin, setting eyes on a $150,000 all-time high.

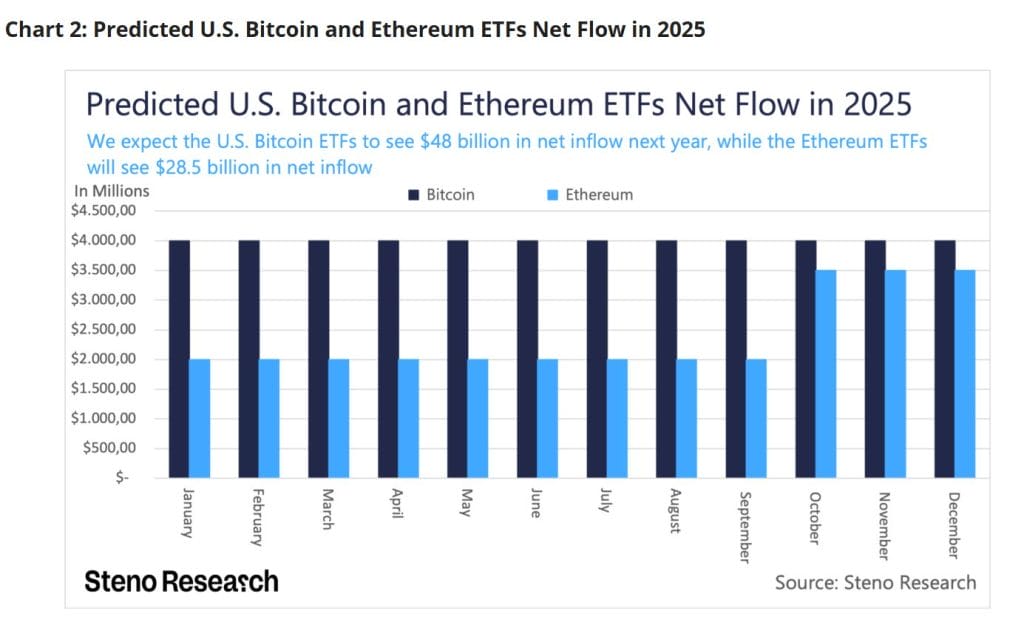

The report cites institutional adoption as the main driver behind these optimistic targets, anticipating “unparalleled levels, further bolstered by significant inflows into U.S.-based Bitcoin and Ethereum ETFs.”

Steno forecasts BTC and ETH exchange-traded funds (ETFs) to see net inflows in 2025 of $48 billion and $28.5 billion, respectively.

While Bitcoin has been the primary market mover thus far, Steno expects altcoins to dominate in 2025, stating they are “increasingly optimistic about an imminent altcoin season” that could see Ethereum outperform the world’s leading cryptocurrency.

This sentiment is echoed by popular X trader Crypto Rover, who notes historical trends of Ethereum outperformance during the year’s first quarter.

Bitcoin Dominance to Fall to ‘Altseason’ Levels

Given this materializes, Bitcoin would find itself further decoupled from the altcoin market.

Steno expects the ETH/BTC ratio to hit “at least 0.06”. That is nearly double the current level of around 0.035, according to TradingView data.

This will usher in a broader altcoin season, with Bitcoin dominance dropping from its current levels of nearly 58% to around 45%, according to the report.

According to Blockchain Centre’s Altcoin season index, the market currently lies at 47, far from its 88 stints in November and the 75 thresholds considered an active altseason.

Bullish Fundamentals Could Make 2025 Altcoin’s Best Year

Steno Research also noted stacking fundamentals in favor of a potential altseason that stands to make 2025 the biggest year for cryptocurrencies yet.

The incoming Trump administration’s “exceptionally favorable regulatory environment for cryptocurrencies” is expected to play a key role in advancing the asset class.

However, this assumes that the argument that the proposition to make the U.S. “crypto capital” is favorable to altcoins as well as Bitcoin holds true, the analysts noted.

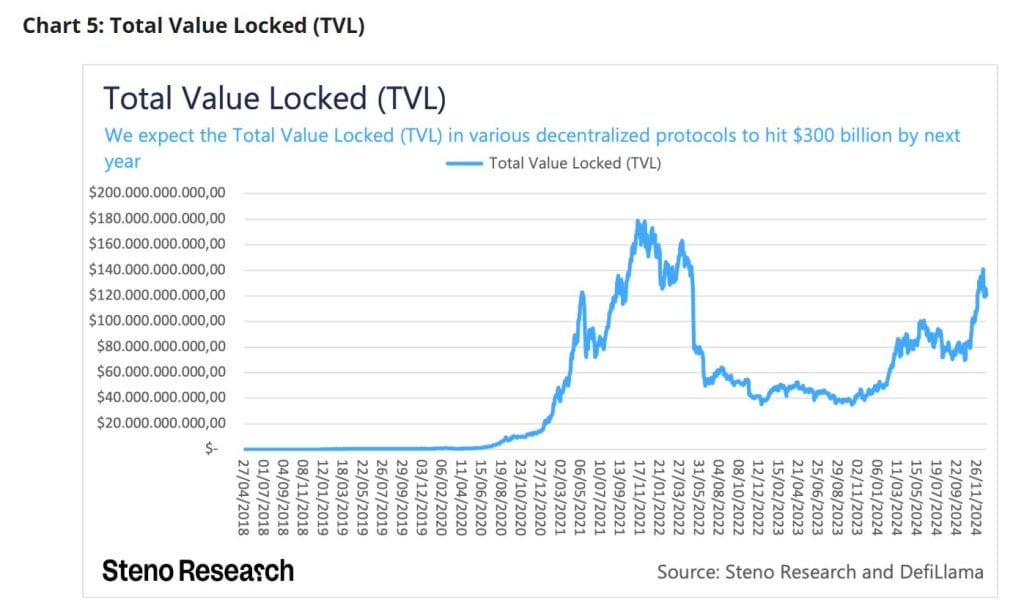

Trump’s presidency “encourages more robust on-chain activity, which benefits altcoins such as Ethereum and Solana significantly,” Steno said, with total value locked (TVL) in dApps to top $300 billion in 2025, far surpassing 2021’s highs of $180 billion.

The report also highlighted that the macroeconomic climate now favors a more risk-on attitude among investors, “marked by declining interest rates and improved liquidity.”

After successfully achieving a soft landing on the following recession concerns in 2024, cryptocurrencies are now a more attractive investment.

However, anticipations of stagflation in 2025, marked by rampant inflation and stagnant economic growth could introduce volatility.

Finally, the report cited “historically strong post-Bitcoin-halving performance” as another factor that could lead to massive movements in the coming year.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.