Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

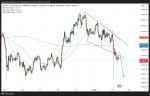

Bitcoin price continues to struggle below the $97,000 resistance, testing critical support levels amid growing macroeconomic uncertainty. The breakout below $95,000 suggests further downside risk, while institutional investors keep accumulating BTC, signaling long-term confidence.

The symmetrical triangle pattern remains intact, limiting Bitcoin’s upside movement unless a decisive breakout occurs.

Despite market uncertainty, institutional adoption of Bitcoin continues to grow. Strategy, formerly known as MicroStrategy, has further reinforced its Bitcoin position.

CEO Michael Saylor announced the company’s latest acquisition of 7,633 BTC for approximately $742 million, with an average purchase price of $97,255 per Bitcoin.

Bitcoin Price Supported as Institutional Demand Soars: Strategy Buys $742M in BTC

Despite short-term price volatility, institutional demand for Bitcoin remains strong. Strategy (formerly MicroStrategy), led by CEO Michael Saylor, has once again reinforced its bullish stance on BTC with another massive purchase.

- 7,633 BTC acquired on February 10 for $742 million

- Total BTC holdings: 478,740 BTC, worth over $46 billion

- Average entry price: $65,033 per BTC

This move signals continued institutional confidence in Bitcoin’s long-term potential. Bitcoin’s supply on exchanges has been shrinking as firms like Strategy aggressively accumulate.

According to CryptoQuant, 47,000 BTC ($4.6 billion) left exchanges on February 5, marking the largest outflow since the FTX collapse in 2022.

Historically, large BTC outflows have preceded price surges. Similar trends in July 2024 and November 2022 led to 125% and 100% rallies, respectively. If institutional accumulation continues, Bitcoin could reclaim the $100,000 mark sooner than expected.

Bitcoin Price Faces Key Resistance at $97,000 Amid Bearish Pattern

Bitcoin’s price action remains range-bound, with $97,000 acting as a key resistance level. The 4-hour chart shows a symmetrical triangle pattern, signaling indecision in the market.

The 50-day EMA at $97,636 serves as an overhead resistance, preventing a breakout. Additionally, Bitcoin’s failure to hold above $98,892 (Fib 61.8%) strengthens the bearish outlook.

On the downside, if $95,000 fails to hold, BTC could see further declines toward $93,500 or even $91,700. A break below $91,700 would confirm a larger bearish trend, potentially leading to deeper losses.

On the upside, a breakout above $97,000 could invalidate the bearish setup, opening the door for a rally toward $100,594.

Macroeconomic Factors: Fed Policy & Inflation Risks

Beyond technicals, macroeconomic trends are shaping Bitcoin’s price movement. The University of Michigan’s consumer sentiment report revealed inflation expectations rising to 3.3%, the highest since 2008.

Meanwhile, Trump’s proposed tariffs on Chinese imports are fueling inflation fears, which could delay Federal Reserve rate cuts. Higher borrowing costs often reduce Bitcoin’s appeal compared to traditional assets like bonds. However, lower rates tend to boost liquidity, increasing BTC’s demand.

Key Macro Drivers to Watch

- Fed Chair Jerome Powell’s testimony for rate guidance

- Inflation data impact on market liquidity

- Tariff-related uncertainties weighing on risk assets

Historically, Bitcoin has performed well when the Fed pauses rate hikes, as seen in 2024. Speculation about a Bitcoin reserve strategy under a pro-crypto Trump administration could further support BTC’s long-term appeal.

Best Wallet Token ($BEST): Next-Gen Crypto Management & Staking Rewards

Best Wallet Token ($BEST) is more than just a presale—it powers Best Wallet, a cutting-edge digital asset management platform available on Google Play and the App Store. Designed for both beginners and professional traders, Best Wallet offers secure storage, investment tools, and early-access token discovery while ensuring seamless staking integration.

What Makes Best Wallet Unique?

- Early-Access to New Tokens: Invest in emerging crypto projects before they hit mainstream markets.

- Robust Security: Fireblocks’ MPC-CMP security framework ensures top-tier protection for transactions and portfolio management.

- Extensive Crypto Support: Best Wallet supports over 1,000 cryptocurrencies, offering a streamlined user experience.

- Latest Update (v2.4.5): Users can now claim tokens directly within the app, eliminating the need for third-party platforms.

Why Investors Are Bullish on $BEST

- 174% APY in staking rewards, making it one of the most rewarding investments in the crypto space.

- 152.8 million $BEST tokens staked, reflecting strong investor confidence.

- $9.63 million raised, with demand increasing ahead of the next price surge.

- Current Price: $0.02395, with a scheduled increase soon—offering early investors an advantage.

With its advanced technology, high staking rewards, and strong investor backing, $BEST is positioned as a leading utility token in the crypto industry.