Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin price is holding steady near $91,300, reflecting cautious optimism as markets weigh President-elect Donald Trump’s pro-crypto stance. His proposals, including a U.S. Bitcoin reserve and supportive regulations, have sparked investor interest, even as concerns about inflation and trade policies temper enthusiasm.

The market’s current consolidation highlights the balancing act between long-term adoption prospects and near-term macroeconomic uncertainty.

Trump’s Crypto Promises Drive Bitcoin Volatility

Bitcoin (BTC) experienced significant price action this week, initially plunging 3% before rebounding to $91,300. This recovery was fueled by optimism surrounding President-elect Donald Trump’s pro-crypto policies, including the potential establishment of a U.S. Bitcoin reserve and regulatory reforms to support digital assets.

However, concerns about inflation and trade tariffs tied to Trump’s economic proposals have injected short-term volatility into the market. Analysts warn that as details of these policies emerge, Bitcoin’s correlation with U.S. equities may amplify market swings.

Despite weekend sell-offs, Bitcoin’s bounce signals strong underlying demand. Investors are optimistic that Trump’s crypto-friendly stance could encourage broader adoption and price stabilization in the long term.

Nasdaq to List Bitcoin ETF Options Amid High Demand

Nasdaq has announced the launch of options trading for BlackRock’s Bitcoin ETF (IBIT), scheduled for release on Tuesday.

This move follows regulatory approval and months of collaboration with BlackRock, enabling traders to access new tools to manage risk and capitalize on market opportunities.

Since its inception, the iShares Bitcoin Trust ETF has amassed $30 billion in assets, underscoring strong institutional demand.

By offering ETF options, Nasdaq aims to enhance trading volumes and attract more investors to the crypto market.

Experts view this development as a sign of the market’s growing maturity, which could drive greater institutional participation and lend further support to Bitcoin prices.

MicroStrategy Expands Bitcoin Holdings Amid Global Interest

MicroStrategy has increased its Bitcoin holdings to 331,200 BTC, valued at $30 billion, after purchasing an additional 51,780 BTC for $4.6 billion. The company continues to raise funds through convertible notes, targeting further acquisitions.

Meanwhile, Poland’s presidential candidate Sławomir Mentzen has pledged to include Bitcoin in national reserves, signaling rising governmental interest in digital assets. This aligns with MicroStrategy’s strategy of reducing Bitcoin supply, fueling demand and strengthening its role as a long-term strategic asset.

With Bitcoin adoption gaining traction worldwide, both institutional and governmental moves are expected to bolster its position as a hedge against inflation and a driver of digital finance innovation.

MicroStrategy Adds Bitcoin; Poland Eyes BTC Reserves

Sławomir Mentzen, the candidate for president of Poland in 2025, promised minimal taxes and policies that are conducive to cryptocurrency, and he promised to include Bitcoin in the nation’s reserves.

In the meantime, MicroStrategy got closer to its $42 billion Bitcoin acquisition target when it paid $4.6 billion for 57,160 BTC. Mentzen’s pro-Bitcoin position and this significant acquisition illustrate the growing interest in Bitcoin adoption around the world.

Due to staking improvements and ETF news, Hedera (HBAR), Tezos (XTZ), and Solana (SOL) also saw notable rallies, indicating a rise in cryptocurrency trust.

Market confidence for wider adoption is increased by Mentzen’s Bitcoin-friendly policy, while demand rises as MicroStrategy’s acquisition reduces the supply of BTC. All of these things work together to boost the price of Bitcoin and strengthen its position as a strategic asset.

Bitcoin (BTC/USD) Daily Technical Outlook: November 19, 2024

Bitcoin is trading at $91,350 and is currently consolidating within a symmetrical triangle pattern on the 2-hour chart. This technical formation suggests a period of market indecision, with a potential for a sharp breakout in either direction as the price approaches the triangle’s apex. The pivot point at $91,481 serves as the immediate level to watch for directional cues.

Immediate resistance is at $93,450, followed by $94,873 and $96,177. On the downside, immediate support lies at $90,423, with further levels at $90,308 and $88,725. The RSI at 55.85 indicates a neutral market, while the 50-day EMA at $91,308 reinforces dynamic support near the lower boundary of the triangle.

A breakout above $93,450 could trigger a bullish surge targeting $94,873, while a break below $90,423 may expose Bitcoin to declines toward $88,725. Traders should monitor volume closely for confirmation of any breakout from this pattern.

Key Insights

- Symmetrical Triangle: Suggests a breakout is imminent; direction depends on whether $93,450 or $90,423 is breached first.

- Resistance Levels: Key resistance lies at $93,450 and $94,873, with potential for bullish continuation.

- Support Levels: Immediate support at $90,423, with $88,725 acting as a crucial bearish target.

–

You might also like

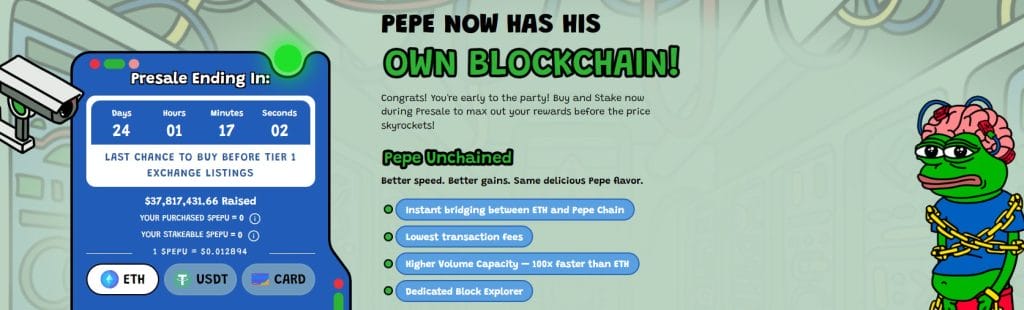

Why Pepe Unchained ($PEPU) Could Be Your Next Crypto Portfolio Boost

As meme coins gain momentum, Pepe Unchained ($PEPU) has emerged as a standout contender, capturing attention with its lucrative features and strong presale performance.

Key Highlights

- Presale Closing Soon: With $37.80 million raised, the $PEPU presale is in its final stretch. At just $0.012894 per $PEPU, prices are expected to surge post-listing on tier-1 exchanges.

- High APY Staking: Offering a 499% APY, $PEPU allows investors to earn substantial passive income. Over 321 million tokens have already been staked, demonstrating high investor confidence.

- Smart Contract Security: Audited by Coinsult and SolidProof, $PEPU provides investors with added assurance of a secure platform.

Act Fast on the Presale

Time is running out—just 24 days remain until the presale closes. Early investors have a limited opportunity to secure $PEPU at presale prices before it hits tier-1 exchanges.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.