Bitcoin is hovering near $114,650 after bouncing from a recent dip to $113,000. The rebound comes as global regulatory developments push crypto back into the spotlight. In the U.S., long-awaited White House recommendations propose a clear division of crypto oversight: the CFTC will regulate spot markets, while the SEC will focus on securities.

This clarity could end years of jurisdictional uncertainty. Legal experts like Edwin Mata believe the move aligns with past rulings and finally gives developers and investors a rulebook. With the SEC retreating from its XRP litigation, the narrative is turning bullish.

The proposal also aligns with Trump’s “same risk, same rules” doctrine and emphasizes strengthening the dollar via stablecoins.

Clearer regulations mean reduced legal risks and greater institutional participation, fueling Bitcoin’s potential to solidify its role as a digital commodity under CFTC oversight.

France Bets on Nuclear-Powered BTC Mining

In a dramatic policy shift, France’s RN Party is proposing Bitcoin mining using excess nuclear energy. Party leader Marine Le Pen, once skeptical of crypto, now supports converting wasted energy into secure digital assets. Legislator Aurélien Lopez-Liguori suggests state-run EDF should lead the initiative by setting up mining hubs at nuclear plants.

This proposal not only tackles energy waste but also boosts the case for Bitcoin’s energy efficiency.

If passed, this could be replicated across Europe and globally, and add institutional backing and a sustainability narrative to the long-term price of BTC.

But political divisions in France could slow things down. RN’s pro-crypto stance clashes with parties opposed to mining’s environmental impact.

Osborne Urges UK to Join Crypto Race

Former UK Chancellor George Osborne has issued a blunt warning: Britain is falling behind in the crypto race. Drawing parallels to the 1980s Big Bang financial reforms, Osborne argues that regulatory inertia is costing the UK its edge in fintech innovation.

He slammed the Bank of England’s strict stablecoin rules and how vague policies are driving talent and capital offshore. With 12% of UK adults already owning crypto, Osborne’s call to act fast is gaining momentum. Pro-crypto pressure is building as places like Singapore, Hong Kong, and Abu Dhabi are leaving everyone else behind.

A regulatory pivot could shift sentiment and make the UK a competitive crypto hub—another potential tailwind for Bitcoin’s adoption in Europe.

Bitcoin (BTC/USD) Technical Outlook: Eyes on $115K Breakout

Bitcoin’s recent recovery from $113,000 to $114,650 has stalled beneath key resistance at $115,343, right along a descending trendline. This area is critical: a bullish RSI divergence formed during the bounce, hinting that sellers may be losing steam.

Candlestick patterns near resistance, including a minor shooting star, suggest indecision or short-term profit-taking.

If Bitcoin (BTC/USD) closes above $115,343 mark, it could confirm a trend reversal and push toward $116,912 and $118,878. Whereas, a failure at this level, however, may lead to another test of $113,558 or even $112,178.

Trade Setup:

- Entry: Wait for a strong bullish candle above $115,350

- Target 1: $116,912

- Target 2: $118,878

- Stop-Loss: Below $114,250

Tip: Don’t rush. Wait for confirmation before entering—indecisive candles below trendline are a red flag.

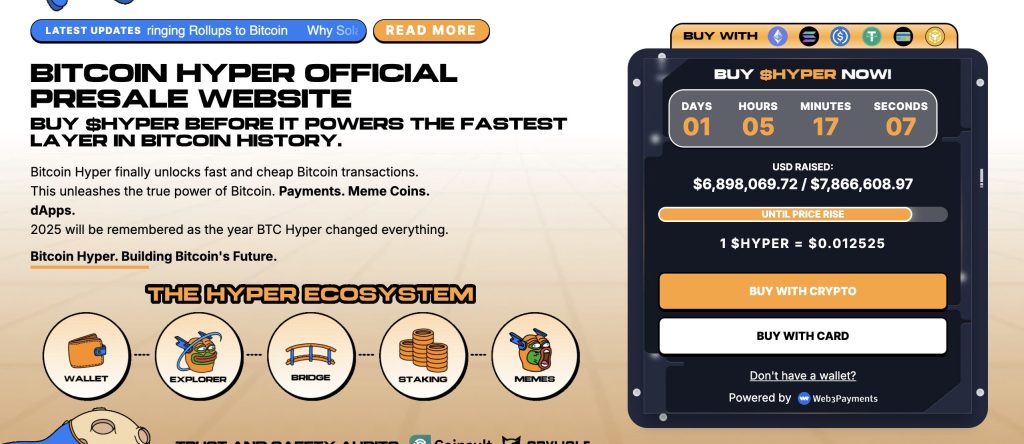

Bitcoin Hyper Presale Over $6.8M as Price Rise Nears

Bitcoin Hyper ($HYPER), the first BTC-native Layer 2 powered by the Solana Virtual Machine (SVM), has raised over $6.8 million in its public presale, with $6,898,069 out of a $7,866,608 target. The token is priced at $0.012525, with the next price tier expected to be announced soon.

Designed to merge Bitcoin’s security with Solana’s speed, Bitcoin Hyper enables fast, low-cost smart contracts, dApps, and meme coin creation, all with seamless BTC bridging. The project is audited by Consult and engineered for scalability, trust, and simplicity.

The golden cross of meme appeal and real utility has made Bitcoin Hyper a Layer 2 contender to watch in 2025. With staking, a streamlined presale, and a full rollout expected by Q1, $HYPER is gaining serious traction.