Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Newer crypto sectors like DeFi and meme coins have recorded notable increases over the past couple of months, but it’s still uncertain if we’re standing on the verge of a full altcoin season (aka altseason) – or we’re just seeing isolated rallies, according to a report by blockchain analytics platform Nansen.

Meme Coins Lead the Pack

Altcoin seasons are phases in the crypto market when alternative coins outperform the number one crypto, Bitcoin (BTC) – not during isolated spikes, but for an extended period.

Each altseason typically lasts a few weeks to a few months. Longer surges and gains tend to be limited to a few coins “that fit a narrative” at that moment.

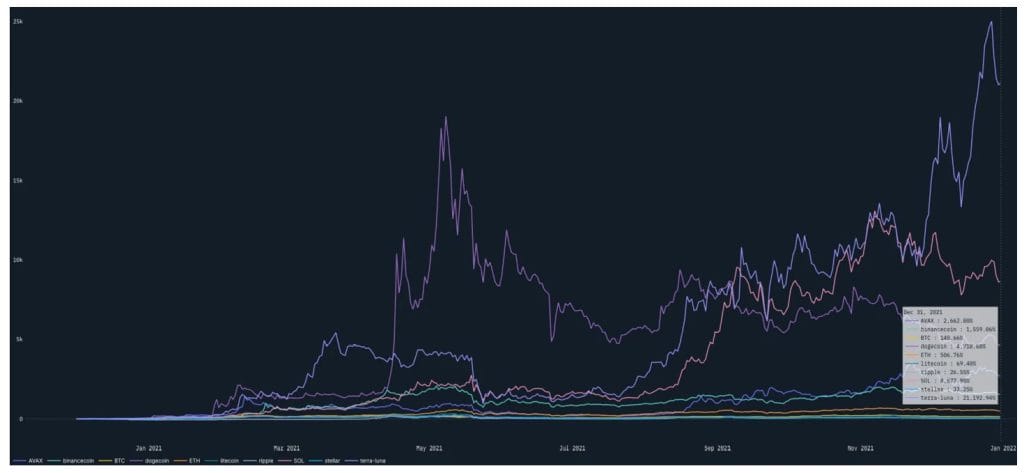

We saw two of the biggest altcoin seasons in late 2017 to early 2018 and late 2020 to early 2021.

These earlier cycles demonstrated “steady growth” for established tokens. However, it was the newer tokens that “captured investor excitement and led in performance.”

Another notable point is that older tokens faced sell pressure from long-term holders looking to cash out.

At the same time, “newer tokens rode the enthusiasm surrounding emerging technologies.”

The cycles bought phases, most notably the ICOs, DeFi, and NFTs. But each phase “illustrates how crypto evolves in cycles, with each wave building on the last and setting the tone for the next big trend,” the report said.

Late 2023 and early 2024 brought another “profitable window for altcoins.” However, per the report, “many argue we didn’t see a full alt season regardless of the price performance.”

Since October, several tokens recorded significant returns. Meme coins are the best performers, while decentralized finance (DeFi) coins “also made a comeback.”

That said, Bitcoin has been hitting new all-time highs over the past ten days. The report argues that it’s possible that investor interest could start rotating into altcoins.

Also, DeFi and newer tokens’ performance may suggest more opportunities for altcoin growth, especially as broader market conditions continue to evolve.

These moves may present an opportunity for investors looking to diversify into riskier assets, especially as Bitcoin stabilizes in this discovery phase.

You might also like

It Seems We’re Not There Yet

Research analyst Nicolai Søndergaard writes that we have plenty of indicators at our disposal, but that these typically lag behind actual market shifts.

Certain macroeconomic and other factors can provide useful insight into the current and potential future state of the market. However, “there’s no clear formula to predict exactly when a broad shift to altcoins might occur,” the analyst stressed.

No single indicator can guarantee the onset of altseason, Søndergaard argued.

To anticipate an altcoin season, analysts observe and analyze macroeconomic factors and specific market indicators.

For example, they will look into the US Federal Reserve’s monetary policy, specifically the Federal Open Market Committee (FOMC) decisions.

However, while the FOMC’s policies and statements can offer guidance, “relying solely on previous meeting outcomes to anticipate an altcoin season is uncertain at best.”

Also, the alt season indicator from Blockchainchenter indicates that we are not yet in an altcoin season.

This is despite certain coins seeing positive price action after a long time.

There are some other indicators analysts observe.

One is Bitcoin dominance. Its drop suggests that investors are reallocating capital into altcoins. This may signal the onset of an altcoin season, Søndergaard said.

Another one is the TOTAL3 index. It represents the market capitalization of all coins excluding Bitcoin and Ethereum. It reflects the broader altcoin market’s strength, the analyst explained.

However, while both of these indicators can show a growing interest in altcoins, both also lag behind market movements, often confirming trends after they have begun.

With all this said, it seems we’ll have to wait for the altseason start for a bit longer.

You might also like