Cathie Wood’s ARK Invest resumed active trading of crypto-related stocks in August after selling an additional $14.7 million of Coinbase shares and investing $21 million in the Ether Staking ETF 3iQ.

Crypto Trades Resurface at ARK Invest

Cryptocurrency-related trades have regained momentum at Cathie Wood’s ARK Invest. The firm returned to trading tens of millions of dollars in crypto-related stocks and exchange-traded funds (ETFs) in a single day.

After resuming notable sales of Coinbase stock in July, ARK increased its sales in August, dumping 69,069 Coinbase shares on August 1.

According to data from TradingView, this amount is worth $14.7 million based on the stock’s closing price. The transaction is ARK’s largest Coinbase sale since early April and late March when the firm sold around 60,000 Coinbase shares daily.

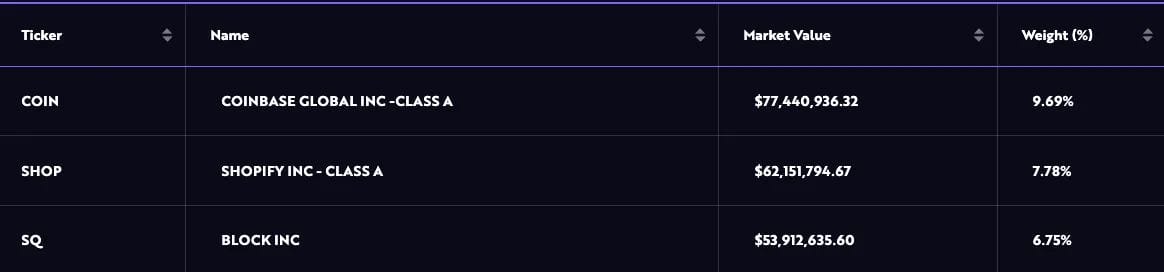

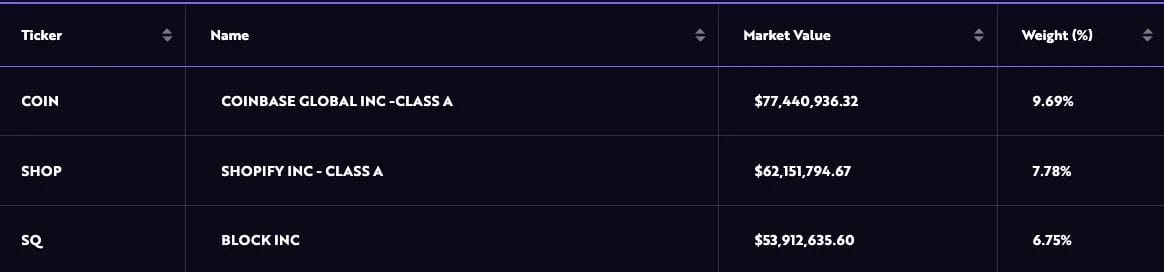

Despite resuming heavy Coinbase sales, ARK’s funds still hold substantial Coinbase shares. Coinbase remains the top asset in the ARK Fintech Innovation ETF (ARKF), accounting for nearly 10% of the fund’s portfolio.

ARK’s massive Coinbase sale came as the exchange reported $1.4 billion in total revenue in the second quarter of 2024.

ARK Makes First Buy of 3iQ Ether Staking ETF

After selling Coinbase shares, ARK made its first purchase of the Canada-based 3iQ.

Launched in 2021, 3iQ expanded the product with staking in 2023 in collaboration with Coinbase and Tetra Trust.

The Ether Staking ETF (ETHQ.U) seeks long-term capital appreciation by investing in Ether and generating passive rewards through staking.

Since our staking program began last October, the 3iQ Ether Staking ETF has seen +24% growth in its units outstanding. It is one of few Canadian ETH ETFs to see net creations in 2024 and is currently the only ETF with staking integrated today. Welcome new investors and thank you… pic.twitter.com/miHhidWRLI

— 3iQ Digital Asset Management (@3iq_corp) June 14, 2024

ARK’s trading data shows the firm purchased 1.7 million ETHQ.U shares on August 1, worth around $21 million according to TradingView data. The 3iQ Ether staking ETF has grown significantly recently, surging around 40% so far this year.

Around one million ETHQ.U shares from this amount were allocated to the ARK Next Generation Internet ETF (ARKW), with the remaining 651,713 shares purchased through the ARK Fintech Innovation ETF.

ARK Moves Away From Bitcoin ETFs

In addition to selling Coinbase stock, ARK has also sold shares from its Robinhood stash and its own spot Bitcoin ETF.

The investment firm offloaded 108,751 ARKB shares from its ARKW fund on August 1, totaling around $6.9 million based on data from TradingView.

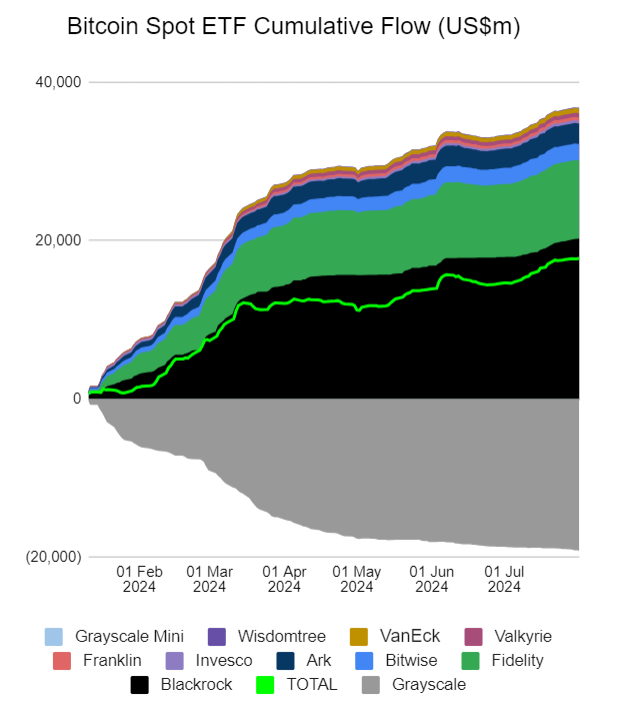

According to Farside data, this move coincides with the ARK 21Shares Bitcoin ETF (ARKB) and others experiencing a slowdown from the explosive inflows observed at launch.

This may be interpreted as a move to capitalize on the growth expected from Ethereum ETFs following their launch.

Despite their disappointing reception, it is early days for the new Ethereum products, which could still gather momentum.

Jag Kooner, head of derivatives at Bitfinex, believes that this will “attract inflows roughly a third the size of Bitcoin ETFs in the long term, aligning with the relative market caps and trading volumes of the two cryptocurrencies.” He added:

“While Bitcoin’s market cap is approximately 3.3 times that of Ether, the inflows into Ethereum ETFs are expected to be anywhere around 30% to 50% of those into Bitcoin ETFs.”

Kooner also noted that the market has seen higher volatility since the launch of Ethereum ETFs.

Ethereum has experienced a “muted price response,” which aligns with expectations following a sell-the-news event, similar to the Bitcoin ETF launch, where BTC price fell post-launch in January.