Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

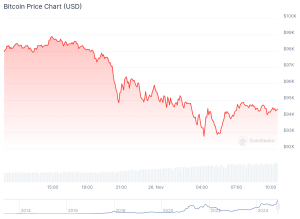

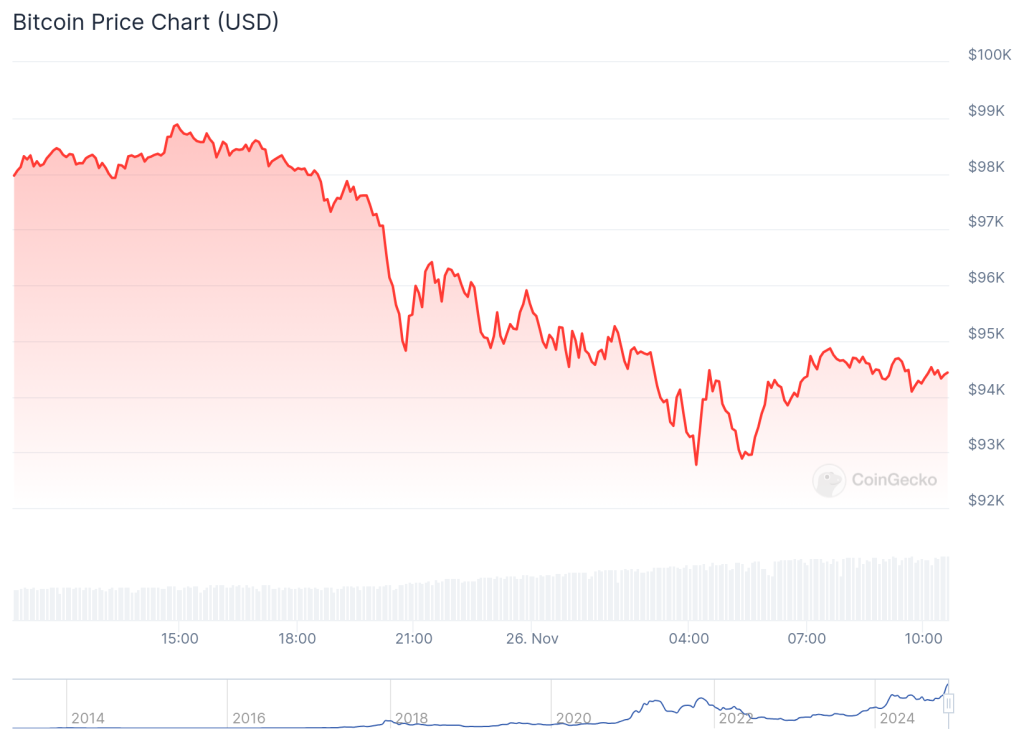

The leading cryptocurrency Bitcoin posted its longest losing streak of the current rally that was kickstarted by Trump’s win earlier this month. After a failed run at $100,000, Bitcoin fell below $93,000, with a 24-hour drop of over 5% before it quickly recovered to trade above $94,200 during early Asian trading hours on Tuesday.

The entire crypto market is down 3.8% in the last 24 hours.

Long Term Bitcoin Holders Are Cashing Out

As Bitcoin hit all-time highs consistently over the month, many long term holders chased out their gains. As per Galassnode data, with long term holders taking out profits, the selling pressure has been at highest since April 2024. The 6-12 months cohort of long-term holders led the selling activity, averaging 25.6K BTC per day in profits, with most of the recent selling coming from this group of investors.

Holders with 6-12 months of Bitcoin spent an average of BTC at a cost basis 71% lower than the market price of around $57.9K, capitalizing on the rally as Bitcoin surged from $74K to $99K.

Spot Bitcoin ETFs Continue to Absorb Selling Pressure

Spot Bitcoin ETFs have been absorbing the selling pressure from long-term holders over the weeks, with more than $7 billion flowing into US spot-Bitcoin exchange-traded funds following the US elections, bringing the total assets of these ETFs to over $105 billion.

On November 25, US Bitcoin spot ETFs saw a net outflow of $438 million, with Bitwise spot Bitcoin ETF leading the outflow with negative $280 million. BlackRock’s IBIT saw a net inflow of $267 million on the same day, as per SoSoValue data.