Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

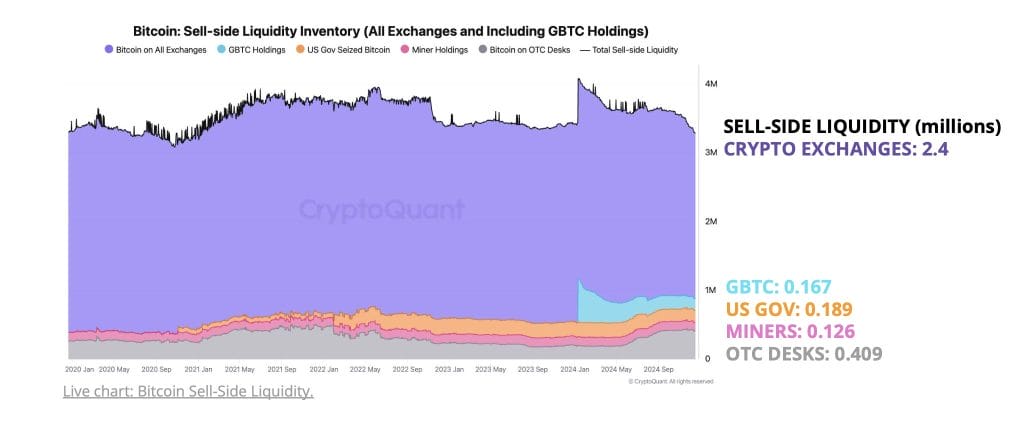

The total amount of Bitcoin readily available for sale, also known as sell-side liquidity inventory, has reached its lowest level since October 2020, according to on-chain analysis firm CryptoQuant.

Data from the firm shows only 3.397 million Bitcoins are available for sale across exchanges, miners, OTC desks, and GBTC. This is a huge drop in sell-side liquidity, which has declined by 678,000 BTC in 2024 alone. The shrinking supply reduces potential selling pressure, creating a tighter market as demand continues to surge.

Liquidity Crunch

Bitcoin demand has remained in “expansion territory” since late September, with apparent demand growing at a monthly rate of 228,000 Bitcoin.

CryptoQuant reports accumulator addresses—wallets that consistently buy Bitcoin but have never sold any—are increasing their holdings at a record-breaking pace of 495,000 Bitcoin per month.

These accumulators have become a force in the market, contributing to the liquidity crunch as more Bitcoin is locked away from circulation. This rise in demand has helped push Bitcoin’s price to a record high of $108,000 this month, say analysts.

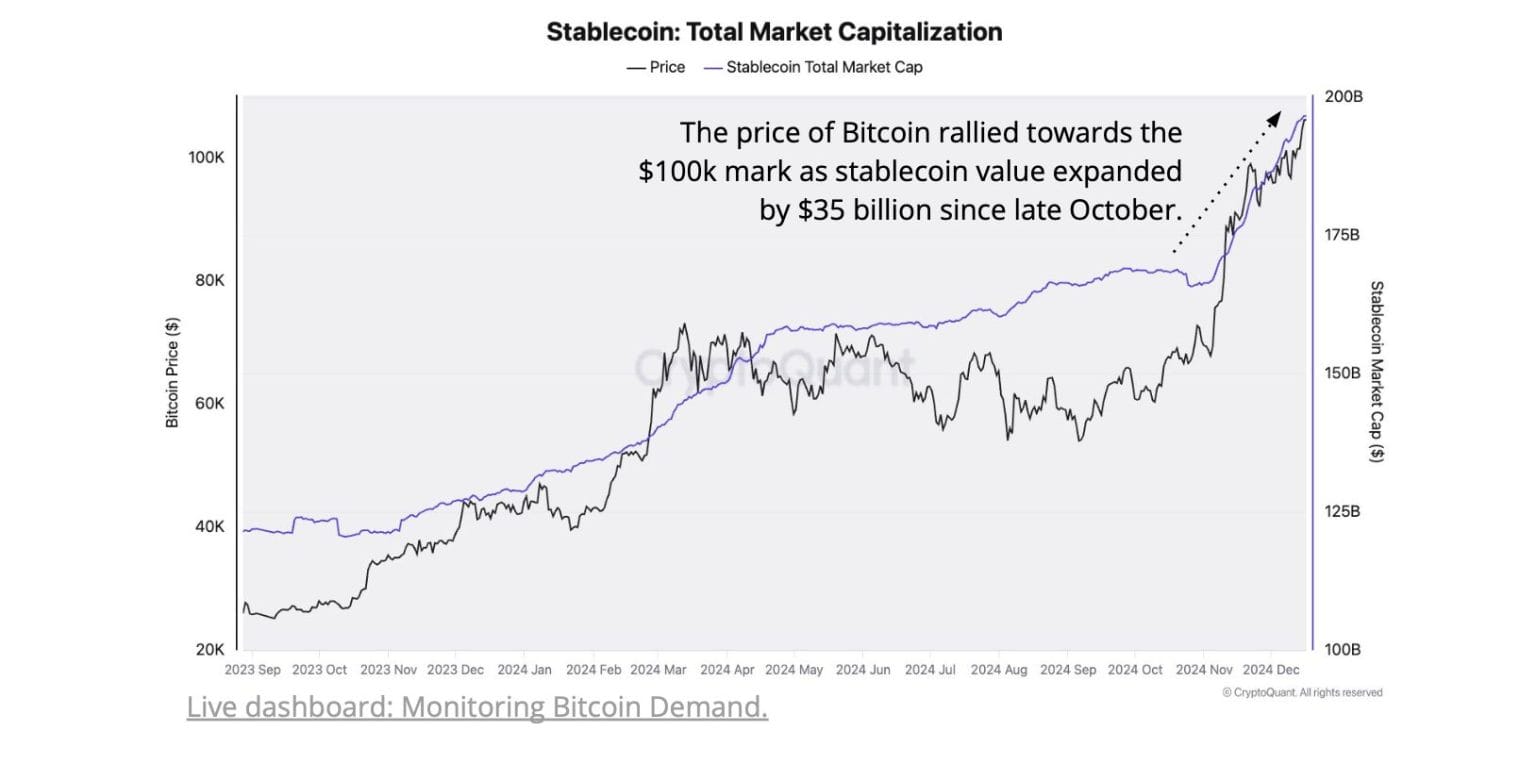

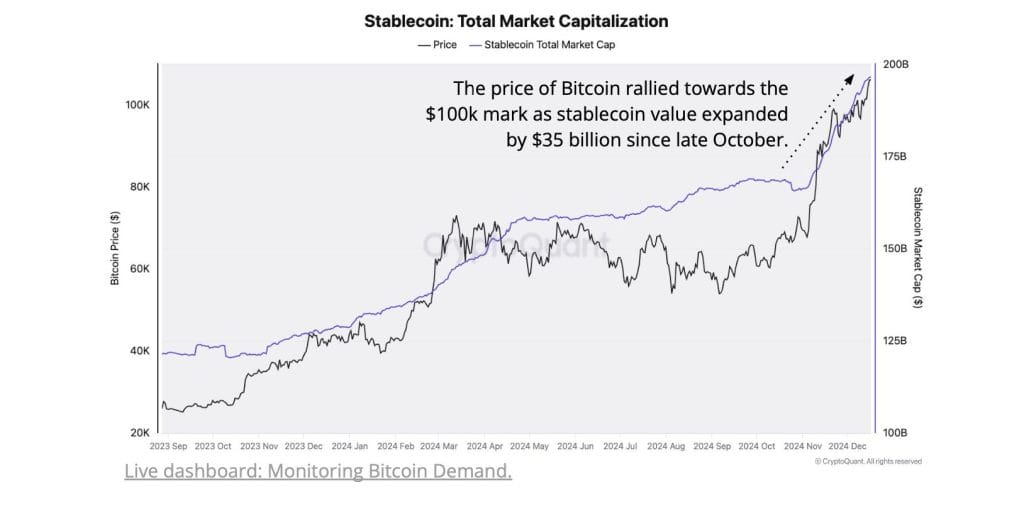

Market Cap of USD-Based Stablecoins Rises to $200B

While Bitcoin’s supply tightens, liquidity in the broader crypto market continues to expand. The total market capitalization of USD-based stablecoins, including Tether and USD Coin has increased to $200 billion. This represents a $35 billion increase, or 20%, since late October, reports CryptoQuant.

The growth in stablecoin supply shows that fresh capital is entering the crypto market, potentially fueling further price increases for Bitcoin and other cryptocurrencies.

Bitcoin Price Action

On Friday, the crypto market faced a major shake-up with over $1 billion in leveraged positions being liquidated within 24 hours. Bitcoin dipped over 8% trading below $96,000.

Bitcoin had maintained strong momentum over the past 30 days, but has slipped below the critical $100,000 psychological mark after the Federal Reserve signaled a more hawkish stance.