Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

As Americans vote today in one of the closest election races in decades, investors consider what could be the best crypto to buy now.

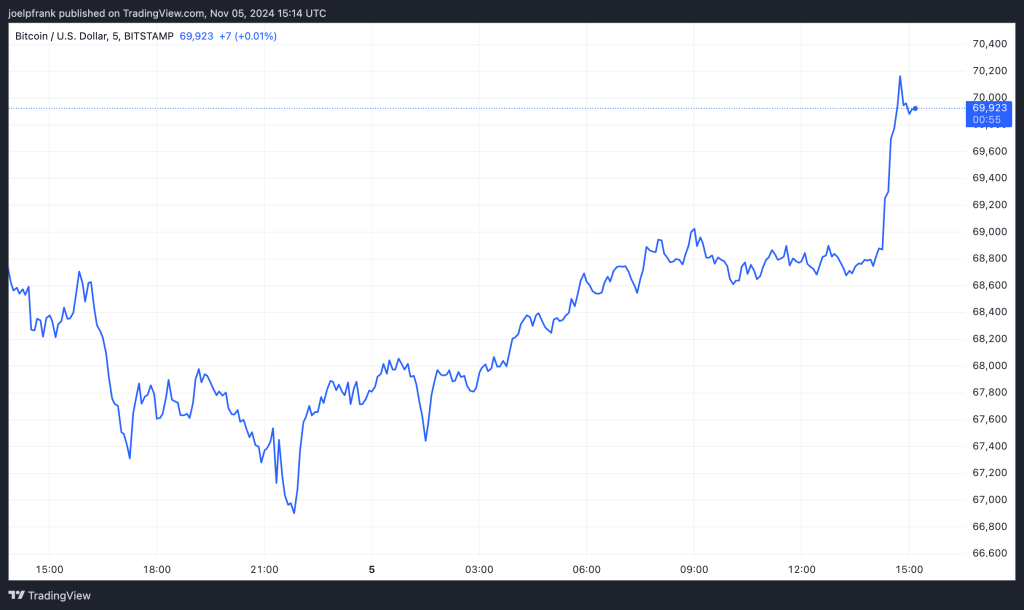

Bitcoin (BTC) surged toward $70,000 in recent trades, reflecting the increased odds of a pro-crypto stance if former President Trump wins.

However, today is likely to be highly volatile as investor sentiment shifts with each change in election projections.

Looking ahead, the best cryptocurrency choices may hinge on the US election outcome. Crypto narratives could shift dramatically depending on who wins.

Potential Narratives if Trump Wins – What’s the Best Crypto to Buy Now?

Pro-crypto former President Donald Trump is broadly seen as more favorable for the crypto market.

Trump has openly endorsed Bitcoin and even pledged to establish a national Bitcoin stockpile when he spoke at the Nashville Bitcoin Conference earlier this year.

Pro-crypto ex-US President Donald Trump is broadly seen as more favorable for the crypto market.

Trump has openly endorsed Bitcoin, and pledged to establish a national Bitcoin stockpile when he appeared at the Nashville Bitcoin Conference earlier this year.

Tesla founder Elon Musk may form a new Department of Government Efficiency (DOGE) under a Trump administration, which could boost interest in Dogecoin (DOGE), a crypto Musk has long supported.

Additionally, if Republicans secure both the House and Senate, we may see increased bets on broad crypto industry regulations in 2025, benefiting various cryptos.

It may also pave the way for additional crypto ETFs, potentially for Solana (SOL) or Ripple (XRP).

Trump’s pledge to remove SEC chairman Gary Gensler on “day one” may benefit cryptos currently facing regulatory challenges, particularly those labeled as securities, such as Solana and Cardano (ADA).

Additionally, Trump’s involvement in decentralized finance (DeFi) could lead to growth in this space, as he has promoted a Trump family-affiliated project called World Liberty Financial.

This could provide a strong narrative for DeFi-related tokens like Aave (AAVE), a prominent protocol in the sector.

If major cryptos reach new all-time highs following a Trump victory, there could also be a resurgence in meme and altcoin interest, further driving market enthusiasm.

However, Trump’s policies, including proposals on tariffs and spending, may bring inflationary pressures, potentially reducing the scope for Fed rate cuts, which could dampen market optimism.

Potential Narratives if Harris Wins

Democrat candidate Kamala Harris is seen as less favorable to crypto than Trump, so her victory could lead to an initial market dip.

Cryptos expected to perform well under Trump’s pro-crypto stance may face more challenges if Harris takes office.

For example, Dogecoin could lose momentum with the unlikelihood of a new Department of Government Efficiency.

A Harris win might signal a continuation of the SEC’s cautious approach to crypto, meaning that additional ETFs for tokens like Solana or XRP could face delays.

Consequently, these assets may struggle to gain traction as leading investment picks. However, any substantial dips might be quickly absorbed by the market.

Despite Harris’s less aggressive crypto stance, she has indicated an openness to fostering growth in the US crypto industry.

The macroeconomic backdrop could remain supportive for established cryptos like Bitcoin and Ethereum, as the Fed maintains an easing stance, and the economy continues to grow.

Harris’ policies might contribute to “goldilocks” economic conditions—stable growth with moderate inflation—potentially benefiting major cryptos in the long term.

Under a Harris administration, debt levels would likely increase, but her stance against new tariffs could help moderate inflation risks.

While a short-term decline in the crypto market is possible, the long-term outlook remains strong.

If Harris prevails, Bitcoin and Ethereum could stand out as the best cryptos to buy now, as they may benefit from regulatory approval and their reputation as more established assets.

With the election in full swing, the crypto market’s trajectory remains tightly intertwined with political dynamics, likely shaping asset performance in response to the chosen administration.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.