Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin price shows the cryptocurrency holding steady around $68,000 as market inflows surge by $15 billion, raising speculation of increased activity by large investors, or “whales.”

With recent bullish momentum and key support levels intact, Bitcoin’s upward trend hints at further gains, potentially challenging resistance near $69,200.

Analysts are closely watching this level for signs of continued accumulation and price acceleration.

Ripple CEO Faces Account Closure, Given Just Five Days to Withdraw Funds

Brad Garlinghouse, CEO of Ripple, recently disclosed that his 25-year-old bank account was closed due to his role in the cryptocurrency sector. This event highlights the increasing regulatory scrutiny facing prominent figures in crypto.

As U.S. regulatory policies remain ambiguous, maintaining banking relationships has become challenging for those in the industry, as demonstrated by Citigroup’s decision to close Garlinghouse’s account.

This development may raise concerns in the wider cryptocurrency community, with fears of more cases of “debanking.”

Garlinghouse, however, remains optimistic that policy adjustments after the upcoming U.S. elections could ease pressure on the sector. A more favorable regulatory stance could provide a better environment for crypto businesses to operate.

This situation might prompt a mixed reaction in Bitcoin markets. While Garlinghouse remains hopeful about regulatory clarity, the immediate banking issues highlight the challenges the sector faces.

However, if regulatory changes do materialize, they could strengthen market confidence, potentially benefiting Bitcoin prices as investors watch for signs of positive shifts

Elon Musk has proposed a $2 trillion reduction in the U.S. federal budget, which he believes a Trump administration would support.

Musk has outlined a “Department of Government Efficiency” that would focus on reducing federal spending, lowering taxes, and eliminating waste.

Bitcoin investors may view these proposed budget cuts favorably, as reduced federal spending could create an environment conducive to alternative investments like cryptocurrencies.

Musk’s growing influence in economic policy, coupled with his advocacy for crypto, may generate optimism in Bitcoin markets.

As traders assess the potential for pro-crypto policies and Musk’s engagement in economic discussions, Bitcoin prices could see a rise in demand. This increased confidence may drive Bitcoin’s appeal as both an investment and a hedge.

Cardano Founder Reveals New Bitcoin Development Project

Charles Hoskinson, the founder of Cardano, announced plans to relaunch the Bitcoin Education Project in 2025.

Hoskinson’s vision involves enhancing the Bitcoin developer community by introducing Aiken, a modern programming language, and updated educational materials to promote hybrid Cardano-Bitcoin applications.

This effort aims to strengthen Bitcoin’s functionality and attract innovative projects.

An additional development is Cardano’s integration with the BitcoinOS Grail Bridge, which uses zero-knowledge cryptography to enable secure BTC transfers. This connection to Cardano’s DeFi ecosystem could improve Bitcoin’s utility and liquidity.

These initiatives suggest new opportunities for Bitcoin’s growth beyond its traditional role as a store of value, potentially drawing more attention to Bitcoin’s expanding infrastructure. As cross-chain applications develop, this could lead to increased market optimism for Bitcoin.

Central Bank Report Considers Bitcoin as Economic Hedge

A recent Bitcoin Policy Institute report suggests central banks consider Bitcoin as a reserve asset to guard against economic instability.

The report argues that Bitcoin’s decentralized structure and low correlation with traditional assets make it a viable hedge against financial sanctions, inflation, and geopolitical risks.

Policymakers’ interest in Bitcoin is rising amid global economic uncertainty. In the U.S., the proposed Bitcoin Strategic Reserve Bill would require the Treasury to hold up to 5% of the total Bitcoin supply, a move with potential to bolster national reserves.

As central banks explore Bitcoin for reserve diversification, Bitcoin could see a rise in institutional interest, potentially boosting prices.

However, concerns over potential government involvement in Bitcoin remain, with questions about how regulatory debates might impact its decentralized foundation.

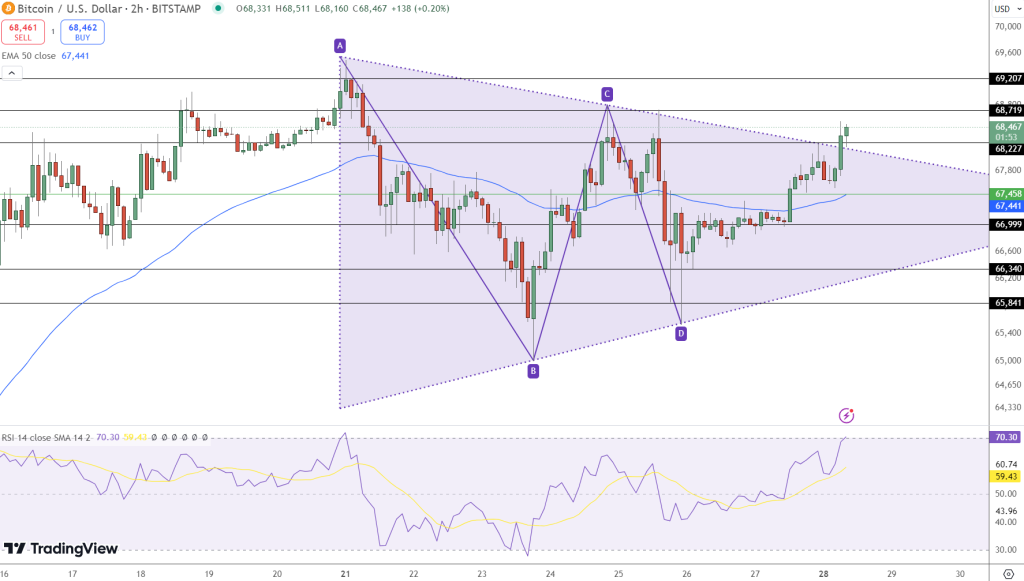

Bitcoin Price Breaks Above $68,200: Bullish Momentum Signals Next Targets at $69,200 and $70,000

Bitcoin is showing bullish momentum, breaking out above the symmetrical triangle pattern at the $68,200 mark. This breakout, reinforced by a bullish engulfing candle, signals potential upward momentum.

Immediate resistance is observed at $68,719, with further levels to watch at $69,207 and $70,000. Support is close, starting at $67,458, followed by $66,999 and $66,340.

The RSI is hovering at 70.30, entering overbought territory, which may invite short-term corrections. The 50-day EMA at $67,441 offers a support base for bullish sentiment.

Key Insights:

- Symmetrical triangle breakout above $68,200 suggests bullish momentum.

- Immediate resistance at $68,719; next levels to monitor are $69,207 and $70,000.

- RSI at 70.30 hints at overbought conditions, potential short-term pullback.

–

You might also like

Pepe Unchained Presale Nears Goal – Secure $PEPU at $0.01179 Before Price Increase

Pepe Unchained ($PEPU) is close to reaching its presale goal, with only hours remaining until the next price increase. Currently, the presale has raised $22,911,006 out of a target of $23,148,84, with each $PEPU token priced at $0.01178.

With less than 8 hours to go, now is an ideal time to lock in this price before it goes up.

Why Invest in Pepe Unchained?

- Presale Advantage: Early investors can secure $PEPU at a lower price before it increases.

- Passive Income Opportunity: The staking feature offers an impressive 499% APY, making it ideal for generating passive income.

- Investor Confidence: With 321 million $PEPU tokens staked, the project has strong backing from the investor community.

Pepe Unchained’s smart contract has undergone thorough audits by Coinsult and SolidProof, ensuring security and transparency. Purchasing $PEPU is easy, with options to use ETH, USDT, BNB, or credit card.

With the presale nearing its end, now is the time to secure your investment in $PEPU and potentially grow your portfolio. Don’t miss out on buying $PEPU before the price increase!

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.