Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin (BTC) has rebounded from its overnight losses, gaining positive traction around $62,750 and reaching an intraday high of $63,280. This recovery is driven by ongoing bullish momentum, which mirrors patterns in the 2013 and 2020 bull markets.

Analyst Crypto Dan from CryptoQuant highlighted that in those previous cycles, long-term investors took profits twice, and the current market is showing similar signs, suggesting another potential upswing.

In addition, the current global macroeconomic situation, especially with central banks cutting interest rates, is injecting more liquidity into the market, creating a bullish investment environment. China’s fiscal policy is another significant factor influencing Bitcoin’s price.

The upcoming fiscal policy update from China’s finance minister is expected to reveal measures to stimulate the struggling economy. If the government announces substantial financial stimulus, it could increase liquidity in the global markets, benefiting risk assets like Bitcoin.

Bitcoin Reclaims $63,000: Bullish Sentiment Fuels Optimism Despite Mixed Signals

However, the recent spike in the BTC price is generating renewed optimism in the cryptocurrency community. According to CryptoQuant analyst Crypto Dan, the market remains in a bull cycle, suggesting bullish long-term prospects for Bitcoin holders.

Dan compared the current market trends to previous bull cycles in 2013 and 2020, indicating that if the patterns hold, another significant upswing could be expected.

He also highlighted the impact of global interest rate cuts, suggesting that prices often rise in anticipation of such changes.

Another analyst, Avocado Onchain, noted a decline in the Coinbase Premium, which usually signals bearish sentiment. However, Bitcoin’s recent price rebound indicates a more favorable outlook.

Historically, Bitcoin tends to recover after the Coinbase Premium drops below -50 during bull markets, and the absence of panic selling suggests that larger investors are accumulating Bitcoin at lower prices, reinforcing the belief that the bull market may still be ongoing.

Hence, Bitcoin’s rebound to $63,000 amid bullish sentiment suggests potential for further price increases. Analysts indicate that historical trends, coupled with institutional accumulation, reinforce optimism, while a decline in Coinbase Premium signals cautious sentiment, contributing to a mixed but positive outlook for BTC.

Bitcoin Surges Amid Positive Sentiment and Anticipated China Policy Update

On the other side, cryptocurrencies experienced a sharp rebound on Saturday, with Bitcoin (BTC) reclaiming the $63,000 mark. Investors quickly brushed off concerns about slightly higher inflation, focusing instead on a fiscal policy update from China scheduled for Saturday.

Bitcoin rose 7% from its Thursday low of below $59,000, marking a strong recovery. However, the positive crypto rally also coincided with gains in the stock market, as both the Dow Jones Industrial Average and S&P 500 reached record highs.

Bitcoin mining stocks like Marathon Digital Holdings (MARA) and Riot Platforms (RIOT) saw increases of 5% to 10%, while Coinbase (COIN) climbed 7%.

Analysts noted that the upcoming China fiscal policy announcement could significantly impact the crypto market, as traders may turn to cryptocurrencies to express their views on China’s financial stimulus plans.

Bitcoin Faces Key Resistance at $63K, Eyes $60K Support

Bitcoin is currently trading around $62,720, showing signs of consolidation just below a descending trendline, which is acting as a significant barrier near $63,450. This level represents immediate resistance, and if Bitcoin manages to break above it, the next target would be $64,400, followed by $65,300.

However, failure to clear these levels could lead to further downward pressure.

The immediate support sits around $61,840, closely aligned with the 50-day EMA ($62,500), providing a key level to watch. Below this, the next support level stands at $61,600, with deeper support at $60,600.

On the technical side, the Relative Strength Index (RSI) is at 62, suggesting that Bitcoin is nearing overbought conditions, which could limit upside potential in the short term. The 50 EMA is providing solid support, currently standing at $62,500.

If Bitcoin fails to hold above these support zones, the market could further decline toward the $60,600 region.

In conclusion, Bitcoin remains at a critical juncture. While a break above $63,450 could open the doors for a more substantial rally, failure to clear this resistance may lead to a retracement.

Investors should keep an eye on the key support at $61,600, as a breach below this level could signal a deeper correction.

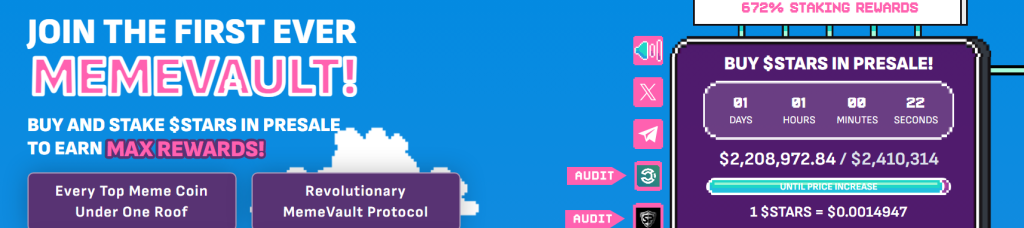

Bitcoin Adoption Surges as Crypto All-Stars Nears $2.2M in Presale

As Bitcoin’s adoption accelerates globally, the innovative platform Crypto All-Stars is gaining massive traction in its ongoing presale. With just over a day left, Crypto All-Stars has impressively raised $2,208,972.84 out of its $2,410,314 target, signalling growing investor interest.

The presale is nearing completion. The current price is 1 $STARS = $0.0014947, and a price increase is expected soon.

Crypto All-Stars is leveraging Bitcoin’s growing influence to create unique staking opportunities, integrating popular meme coins with BTC’s market power.

Since its launch, the platform has seen rapid growth, initially raising $730,000 in just a week and now approaching its final target. Investors looking to capitalize on meme coins and Bitcoin staking have found a compelling opportunity in Crypto All-Stars.

With strategic token allocation and long-term growth plans, Crypto All-Stars is setting itself apart as a competitive alternative to projects like Sun Wukong. Interested investors can still purchase $STARS using ETH, USDT, BNB, or by card before the presale ends.

Follow them on social media – X (Twitter) | Telegram to stay up-to-date on all their development plans.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.