Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

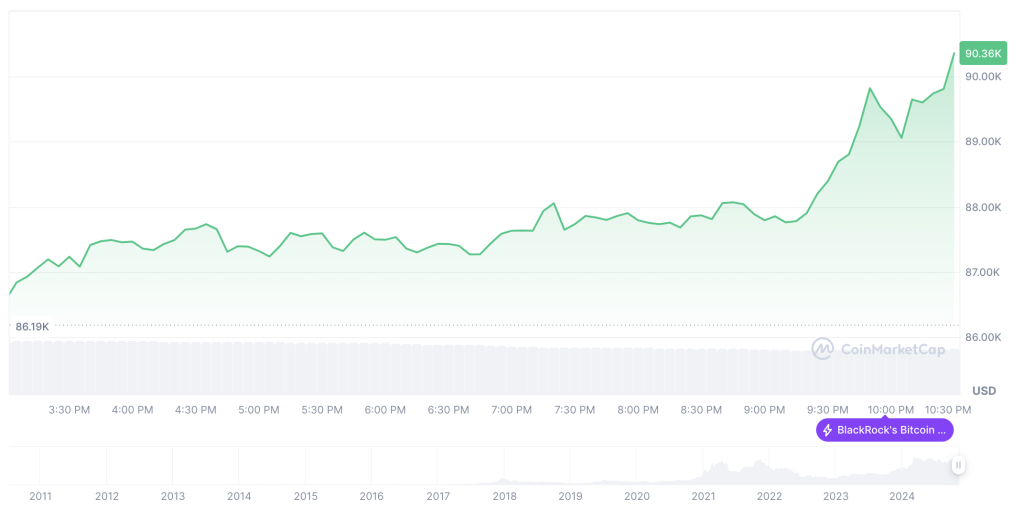

Bitcoin reached an all-time high (ATH) of $93,000 on Wednesday, marking a dramatic price surge driven by renewed investor confidence linked to President-elect Donald Trump.

Bitcoin’s ascent represents a 5.98% increase so far today after setting multiple ATHs throughout the week.

Market analysts attribute this climb to the so-called “Trump trade,” with investors anticipating more favorable cryptocurrency regulations under a potential Trump administration.

Bitcoin’s ATH: A Trump Trade Triumph?

The cryptocurrency market witnessed an unprecedented Bitcoin surge in the wake of Trump’s electoral victory.

The BTC price appreciated by an impressive 32.3% so far this month and an astounding 122% since the start of the year.

The unprecedented price movement, largely attributed to the “Trump trade,” reflects investors’ belief that a Trump presidency would support a more accommodating regulatory environment for cryptocurrencies compared to the current administration.

Trump’s public pronouncements on cryptocurrency, including his pledge to make the United States the “crypto capital of the planet” and his stated intent to replace Securities and Exchange Commission (SEC) Chair Gary Gensler, have further bolstered this sentiment.

The expectation of a pro-crypto SEC chair has greatly contributed to the recent Bitcoin price surge.

Bitcoin’s Market Cap Ascendancy

With its recent price surge, Bitcoin has surpassed silver in market capitalization. Bitcoin’s market cap currently sits at approximately $1.735 trillion, eclipsing silver’s valuation and solidifying its position as a prominent asset class.

Some market analysts believe Bitcoin could reach a six-figure valuation in the coming months.

Josh Gilbert, a market analyst at eToro, predicts continued momentum, potentially driving the Bitcoin price to $100,000 in the near future.

He noted a record daily surge in inflows to Bitcoin ETFs last week, suggesting a renewed wave of investor interest that could trigger a retail buying frenzy reminiscent of the 2021 bull market.

While the overall sentiment around Bitcoin continues to be positive, potential risks loom. Trump’s proposed tariff policies could trigger inflationary pressures, potentially impacting the cryptocurrency market negatively.

Cryptocurrencies are often viewed as a hedge against inflation, thriving in environments with lower interest rates and ample liquidity. If Trump’s tariffs lead to increased inflation and subsequent interest rate hikes by the Federal Reserve, it could exert downward pressure on Bitcoin and other digital assets.

The Political Landscape and Bitcoin’s Future

The outcome of the Congressional elections will also play an important role in shaping the future of the crypto market. The balance of power in the House and Senate will influence the legislative agenda and regulatory decisions concerning cryptocurrencies.

Michael McCarthy, chief commercial officer at Moomoo, warns that the potential inflationary impact of Republican policy promises could affect all asset classes, including Bitcoin and gold.

He suggests the possibility of higher interest rates for a longer period, potentially dampening the current market enthusiasm.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.