Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

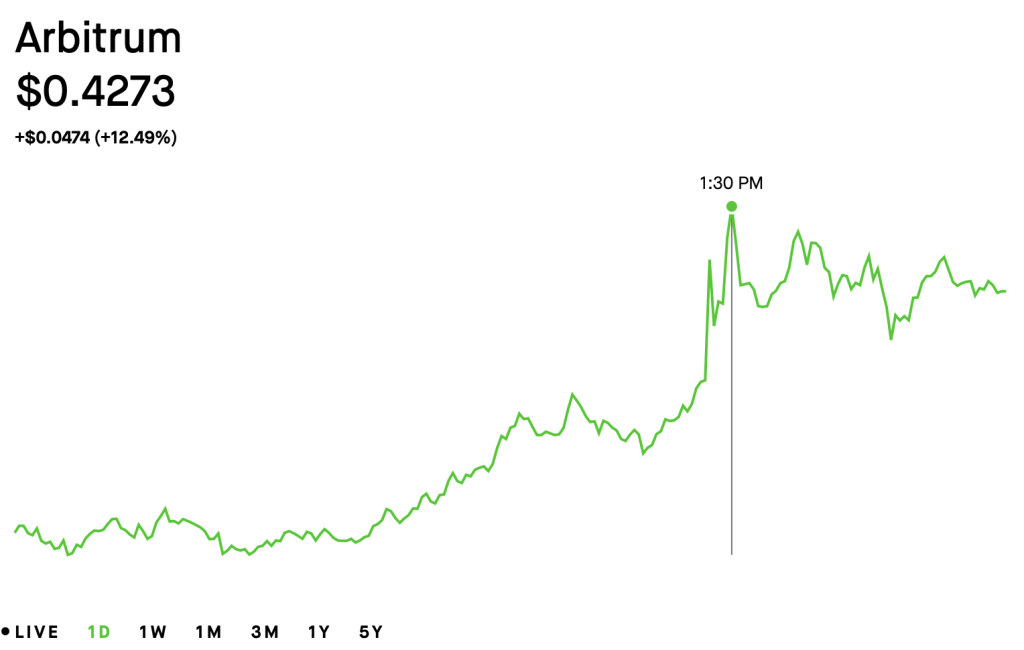

Robinhood announced the listing of Arbitrum (ARB) on its trading platform earlier today, triggering a 12.4% surge in the token’s price to $0.42.

The listing marks a notable milestone for Arbitrum, as it gains exposure to millions of retail investors using the popular commission-free trading app.

“Arbitrum landing on Robinhood is a huge win for the industry and something that would be completely unheard of just six months ago,” Mati Greenspan, founder of Quantum Economics, told CryptoNews.

“Layer 2 tokens reaching mainstream platforms. Even if buyers on RH are purely speculators and will never use it for its most exciting use cases, this level of exposure and liquidity is a major win for the community,” adds Greenspan.

What is Arbitrum?

Arbitrum is a layer-2 scaling solution for Ethereum, designed to improve transaction speed and reduce gas fees while maintaining the security of the Ethereum blockchain.

Built by Offchain Labs, Arbitrum uses a technology called Optimistic Rollups, which processes transactions off-chain before settling them on Ethereum, significantly increasing efficiency.

ARB is the governance token of the Arbitrum One and Arbitrum Nova networks, allowing holders to participate in decision-making related to upgrades, protocol changes, and treasury management.

Since its launch in March 2023, Arbitrum has emerged as one of the leading layer-2 solutions, with billions in total value locked (TVL) across decentralized finance (DeFi) protocols.

Impact of Robinhood Listing

Robinhood’s decision to list ARB provides increased liquidity and accessibility, particularly for retail investors who may have been hesitant to trade the token on decentralized exchanges.

While ARB has seen a double-digit price jump, analysts are watching whether the rally will sustain or if short-term traders will take profits.

As Ethereum’s scaling needs continue to grow, Arbitrum’s role in the ecosystem is expected to expand, potentially driving further demand for its native token.

Robinhood Says SEC Has Dismissed Crypto Investigation

In February, Robinhood announced that the United States Securities and Exchange Commission (SEC) had closed its investigation without enforcement action, effectively ending concerns over alleged sales of securities on the platform.

The SEC initially launched its probe into Robinhood Crypto last spring, notifying Robinhood’s digital asset branch via a Wells Notice that it would likely face regulatory consequences for allegedly selling securities.