Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin (BTC) surged past $97,300, driven by robust institutional interest and growing popularity of BTC exchange-traded funds (ETFs). Recent data reveals that spot Bitcoin ETFs accumulated over $40 billion in net inflows, significantly outpacing gold ETFs.

This trend marks a pivotal shift in investor sentiment, with digital assets gaining traction as the preferred investment choice.

Former U.S. President Donald Trump’s pro-crypto stance has further fueled optimism. During a recent speech, he reiterated his vision to make the U.S. the “crypto capital” of the world, sparking renewed interest in BTC among institutional investors. This political support has strengthened Bitcoin’s appeal as a potential safe-haven asset.

In stark contrast, gold ETFs saw minimal net inflows of just 2.17 tons ($203 million), despite a remarkable 45% price surge to $2,950 per ounce since February 2024. Bloomberg ETF Analyst Eric Balchunas summarized the market sentiment, stating, “No one cares,” underscoring the growing disinterest in traditional safe-haven assets.

- BTC surpassed $97,300 amid strong ETF inflows and Trump’s pro-crypto stance.

- Gold ETFs saw weak inflows despite a 45% price surge to $2,950.

- Bitcoin ETFs attracted $40B+, dominating over gold ETFs.

Gold ETFs Struggle as Bitcoin Dominates Investment Flows

Despite gold reaching $2,950 per ounce, its highest level since February 2024, investor interest in gold ETFs remains tepid. While gold saw a 45% price increase, Bitcoin ETFs continued to dominate, amassing over $110 billion in total assets, according to Sosovalue.com.

This disparity illustrates a significant shift in investment preferences, with BTC emerging as a more attractive alternative. Investors are increasingly drawn to Bitcoin’s higher growth potential and the ease of access provided by ETFs.

Key figures highlighting this trend include:

- $40 billion in Bitcoin ETF inflows since February 2024

- Only $203 million net inflows into gold ETFs during the same period

- Bitcoin ETFs holding over $110 billion in total assets

The growing dominance of Bitcoin ETFs reflects a broader institutional shift toward digital assets, challenging gold’s status as the traditional safe haven. Analysts attribute this trend to Bitcoin’s potential for higher returns and its growing acceptance as a legitimate investment vehicle.

Institutional Adoption Fuels Bitcoin’s Bullish Momentum

Institutional adoption continues to power Bitcoin’s upward trajectory. Metaplanet, a leading institutional investor, recently expanded its BTC holdings to 2,100 BTC, investing $169.9 million since April 2024. The firm aims to grow its reserves to 10,000 BTC by 2025 and 21,000 BTC by 2026, reinforcing its presence in the crypto market.

To support this strategy, Metaplanet raised an additional $20 million in funding and secured JPY 4 billion through bond issuances. This aggressive accumulation underscores the rising institutional confidence in digital assets, driving Bitcoin’s price momentum.

The market’s bullish sentiment is further supported by Trump’s pro-crypto stance, which is viewed as a catalyst for continued institutional adoption and price appreciation. As regulatory clarity improves, Bitcoin’s appeal as a safe-haven asset is likely to grow, positioning it as a formidable rival to gold.

Bitcoin (BTC/USD) Technical Outlook – February 20, 2025

The Bitcoin (BTC/USD) 1-hour chart shows a clear breakout from a descending triangle pattern, signaling a potential bullish reversal. The price has successfully moved above the 50-period EMA, currently acting as dynamic support at $96,400.

This breakout is supported by strong buying momentum, pushing Bitcoin to test the key resistance level at $97,900. If this level is breached, the next major resistance is at $98,900, followed by the psychological level of $100,200.

On the downside, immediate support is seen at $96,800, with a stronger floor at $95,700. A break below these levels could invalidate the bullish scenario, leading to a retest of the $94,800 support zone. The overall sentiment remains bullish as long as Bitcoin sustains above the 50 EMA and maintains upward momentum.

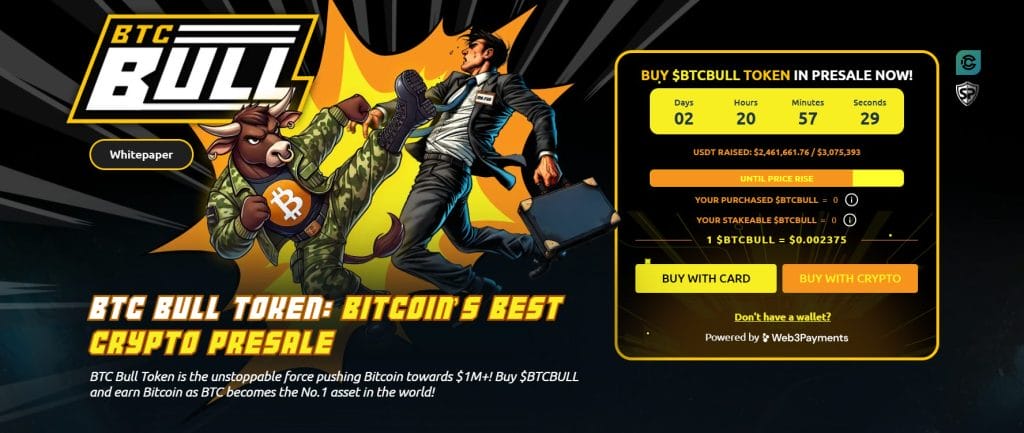

BTC Bull: Earn Real Bitcoin Rewards

Bitcoin’s rising popularity is also driving innovative investment products like BTC Bull ($BTCBULL), a meme-powered, community-driven token that rewards holders with real Bitcoin.

As Bitcoin hits key price milestones, BTC Bull automatically airdrops rewards, providing a unique incentive to participate early and stay invested.

Additionally, BTC Bull introduces a staking feature with an impressive 363% annual yield, allowing users to generate passive income while supporting the token’s growth. The presale is currently live, with tokens available at $0.002375 each.

With over $2.4M already raised and a price increase just around the corner, now is the ideal time to secure your share of $BTCBULL and maximize potential reward.