Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

November marked a significant turning point in the cryptocurrency market, with monthly exchange volumes reaching a three-year high of $2.9 trillion and traders searching for the best crypto to buy now.

This surge followed Donald Trump’s U.S. presidential election victory, which fueled hopes of pro-crypto regulatory changes.

However, Bitcoin’s struggle to break the $100,000 barrier, despite a 38% monthly gain, has kept investors cautious.

Amid this consolidation, altcoins like Ondo Finance (ONDO), JasmyCoin (JASMY), and Chainlink (LINK) are gaining traction as some of the best crypto to buy in the current market.

Ondo Finance (ONDO): Price Rally and Technical Indicators Suggest Momentum

Ondo Finance has quickly risen as a notable project in decentralized finance (DeFi), offering tokenized real-world assets (RWAs) and fixed-yield loans.

Its recent price rally of 44.88% between December 2 and 3 pushed ONDO to a new all-time high of $1.80 before stabilizing at $1.69.

Technical analysis highlights a robust upward trend, with the Relative Strength Index (RSI) reading at 85, signaling overbought conditions.

Open interest in ONDO futures has surged, rising from $185.45 million to $304.53 million, indicating growing market confidence.

If momentum persists, ONDO may approach the $2 mark, though traders should remain cautious about potential pullbacks given its strong rally.

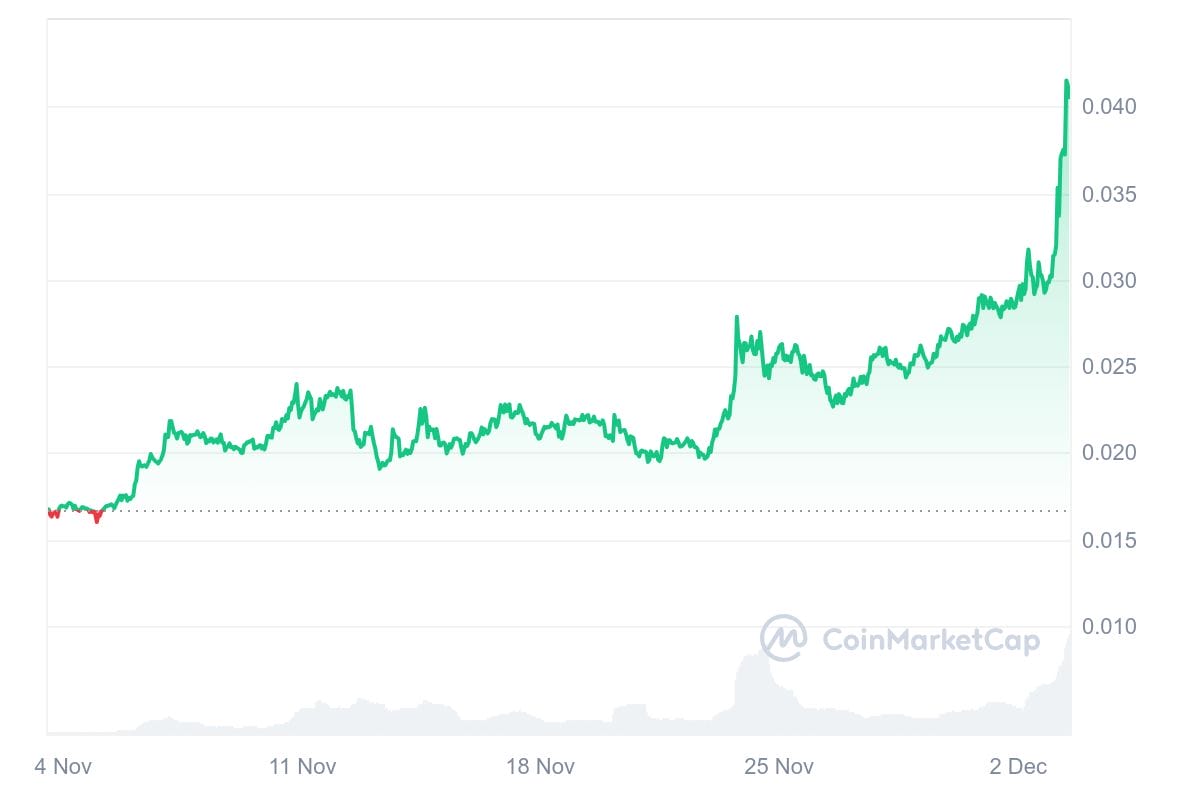

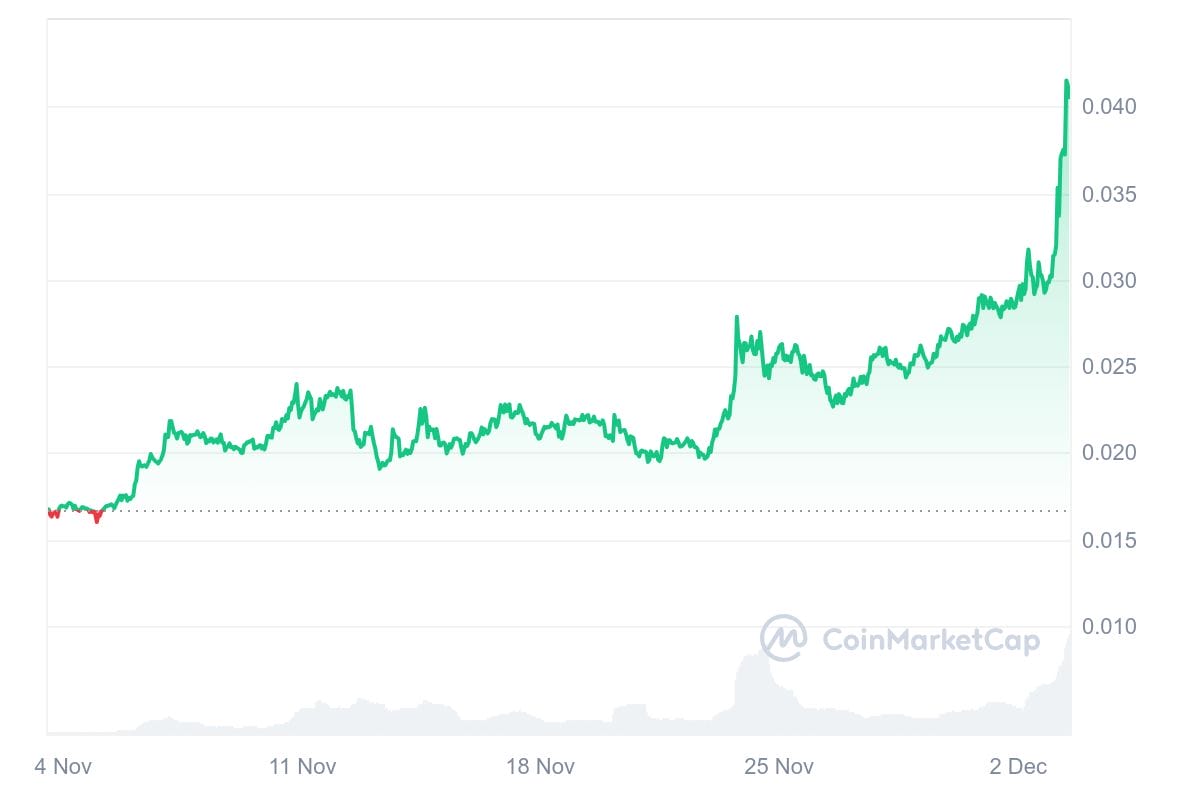

JasmyCoin (JASMY): Fibonacci Levels and Bullish Patterns Drive Gains

JasmyCoin, often called “Japan’s Bitcoin,” has shown strong bullish momentum backed by technical patterns.

The token surged 40.5% in the last 24 hours to $0.4068, building on a broader uptrend that began on November 5 and saw a 145% increase in its value.

The price action has formed a rounding bottom reversal pattern, a classic indicator of sustained upward movement.

JasmyCoin is currently trading near the 100% Fibonacci retracement level at $0.04077, with upside targets at $0.0522 and $0.0717.

However, key support at the 78.6% Fibonacci level of $0.0335 could be retested before the next leg higher.

Chainlink (LINK): Ascending Channel and Golden Cross Bolster Uptrend

Chainlink has strengthened its technical position as its LINK token trades above $24, following a 123% surge over the past three weeks.

Recent price action includes an intraday gain of 26.14%, supported by technical indicators signaling sustained buying interest.

The token is trading within an ascending channel pattern, with a Golden Cross between its 50-day and 200-day exponential moving averages (EMAs) highlighting bullish momentum.

Maintaining support above $20 may allow LINK to retest resistance at $30.

Conversely, a bearish reversal could see prices decline toward the lower trendline support at $17.

Better Alternatives and Market Outlook

The cryptocurrency market is experiencing a renewed wave of optimism, partly driven by increasing institutional participation.

MicroStrategy recently purchased 15,400 Bitcoin for approximately $1.5 billion, bringing its total holdings to 402,100 BTC.

Similarly, Genius Group has advanced its “Bitcoin-first” strategy by acquiring 172 BTC for $1.8 million, aiming to allocate 90% of its reserves to Bitcoin.

These high-profile moves underscore the growing confidence in Bitcoin’s long-term value, even as its price consolidates below $100,000.

At the same time, the altcoin market is gaining prominence as up-and-coming projects and presale tokens attract investors seeking high-growth opportunities.

Top 11 Cryptocurrencies to Watch in December 2024 Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.