Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The past week saw major turbulence in the cryptocurrency market, particularly among Bitcoin and Ethereum exchange-traded funds (ETFs).

According to Wu Blockchain, between February 10 and February 14, Bitcoin spot ETFs recorded a net outflow of $586 million, with Grayscale’s GBTC alone witnessing a $282 million net outflow.

Conversely, BlackRock’s IBIT ETF saw a net inflow of $106 million, highlighting a divergence in investor sentiment. Ethereum ETFs also faced sell-offs, with a net outflow of $26.26 million.

Despite these ETF outflows, Bitcoin remains near the $95,845 mark, down by 0.3%, while Ethereum has climbed 3.57% to $2,757 in the last 24 hours.

On-chain metrics suggest continued demand, indicating that while ETFs are experiencing turbulence, broader institutional and retail interest in Bitcoin remains resilient.

However, Bitcoin’s price action is under pressure, with analysts warning of potential further downside due to macroeconomic factors and technical indicators flashing red.

Bitcoin ETF Outflows and Market Sentiment

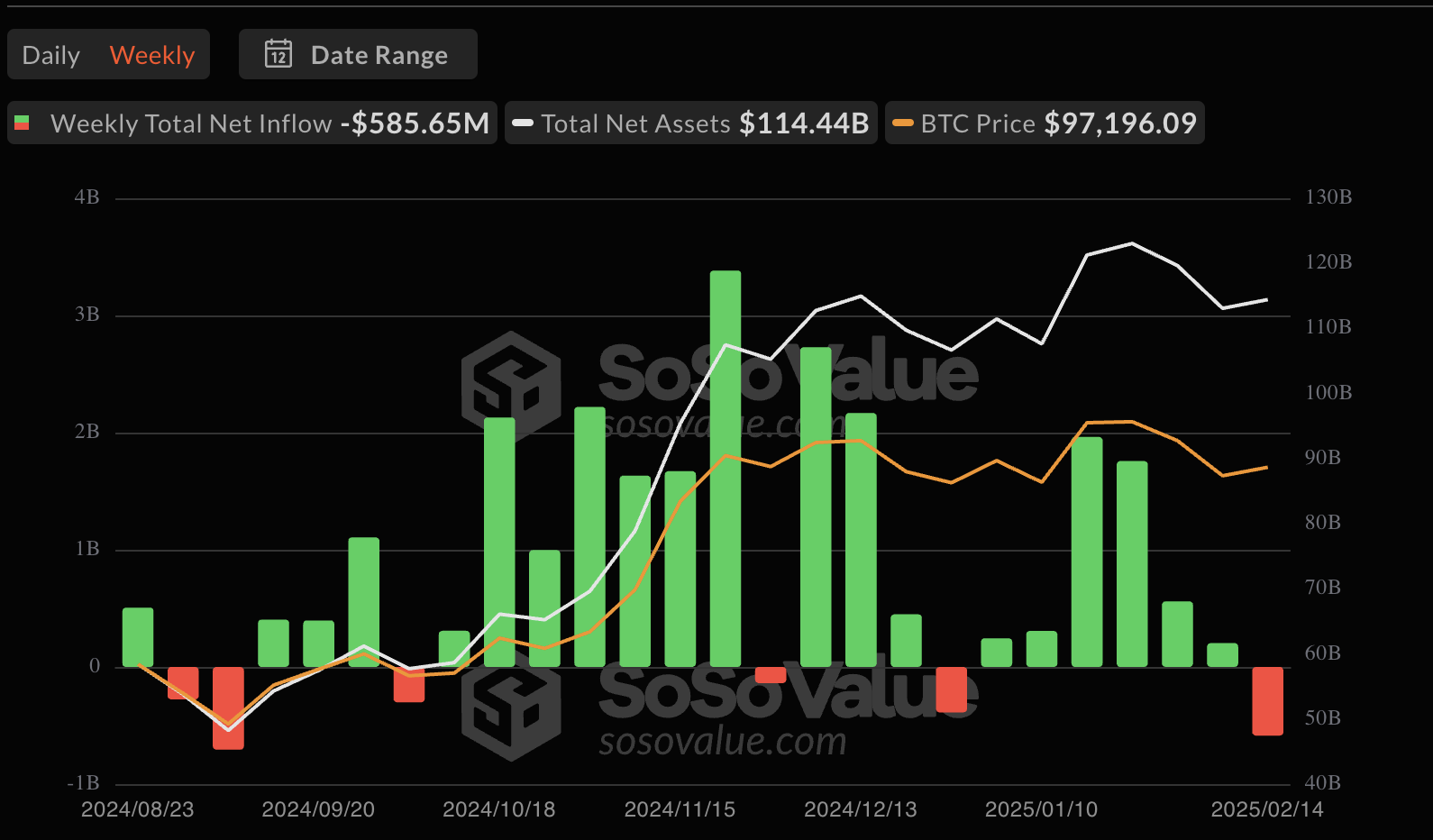

Recent data from SoSoValue as of February 14 reveals a complex picture of Bitcoin ETF activity.

On that day alone, Bitcoin spot ETFs experienced a total net inflow of $66.19 million, suggesting that despite an overarching trend of outflows, interest in certain funds remains.

Fidelity’s FBTC led inflows with $94.04 million, while BlackRock’s IBIT followed with $22.26 million, pushing its total historical net inflow to $40.90 billion.

On the other hand, Grayscale’s GBTC continued its trend of net outflows, losing $46.95 million in a single day, bringing its total historical net outflow to $22.01 billion.

The disparity in investor behavior across different ETFs indicates that while some institutions are selling off, others are positioning themselves for potential long-term gains.

The broader cryptocurrency market also experienced a sharp sell-off in cryptocurrency exchange-traded products (ETPs), marking the first major outflows of 2025.

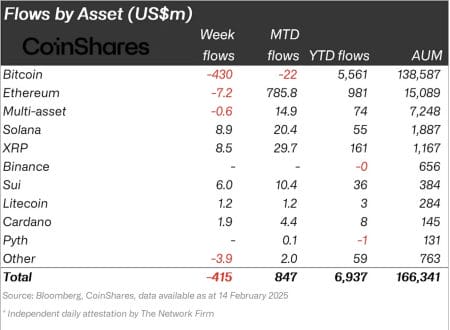

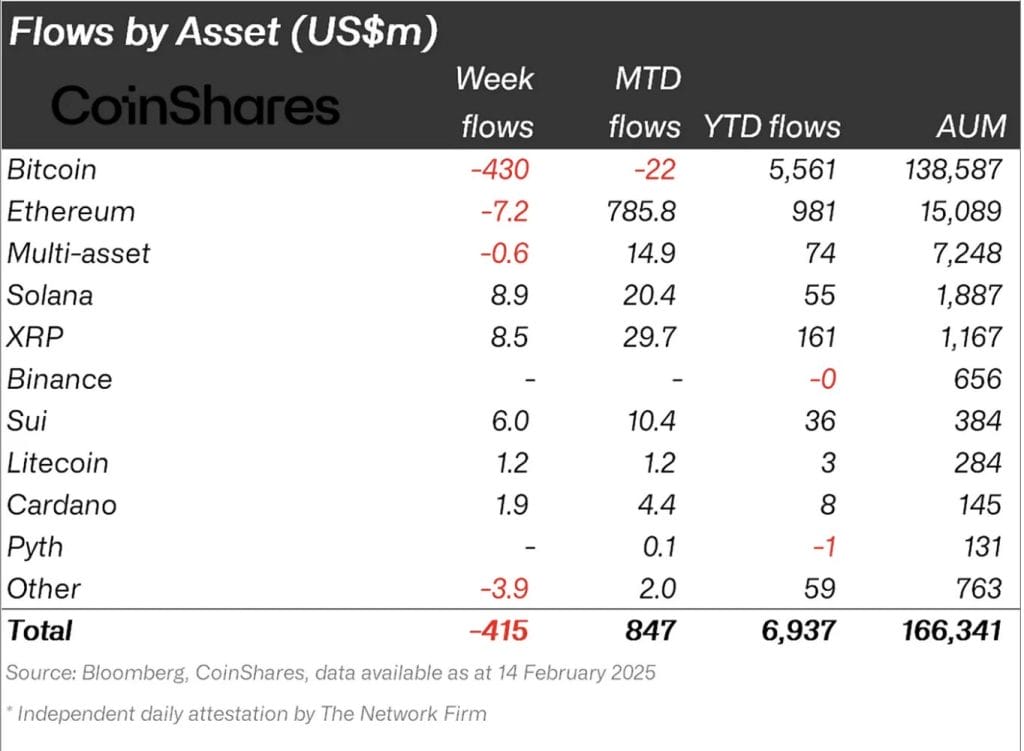

CoinShares recently reported that crypto ETPs recorded $415 million in outflows, with Bitcoin alone losing $430 million.

However, altcoin ETPs, particularly those tracking Solana, XRP, and Sui, witnessed positive inflows, demonstrating shifting investor preferences.

The downturn in Bitcoin ETF performance has been linked to macroeconomic concerns, specifically the Federal Reserve’s stance on interest rates and inflation data.

James Butterfill, head of research at CoinShares, noted that Bitcoin’s sensitivity to interest rate expectations contributed to investor hesitation.

Clearly, the end of a 19-week inflow streak in crypto investment products further shows the shifting market sentiment.

Technical Indicators Suggest More Volatility Ahead

Beyond ETF outflows, Bitcoin’s technical indicators are flashing warning signs.

Trading resource Material Indicators highlighted the emergence of “death crosses” on the daily chart, a bearish signal that could indicate further downside movement.

Analysts suggest that Bitcoin’s immediate support level is $95,000, and its secondary support level is $92,000. A drop below these levels could increase volatility and cause a potential market shakeout.

Market liquidity analysis reveals that bid interest at $95,000 remains strong, but retail investors were the only group increasing exposure over the weekend, while institutional players reduced holdings.

This dynamic suggests that while short-term traders may be bracing for further downside, long-term holders could accumulate at lower levels.

Additionally, CryptoQuant’s data suggests that Bitcoin demand remains intact despite the recent price fluctuations.

The 30-day moving average exchange inflow/outflow ratio remains below 1, a historically bullish indicator.

However, some analysts caution that not all outflows indicate direct buying pressure, as institutional movements, including ETF reallocations, can distort the data.

The coming weeks will be pivotal for Bitcoin’s price action. Traders are eyeing key support levels at $92,000 and potentially as low as $80,000 – $89,000.

Looking ahead, Bitcoin and Ethereum’s resilience will hinge on how investors adapt to looming economic pressures.

While inflows to certain ETFs may signal renewed optimism, the market’s true trajectory will become clearer as institutional players, regulatory developments, and broader economic trends converge.

This juncture offers an opportunity for both seasoned traders and new entrants to observe how crypto assets respond to evolving conditions, potentially reshaping strategies and influencing the long-term outlook.