Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

In this Bitcoin price analysis, Anthony Scaramucci of SkyBridge Capital predicts Bitcoin could reach $170,000 by 2026, fueled by strategic inflation and financial shifts in the U.S.

Adding to the momentum, MicroStrategy’s ambitious $42 billion plan to buy more Bitcoin could further drive demand, positioning BTC as an increasingly attractive asset in the evolving financial landscape.

Scaramucci Predicts Bitcoin to Triple by 2026 Amid U.S. Financial Shift

Anthony Scaramucci, founder of SkyBridge Capital, predicts Bitcoin’s value could rise to $170,000 by mid-2026. He believes the U.S. will manage its debt crisis by allowing modest inflation, which could impact savers and lower-income households.

Despite concerns over the growing budget deficit, Scaramucci remains optimistic, expecting the government to prevent a financial crisis.

Though Wall Street largely backs Trump, whose economic plan could support crypto, Scaramucci favors Kamala Harris’s policies.

He attributes Bitcoin’s potential growth to its limited supply and increased demand, which could drive prices up as market sentiment improves.

- Bitcoin supply limits and demand boost prices

- Scaramucci foresees $170K BTC by 2026

- Inflation to impact savers, support debt strategy

MicroStrategy’s $42B Bitcoin Investment Plan Could Boost BTC Demand

MicroStrategy has outlined a bold “21/21 Plan” to raise $42 billion over the next three years to purchase more Bitcoin. This move reflects continued institutional confidence in Bitcoin as a reserve asset and could significantly increase demand for the cryptocurrency.

If MicroStrategy executes its plan effectively, it may absorb a substantial portion of Bitcoin’s supply, which could lead to upward price pressure.

Analysts see this as a strategic validation of Bitcoin’s role in corporate treasury, potentially accelerating BTC’s long-term value.

- MicroStrategy aims to boost Bitcoin holdings

- Analysts support BTC’s role in corporate treasury

- Plan could create substantial demand for Bitcoin

China’s QE May Drive Unprecedented Bitcoin Surge, Predicts Arthur Hayes

BitMEX founder Arthur Hayes suggests China’s latest quantitative easing (QE) could trigger a historic Bitcoin rally.

China’s QE, designed to support its struggling banking and real estate sectors, is expected to flood the market with yuan, making Bitcoin an attractive alternative as investors seek refuge from potential currency devaluation.

Hayes draws parallels with the U.S. credit expansion during COVID-19, predicting a similar, long-term boom for Bitcoin as a store of value.

Although crypto trading is restricted, ownership remains allowed, which could amplify demand if investors look to hedge against fiat devaluation.

- China’s QE expected to boost Bitcoin demand

- Investors may favor BTC as a yuan hedge

- Potential for long-term BTC value increase

Bitcoin Price Forecast: Bullish Momentum Builds as BTC Holds Above Key $71,850 Support

Bitcoin has shown resilience, completing a 23.6% Fibonacci retracement at approximately $71,850. This level is serving as a critical support, and recent candles forming above it suggest a potential for bullish momentum.

Should Bitcoin maintain support above this retracement, it may drive towards the next resistance around $73,600, with further targets near $75,070 and $76,630.

On the downside, immediate support is seen at $71,850, with subsequent support levels at $70,640 and $69,650. The 50-day EMA, currently near $70,645, reinforces a bullish trend and suggests that Bitcoin could stay on an upward trajectory if it holds these levels.

The RSI at 64 indicates a slightly overbought condition, but not excessively so, allowing room for potential gains.

Key Insights:

- 23.6% Fibonacci Level: $71,850 support may fuel bullish momentum.

- Immediate Resistance: Key resistance at $73,600, followed by $75,070.

- 50 EMA Support: Positioned near $70,640, strengthening bullish outlook.

–

You might also like

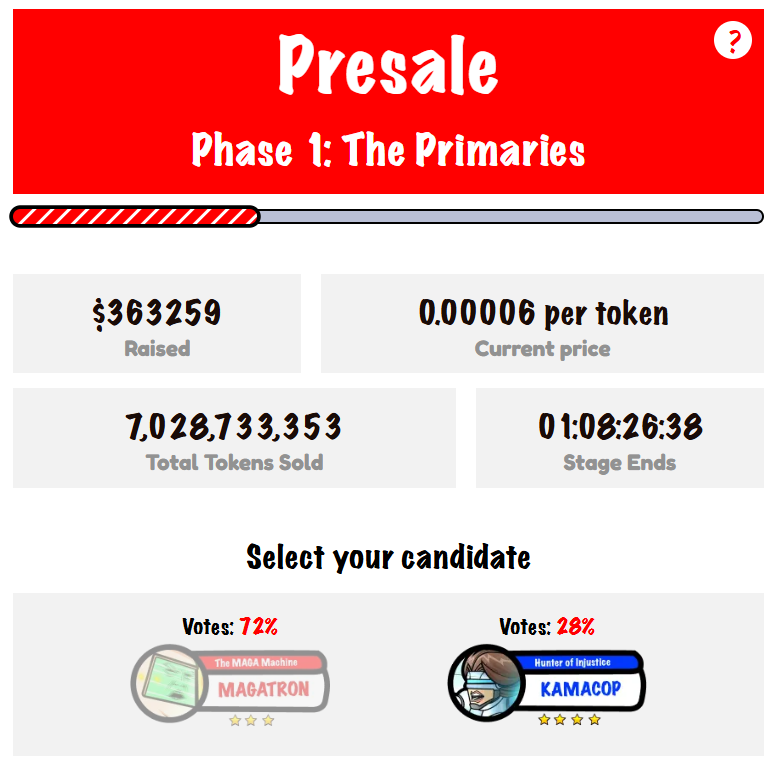

Join the Epic FreeDum Fighters Showdown: MAGATRON vs. Kamacop!

Join FreeDum Fighters, a satirical token project that turns the US election into a battle royale! MAGATRON vs Kamacop 9000, mechanized leaders go head to head. With $DUM tokens you can stake, accumulate points and earn rewards based on the side you choose.

FreeDum Fighters has two reward pools: if MAGATRON wins, Kamacop stakers get higher rewards, if Kamacop wins, MAGATron stakers get higher rewards.

Weekly debates and community events will keep it exciting, where you can “inflate egos” and support your side in the race for virtual supremacy.

Presale is open and you can get $DUM early.

With 7 billion tokens already sold and counting, join now to fuel this satirical political theater. Token price starts at 0.00006 per token. Don’t miss out—back your chosen fighter and watch your $DUM grow!

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.