Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin (BTC) has extended its rally, surpassing $73,000 and reaching a peak of $73,500 in the last 24 hours. This surge is driven by strong institutional demand, with U.S. Bitcoin ETF holdings reaching a record $66 billion.

Additionally, Bitcoin’s open interest grew by $2 billion in 48 hours, signaling heightened trading activity.

The positive outlook for Bitcoin is bolstered by the success of spot ETFs and favorable economic conditions. Investors anticipate that BTC needs to close above $76,000 to confirm a sustained breakout, indicating strong bullish momentum.

With growing institutional interest, market sentiment remains optimistic about Bitcoin’s potential.

However, a new ETF partnership between China and Saudi Arabia could reduce demand for U.S. Bitcoin ETFs. If investors favor these new ETFs, inflows to U.S. markets may decrease, potentially dampening Bitcoin’s price growth.

Impact of China-Saudi ETF Partnership on U.S. Bitcoin Market

China and Saudi Arabia’s new $1 billion ETF partnership could affect the U.S. Bitcoin ETF market. Following Chinese President Xi Jinping’s visit to Riyadh, both nations agreed to invest in each other’s ETF markets to boost local investment appeal, potentially redirecting funds from U.S. Bitcoin ETFs, currently valued at approximately $68.5 billion.

This development reflects concerns about non-U.S. markets losing investors to American ETFs, which command a large share of global assets and trading activity.

In October, Bitcoin ETFs in the U.S. drew over $3 billion in new investments, raising Bitcoin’s price to around $72,500.

However, competition from the China-Saudi alliance could challenge this upward trend if local investors favor their new ETFs over U.S. options.

China’s $2.13 Trillion Stimulus Could Drive Wealthy Investors to Bitcoin

Arthur Hayes, founder of BitMEX, argues that China’s upcoming $2.13 trillion stimulus package might weaken the yuan, prompting wealthy Chinese investors to consider Bitcoin as a safe alternative.

Despite government restrictions, Hayes notes that many continue to trade Bitcoin via platforms like Binance and OKX.

He suggests the Chinese government’s restrictions aim to obscure yuan devaluation rather than eliminate Bitcoin entirely.

China’s plan includes a 10 trillion yuan borrowing package, funded by special bonds over three years. Hayes highlights that Bitcoin saw significant growth during the yuan’s depreciation in 2015, suggesting a similar response could occur this time.

While it may take time for Chinese investors to respond, increased stimulus could indeed boost Bitcoin demand, adding to its bullish outlook.

Bitcoin Price Analysis: BTC Eyes $73,850 Amid Key Support at $71,850

Bitcoin (BTC) is trading near $72,000, indicating a possible consolidation phase following a strong upward trend. The cryptocurrency recently completed a 23.6% Fibonacci retracement at the $71,850 level.

The appearance of a Doji candle around this level signals potential for a bullish reversal, suggesting that buying interest could emerge if BTC holds above $71,850.

However, caution is advised as the Relative Strength Index (RSI) hovers above 70, indicating overbought conditions that may limit further gains in the short term.

Immediate resistance sits at $73,850, with higher targets at $75,070 and $76,630 if the upward momentum continues.

On the downside, key support levels are found at $71,840 and $70,640, with further support around the 50-day EMA at $69,110, which could stabilize any potential pullbacks.

While technical indicators hint at a bullish bias above $71,850, a break below this level might expose Bitcoin to further declines.

–

You might also like

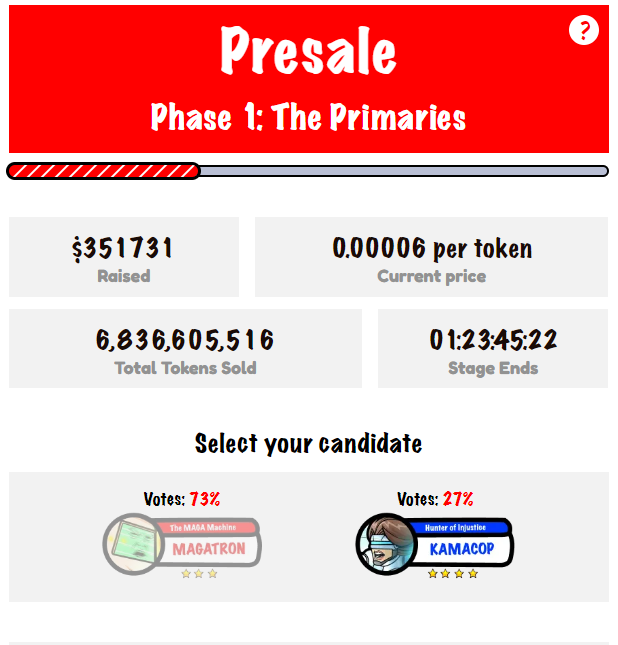

Join the Epic FreeDum Fighters Showdown: MAGATRON vs. Kamacop!

Join FreeDum Fighters, a satirical token project that turns the US election into a battle royale! MAGATRON vs Kamacop 9000, mechanized leaders go head to head. With $DUM tokens you can stake, accumulate points and earn rewards based on the side you choose.

FreeDum Fighters has two reward pools: if MAGATRON wins, Kamacop stakers get higher rewards, if Kamacop wins, MAGATron stakers get higher rewards.

Weekly debates and community events will keep it exciting, where you can “inflate egos” and support your side in the race for virtual supremacy.

Presale is open and you can get $DUM early.

With 6.83 billion tokens already sold and counting, join now to fuel this satirical political theater. Token price starts at 0.00006 per token. Don’t miss out—back your chosen fighter and watch your $DUM grow!

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.