Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

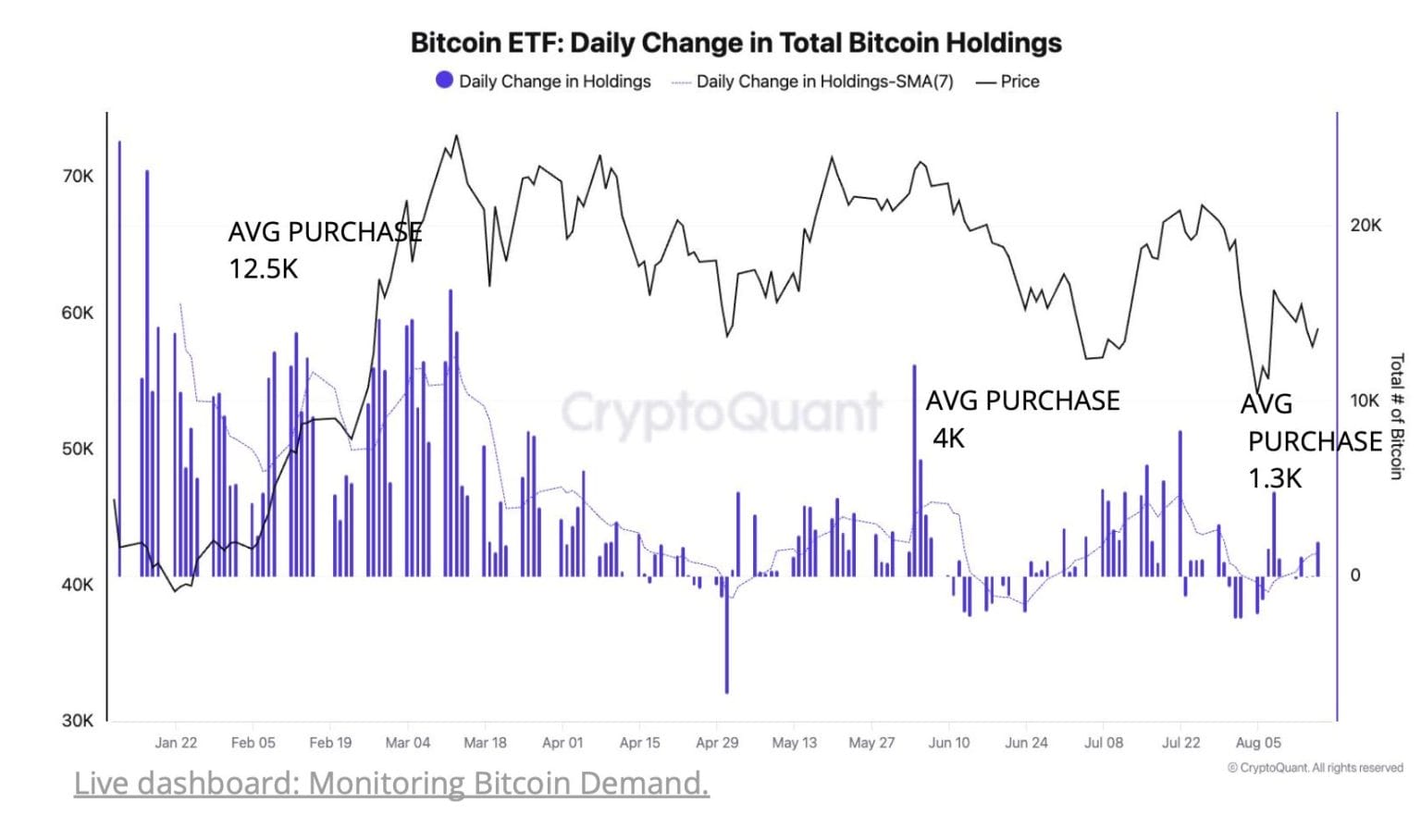

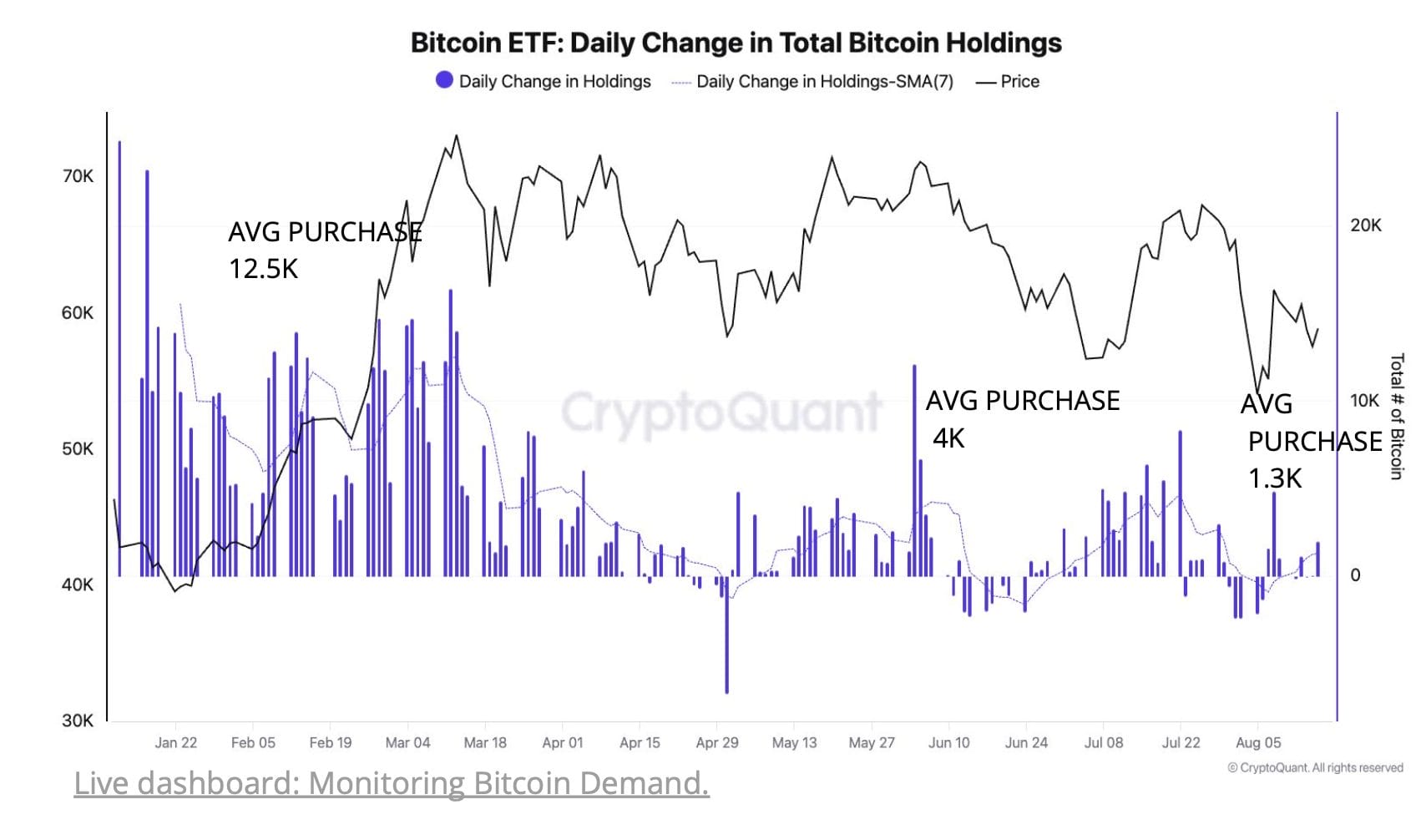

Bitcoin demand has slowed since early April and dipped into negative territory this month, according to South Korean data firm CryptoQuant.

On Wednesday, Bitcoin is trading at the $60,700 mark and has failed to hit $70,000.

Growth in the total holdings of large Bitcoin investors has also slowed, from a monthly pace of 6% in March to just 1%, notes the research firm.

“This slowdown in Bitcoin demand coincided with smaller purchases from spot ETFs in the USA. The average daily purchases from Bitcoin spot ETFs in the USA have declined from 12.5K Bitcoin in March, when Bitcoin was trading above $70K, to an average of 1.3K Bitcoin last week,” said CryptoQuant in its weekly note.

Bitcoin Spot ETF Hype Falters in the U.S.

The significant drop in ETF activity is a reflection of the reduced appetite for Bitcoin in the spot market.

The decline in U.S. spot demand has also been reflected in the reduced price premium for Bitcoin on the Coinbase exchange, a leading U.S.-based cryptocurrency exchange. Lower premiums generally suggest that the demand pressure from buyers has weakened, contributing to the stagnation in Bitcoin’s price momentum.

While the weakening spot demand has raised concerns about Bitcoin’s ability to stage a sustainable price recovery, a few other metrics suggest that the market is not entirely bearish. Long-term holders, for instance, continue to accumulate Bitcoin at unprecedented levels.

CryptoQuant’s data shows that this cohort is adding to their holdings at a record-high monthly rate of 391,000 Bitcoin. This accumulation suggests that long-term investors remain confident in Bitcoin’s future prospects, even amid short-term price volatility.

Stablecoins Market Cap Surges

The total market capitalization of stablecoins has surged to a fresh record high of $165 billion. This increase in stablecoin capitalization points to rising liquidity in the broader crypto market, signaling that market participants are potentially preparing for future investment opportunities once the Bitcoin demand picks up again.