Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin price continues to show resilience near the $67,000 level despite recent market fluctuations. A stronger US dollar, as indicated by the Dollar Index (DXY) reaching three-month highs, briefly pushed Bitcoin to an intra-day low of $66,759. However, Bitcoin has managed to maintain a bullish stance amid these challenges.

With the US presidential election approaching on November 5, both candidates have highlighted cryptocurrency, boosting Bitcoin’s prominence. As of October 17, Bitcoin posted a notable 10.59% gain over the past week on foreign exchanges, driven by increased interest in Trump-backed WLFI tokens and optimism around potential crypto-friendly regulations.

In addition, rising investment in Bitcoin ETFs, which have seen over $19 billion in net inflows, has reinforced market confidence. The broader outlook remains positive, with BlackRock’s bullish stance and Standard Chartered’s forecast of BTC reaching $73,000 supporting continued upward momentum. Although uncertainty remains, the fundamentals suggest that Bitcoin’s rally is far from over.

Bitcoin Price Hits Three-Month High Amid Concerns Over Rising US Dollar Strength

Bitcoin (BTC) recently hit a three-month high, reaching around $68,000, but the strength of the US dollar is causing concern among Bitcoin bulls.

The US Dollar Index (DXY) soared to 103.45, its highest level since early August, which usually negatively impacts Bitcoin prices. Despite this, Bitcoin has managed to rise, which some analysts find unusual given their typical inverse relationship.

Traders are wary, with many speculating that this could lead to an “exit pump,” where investors might sell off their Bitcoin holdings due to the dollar’s strength.

Market activity has been volatile, and traders have noted signs of manipulation in the trading of Bitcoin. Large buying pressure is observed from exchanges like Binance and Bitfinex, while smaller investors are also increasing their exposure.

Some analysts are optimistic about Bitcoin’s future, predicting it could reach new all-time highs within weeks.

They believe the current bullish trend could lead Bitcoin to $90,000 by the end of the year. However, caution remains prevalent, with traders advised to watch for potential sell-offs if the DXY continues to rise, as this could impact Bitcoin’s momentum.

Matt Hougan’s Bullish Outlook: Bitcoin Could Reach $200,000 by 2025

Matt Hougan, Chief Investment Officer at Bitwise, forecasts that Bitcoin could reach $200,000 by 2025. He believes that a Donald Trump victory in the upcoming US elections could positively influence Bitcoin and the broader cryptocurrency market.

Hougan outlines three key drivers for his outlook: the impact of the US elections, the rise of new investors, and the long-term benefits of spot Bitcoin ETFs. He notes that while election-related uncertainty may cause some hesitation, more investors will ultimately recognize the staying power of cryptocurrency.

He points to the success of Bitcoin ETFs, which have attracted over $20 billion in inflows, as a sign of increasing institutional interest. Hougan argues that if Bitcoin’s price reaches $70,000, it could spark even greater momentum, drawing more investors into the market.

As for Ethereum, Hougan remains optimistic, highlighting its role in decentralized finance (DeFi) and tokenization. Despite potential short-term volatility, he believes Ethereum is well-positioned for long-term growth, especially with supportive regulatory and technological developments.

Bitcoin Holds Bullish Trend Within Upward Channel as $66,850 Pivot Offers Key Support

Bitcoin continues to trade within an upward channel, supporting the ongoing bullish trend around the $66,850 pivot level.

The price is showing signs of consolidation after reaching the resistance level at $68,300, which remains a crucial barrier for further upward movement.

If Bitcoin breaks this level, the next resistance is set at $69,140, followed by a more significant hurdle near $69,977.

On the downside, Bitcoin has immediate support around $66,105. A break below this could see prices testing $65,217, and further support is located near the 50-day EMA at $64,934.

The RSI has declined to 58.36, indicating a potential cooling off in momentum, but not enough to shift the overall bullish bias.

As long as the price holds above $66,105, the outlook remains positive, with the channel providing upward support.

Traders may find buying opportunities around the $66,850 pivot point, targeting the next move toward $68,300 and beyond.

–

You might also like

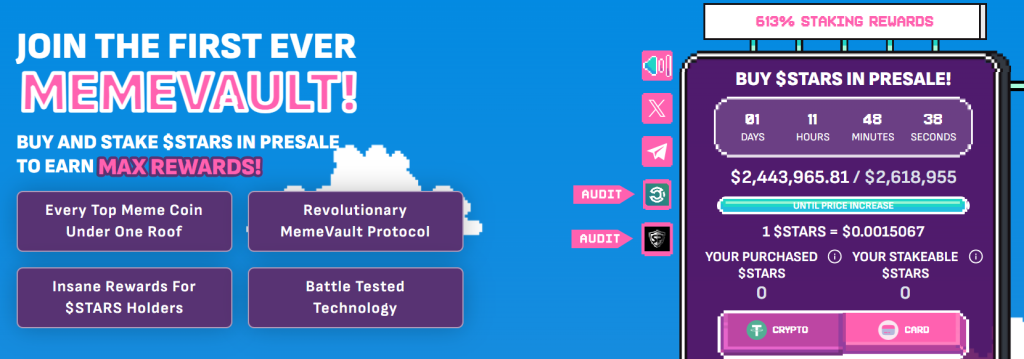

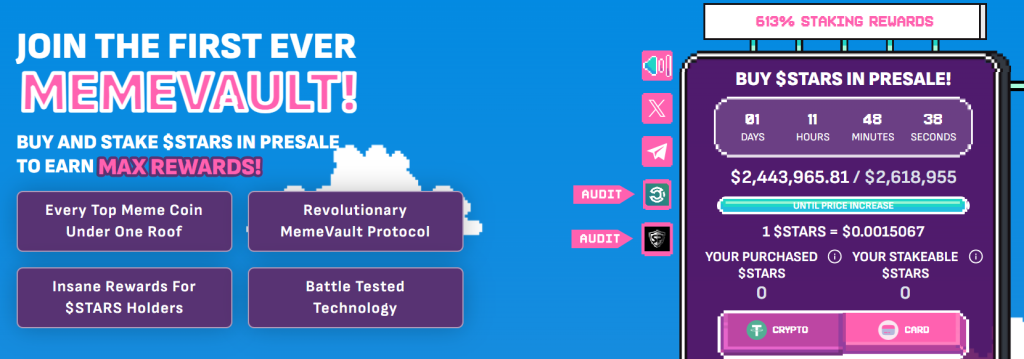

Crypto All-Stars Presale Nears $2.6M as Bitcoin Adoption Drives Investor Momentum

As Bitcoin continues to gain traction globally, Crypto All-Stars is nearing a significant milestone in its presale. With just over a day remaining, the platform has raised $2,443,965 out of its $2,618,955 target.

This strong showing reflects growing investor interest as the presale approaches its final phase, with the current price of 1 $STARS at $0.0015067.

Crypto All-Stars has leveraged Bitcoin’s expanding influence to create a unique platform that combines meme coin staking opportunities with Bitcoin’s established market presence.

The project has seen rapid growth, initially raising $730,000 in just one week and now edging closer to its final goal. With only hours left until the price increases, investors are seizing the opportunity to buy into $STARS before the presale ends.

The platform distinguishes itself from competitors like Sun Wukong through strategic token allocation and long-term growth plans. Investors can purchase $STARS using ETH, USDT, BNB, or by card, with the window quickly closing.

Follow them on social media – X (Twitter) | Telegram to stay up-to-date on all their development plans.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.