Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

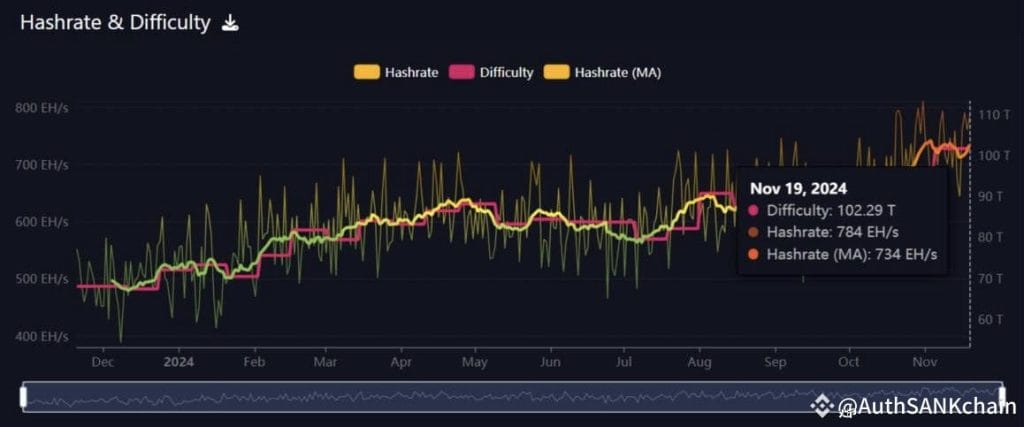

Bitcoin’s mining difficulty has climbed to an all-time high of 102.29 trillion, reflecting the increasing computational power securing the network. This metric, which adjusts every 2,016 blocks (approximately two weeks), ensures a consistent block production rate despite changes in miner activity.

Since mid-2024, mining difficulty has surged nearly 20%, underscoring heightened competition among miners globally.

The record-setting difficulty coincides with Bitcoin’s hash rate peaking above 900 exahashes per second (EH/s) before stabilizing at 730 EH/s.

These developments emphasize the network’s growing scale and resilience, driven by more miners entering the ecosystem and deploying advanced technologies.

Key Drivers of Rising Difficulty and Hash Rate

Several factors are contributing to this growth in mining activity:

- Advanced Hardware: Next-generation mining equipment is enabling higher efficiency, optimizing power consumption even in regions with elevated electricity costs.

- Renewable Energy Use: Large-scale mining farms leveraging renewable energy are playing a pivotal role in expanding mining operations sustainably.

- Network Confidence: The steady rise in hash rate signals miner confidence in Bitcoin’s long-term prospects, despite market volatility.

Implications for Bitcoin’s Ecosystem

The rise in mining difficulty and hash rate strengthens Bitcoin’s network by enhancing its:

- Security: Increased competition among miners makes the blockchain more robust against potential threats.

- Decentralization: A growing number of global participants reinforce the network’s integrity and scalability.

- Sustainability: Adoption of efficient mining technologies aligns with long-term environmental goals.

These metrics also reflect Bitcoin’s growing global adoption. As the ecosystem evolves, the integration of cutting-edge hardware and renewable energy ensures scalability while addressing concerns about energy consumption.

Takeaways:

- Bitcoin’s mining difficulty surged to 102.29 trillion, marking a nearly 20% rise since mid-2024.

- The hash rate peaked at 900 EH/s, stabilizing around 730 EH/s, signaling robust network activity.

- Advancements in hardware and sustainable practices are key drivers of this growth.

Bitcoin Tests $93,450 Resistance Amid Key Setup

Bitcoin is trading within an ascending triangle pattern, with resistance at $93,450 forming a double-top structure. This resistance level is crucial, as a breakout above $93,450 could signal further bullish momentum, targeting $94,873 and potentially $96,177.

On the downside, immediate support is provided by the 50 EMA at $91,000, followed by additional support levels at $89,760 and $88,401.

The RSI stands at 55.31, reflecting neutral momentum, with room for movement in either direction. A sustained push above $93,450 would likely attract buyers, confirming bullish intent.

Conversely, failure to clear this resistance may lead to a retest of support levels, particularly if $91,000 is breached.

The ascending triangle setup, combined with the double-top resistance, underscores a pivotal moment for Bitcoin. Traders should closely monitor these levels for directional cues.

Key Insights:

- Resistance Levels: Immediate at $93,450; next at $94,873 and $96,177.

- Support Levels: Immediate at $91,000; next at $89,760 and $88,401.

- Technical Indicators: RSI at 55.31 indicates neutral momentum; 50 EMA provides key support at $91,000.

Bitcoin’s trajectory hinges on breaking $93,450 or holding above $91,000 to sustain upward momentum.

–

You might also like

Why Pepe Unchained ($PEPU) Could Be Your Next Crypto Portfolio Boost

As meme coins gain momentum, Pepe Unchained ($PEPU) has emerged as a standout contender, capturing attention with its lucrative features and strong presale performance.

Key Highlights

- Presale Closing Soon: With $37.80 million raised, the $PEPU presale is in its final stretch. At just $0.012894 per $PEPU, prices are expected to surge post-listing on tier-1 exchanges.

- High APY Staking: Offering a 499% APY, $PEPU allows investors to earn substantial passive income. Over 321 million tokens have already been staked, demonstrating high investor confidence.

- Smart Contract Security: Audited by Coinsult and SolidProof, $PEPU provides investors with added assurance of a secure platform.

Act Fast on the Presale

Time is running out—just 23 days remain until the presale closes. Early investors have a limited opportunity to secure $PEPU at presale prices before it hits tier-1 exchanges.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.