Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin price remains around $69,560, showing resilience near the crucial 61.8% Fibonacci retracement level at $68,670.

In the backdrop, MicroStrategy has revealed a “21/21 Plan” to invest $42 billion in Bitcoin over three years, signaling confidence in the digital asset’s long-term value.

MicroStrategy Unveils $42B Bitcoin Investment Plan to Boost Holdings and Market Confidence

MicroStrategy has announced a bold “21/21 Plan” to raise $42 billion for Bitcoin purchases over the next three years, aiming to solidify its position as the largest publicly traded Bitcoin holder.

The strategy, detailed in the company’s Q3 2024 earnings, includes $21 billion from equity sales and another $21 billion through fixed-income bonds between 2025 and 2027.

Recently, MicroStrategy paid off $500 million in debt, freeing its Bitcoin holdings from loan obligations. The company now holds 252,220 BTC, valued at around $16 billion.

CEO Phong Le emphasized the plan’s goal of leveraging Bitcoin as a value hedge. MicroStrategy’s Bitcoin holdings rose by 11% in Q3 alone, and its ongoing acquisitions are likely to boost market sentiment and strengthen investor confidence in Bitcoin.

Key Points:

- $42 billion investment plan for Bitcoin

- Strategy split: $21 billion from equity, $21 billion from bonds

- Current Bitcoin holdings at 252,220 BTC, worth $16 billion

JPMorgan: Trump Win Could Boost Gold and Bitcoin as Safe-Haven Assets

JPMorgan analysts suggest that if Donald Trump wins the next U.S. presidential election, both gold and Bitcoin could see increased demand.

The firm highlights that heightened market uncertainty may drive a “debasement trade,” where investors flock to assets like gold and Bitcoin as protection against geopolitical risks and a weakening dollar.

Trump’s pro-crypto stance and potential tariff policies may fuel inflation, further strengthening the appeal of these safe-haven assets.

Currently, Bitcoin trades near $70,114, close to its peak, while gold has already hit new highs this year. BlackRock also promotes Bitcoin as “digital gold,” reinforcing its role as a hedge against economic instability.

Key Points:

- Trump win may trigger “debasement trade” in gold and Bitcoin

- Safe-haven assets gain appeal amid geopolitical risks

- Bitcoin near peak, with potential for further demand

Crypto Market Drops as Election Uncertainty and Profit-Taking Impact Bitcoin Price

With Election Day approaching, Bitcoin and the broader cryptocurrency market are feeling the effects of increased uncertainty.

Bitcoin dropped 1.9% over the past day, while the larger CoinDesk 20 index fell 3.9%. This decline aligns with shifting odds for Donald Trump’s re-election on the betting platform Polymarket, where his chances slipped from 67% to 61%.

Trump’s media company also saw its stock plunge 34% in recent days, underscoring the market’s nervous sentiment.

Analysts suggest profit-taking after Bitcoin’s recent 22% rally, coupled with rising bond yields and geopolitical concerns, could be driving the selloff.

As election outcomes remain uncertain, Bitcoin’s price may see further fluctuations, balancing between resilience and potential downside pressures.

Key Points:

- Bitcoin down 1.9%, wider crypto index drops 3.9%

- Shifts in Trump’s election odds add to market caution

- Rising yields and profit-taking also weigh on cryptocurrency

Bitcoin Price Analysis: BTC Holds Key Support at $68,670 Amid Volatility

Bitcoin (BTC/USD) is holding steady around $69,560, with price action showing resilience near the key 61.8% Fibonacci retracement level at approximately $68,670.

This level is acting as strong support, aligning closely with the 50-day EMA, which is currently positioned at $69,640.

A sustained break above the immediate pivot of $70,630 could fuel momentum toward resistance at $71,830, with further upside targets near $73,800 and $75,070.

However, failure to hold above $68,670 may lead to a downside extension, with the next support zones around $67,280 and $65,550.

The RSI at 42 indicates mildly oversold conditions, suggesting potential for a corrective bounce, although caution remains as BTC trades within a consolidative phase.

Conclusion: Bitcoin’s outlook is cautiously bullish above $70,630, with $68,670 acting as a key support level to watch.

Key Insights:

- Support: Strong support at the 61.8% Fibonacci level of $68,670

- Resistance: Immediate resistance near $71,830, with $73,800 as next target

- RSI: Mildly oversold at 42, suggesting potential for short-term bounce

–

You might also like

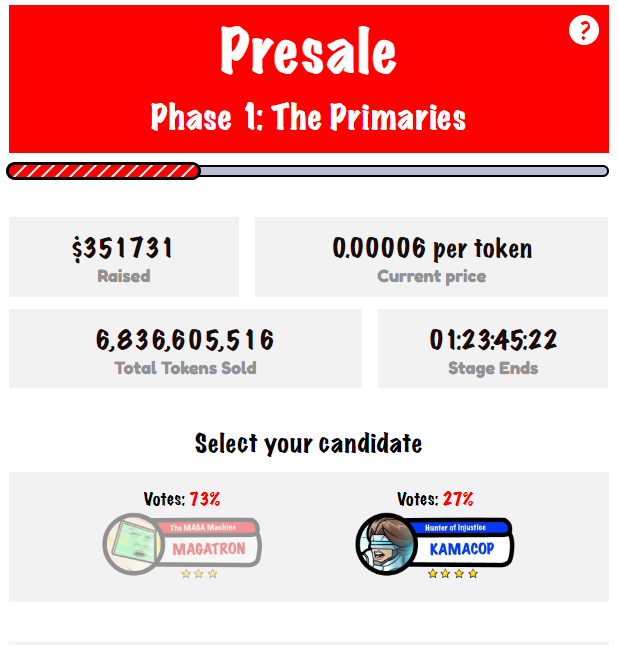

Join the Epic FreeDum Fighters Showdown: MAGATRON vs. Kamacop!

Join FreeDum Fighters, a satirical token project that turns the US election into a battle royale! MAGATRON vs Kamacop 9000, mechanized leaders go head to head. With $DUM tokens you can stake, accumulate points and earn rewards based on the side you choose.

FreeDum Fighters has two reward pools: if MAGATRON wins, Kamacop stakers get higher rewards, if Kamacop wins, MAGATron stakers get higher rewards.

Weekly debates and community events will keep it exciting, where you can “inflate egos” and support your side in the race for virtual supremacy.

Presale is open and you can get $DUM early.

With 6.83 billion tokens already sold and counting, join now to fuel this satirical political theater. Token price starts at 0.00006 per token. Don’t miss out—back your chosen fighter and watch your $DUM grow!

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.