Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin (BTC) made a strong attempt to reclaim the $100K mark over the weekend, reaching as high as $99,500. However, the rally was short-lived, as BTC tumbled below $95,000 following a massive $1.4 billion hack on ByBit, one of the largest crypto heists in recent history.

The hacker exploited a vulnerability to withdraw Ethereum (ETH) to an unknown address, triggering panic withdrawals from investors. The incident also rattled the broader crypto market, affecting major altcoins like Ethereum, XRP, and Solana.

Despite the downturn, Bitcoin’s seasonal trends suggest a potential recovery in the coming months. Historically, BTC has performed well in spring, with average gains of +11.8% in March, +34.7% in April, and +20% in May, according to CryptoRank data. If these patterns continue, Bitcoin could challenge its January 2025 all-time high of $108,824.

US Dollar Weakness and Trade Policy Concerns Support Bitcoin

The US Dollar’s continued weakness is providing a cushion for Bitcoin’s losses. Concerns over former President Donald Trump’s trade policies, including a 25% tariff on steel and aluminum and a 10% tariff on Chinese imports, have weighed on the dollar. A weaker dollar typically benefits Bitcoin as investors seek alternative stores of value.

Additionally, disappointing US economic data has further pressured the greenback. The flash S&P Global US Composite PMI fell to 50.4 in February from 52.7 in January, signaling slower business activity.

Meanwhile, the University of Michigan’s Consumer Sentiment Index dropped to a 15-month low of 64.7, reflecting growing economic uncertainty. Inflation expectations are also rising, with consumers predicting a 4.3% price surge in the next year.

These factors suggest that Bitcoin could see continued support as a hedge against the weakening US Dollar. However, uncertainties surrounding US trade policies could introduce volatility, impacting BTC’s short-term price movements.

Technical Analysis: Can Bitcoin Break $97,000?

Bitcoin (BTC/USD) is trading at $95,500, maintaining bearish pressure below the 50 EMA at $96,500 on the 4-hour chart. The price is struggling to break above the key resistance at $96,700, aligned with the descending trendline, indicating that sellers are in control.

Immediate support is at $93,700, and a break below this level could lead to declines toward $92,100 and $90,700. Conversely, if Bitcoin reclaims $96,700, it could target the next resistance at $98,100. Bullish momentum would need to push through $99,500 to shift the outlook.

The overall trend remains bearish below the 50 EMA and descending trendline, with downside risk increasing if support at $93,700 fails. Traders should closely monitor the $96,700 resistance level for any signs of a bullish breakout.

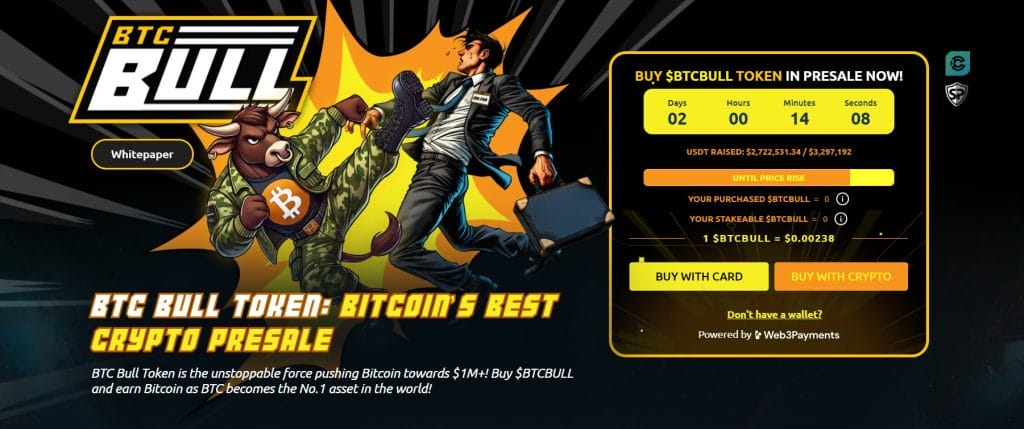

BTC Bull: Earn Real Bitcoin Rewards

BTC Bull ($BTCBULL) is rapidly gaining popularity as a meme-powered, community-driven token that rewards its holders with real Bitcoin. Unlike conventional tokens, BTC Bull automatically airdrops BTC to its holders as Bitcoin reaches key price milestones. This unique mechanism creates a strong incentive for early adopters and long-term investors to participate.

The project features a high-yield staking option with an impressive 158% annual return, enabling users to earn passive income while supporting the token’s ecosystem. With a total staking pool of 665,623,207 BTCBULL, the rewards system is designed to maximize investor gains.

Currently, the presale is live, offering tokens at $0.00238 each. Over $2.72 million has been raised out of a $3.29 million target. With a price increase expected soon, this is an ideal opportunity to invest and maximize potential rewards with BTCBULL.