Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The Avalanche Foundation has finalized the repurchase of 1.97 million AVAX tokens previously held by the now-defunct Luna Foundation Guard (LFG).

These tokens were initially acquired to bolster the Terra blockchain ecosystem but have since been reclaimed.

The Avalanche Foundation described the buyback as a strategic move to ensure compliance with original agreements and to shield the tokens from potential complications in a bankruptcy liquidation.

AVAX Tokens Appreciate in Value Amid Market Rally

At the time of the agreement, the tokens were valued at $45.5 million, though their current market price places their worth at approximately $53 million.

The Avalanche Foundation emphasized that this move ensures LFG adheres to initial usage restrictions while enabling Avalanche to reclaim its tokens.

Per the project, the reclaimed AVAX will support the Avalanche ecosystem through initiatives such as grants, events, and incubation programs.

The LFG was established in 2022 by Terraform Labs founder Do Kwon to safeguard Terra’s algorithmic stablecoin, TerraUSD (UST).

To stabilize UST, LFG amassed reserves of Bitcoin and other altcoins, including a $100 million allocation of AVAX.

Additionally, Terraform Labs swapped $100 million worth of Terra (LUNA) tokens for AVAX to foster ecosystem alignment.

However, the Terra ecosystem collapsed in May 2022 after UST lost its dollar peg, leading to a catastrophic decline in LUNA’s value.

Following the collapse, the Avalanche Foundation sought to reclaim the AVAX tokens.

On October 12, it announced a negotiated agreement to repurchase the holdings.

At the time, Terraform Labs, the company behind the Terra blockchain, noted in its filing that the settlement wouldl reduce litigation costs and preserve more assets for creditors.

The settlement price was calculated based on the volume-weighted average price of AVAX over a seven-day period in early August 2024.

Judge Signs Off on $4.5B Terraform, Do Kwon Settlement

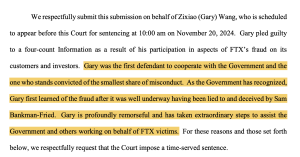

In July, U.S. District Court Judge Jed Rakoff of the Southern District of New York (SDNY) approved a settlement that will require Terraform Labs and Kwon to pay a staggering $4.5 billion in disgorgement and civil penalties.

Additionally, they will be permanently banned from engaging in any transactions involving “crypto asset securities,” which includes tokens within the Terra ecosystem.

The settlement came after initial proposals from the SEC suggested a $5.3 billion penalty, which Terraform Labs contested by advocating for a maximum fine of $1 million.

Ultimately, on June 6, the legal representatives for both Kwon and Terraform Labs agreed to the SEC’s revised settlement offer of $4.5 billion.

It is important to note that Kwon, who is currently in custody in Montenegro awaiting a decision on his extradition, did not attend the trial where the settlement was reached.

Terraform Labs, currently operating under Chapter 11 bankruptcy protection, faces the challenge of how to fulfill the substantial financial obligations imposed by the settlement.

According to the trial testimony of the company’s current CEO, Chris Amani, Terraform Labs has approximately $150 million in assets.