Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Tesla has moved most of its Bitcoin into unknown wallets and Bitcoin (BTC) has broken $68,000 and is at an intraday high of $68,261. This is likely due to rising investor confidence and good news. Bitcoin ETFs have seen their largest inflows in over 4 months, $556 million. Institutional interest in cryptocurrency is still there.

Vice President Kamala Harris didn’t mention cryptocurrency in her recent speech but regulatory discussions are helping the market.

Bitcoin outlook is good and could go higher as we approach year end and more people get into digital assets.

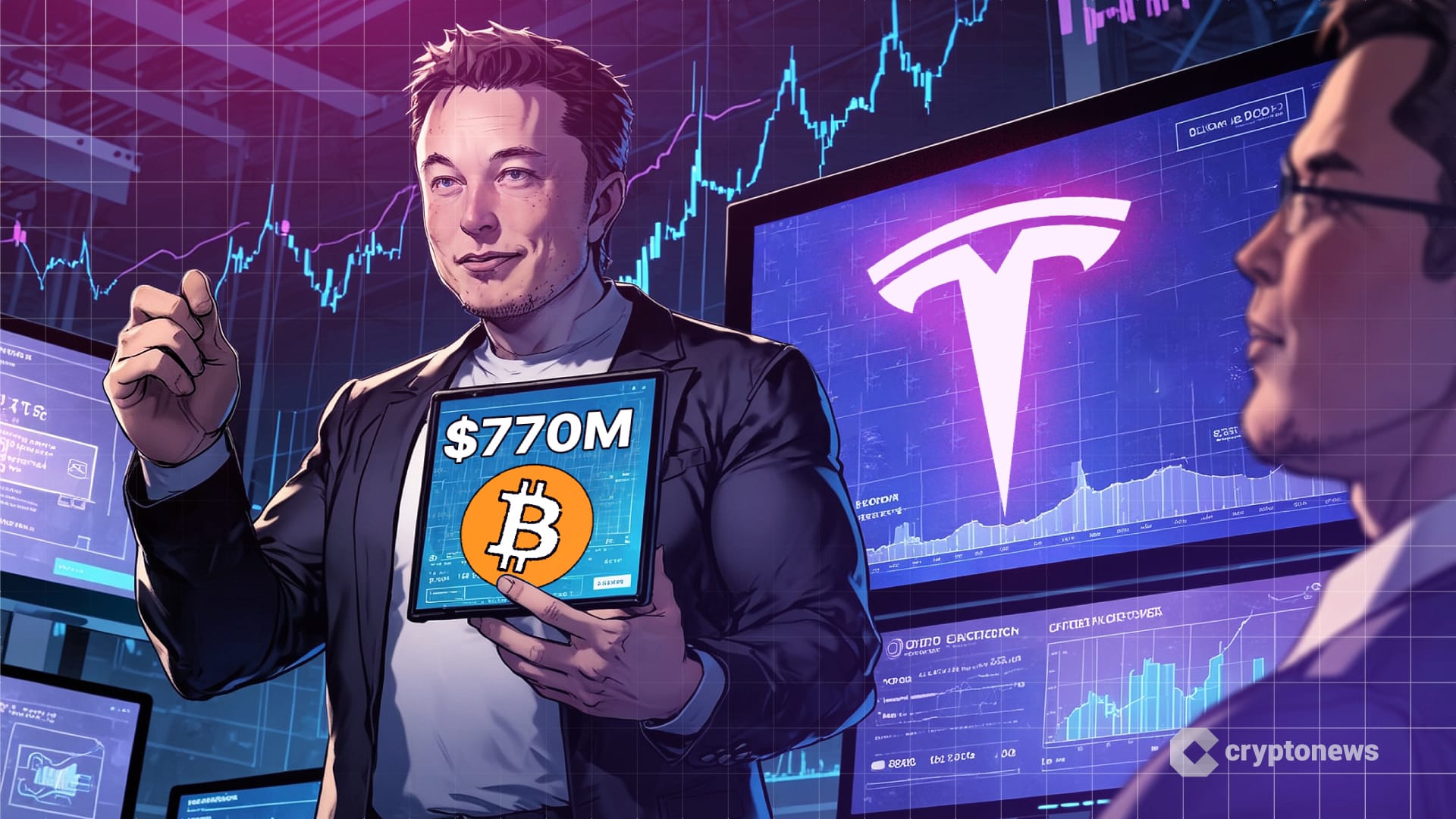

Tesla has moved 11,509 BTC worth $770m to multiple unknown wallets, its first big Bitcoin move since early 2022 when it sold a large chunk of its holdings.

This has led to speculation that Tesla might be selling the rest of its Bitcoin with its next earnings report on October 23, 2024.

Investors are watching Tesla’s Bitcoin plans closely as it has a history of using asset liquidation to fortify its balance sheet.

If Tesla sells its Bitcoin it will create market volatility, just like it did previously when it sold. Some think it’s just a security measure, others think it’s a sign of an imminent sale.

With companies like MicroStrategy still adding to their Bitcoin holdings, Tesla’s move will have a big impact on market sentiment and Bitcoin’s overall stability.

Tesla selling its Bitcoin will indeed create market volatility and potentially drop BTC prices. If other institutional players follow Tesla’s move it will only make investor sentiment worse and create more uncertainty in the crypto market.

Bitcoin’s price is up big as US Bitcoin ETFs see their best 3 days since June. Investor sentiment is improving and a lot of money is flowing in over the last few days. Since Friday, inflows have been $1.18 billion with big contributions from funds like Fidelity’s FBTC, Bitwise’s BITB and BlackRock’s IBIT.

US Bitcoin ETFs now have around $60 billion in AUM and Bitcoin is up from under $59,000 to $67,000.

Meanwhile, Ethereum ETFs have been struggling since their launch in late July. They’ve had big outflows especially from the Grayscale fund with some days having no trading activity.

There was a brief inflow at the start of the week but that was followed by outflows. This shows the sustained demand for Bitcoin ETFs and Ethereum ETFs are still struggling to attract investor interest.

The Bitcoin ETF inflows have pushed BTC up from under $59,000 to $67,000. This demand is a sign of increasing investor confidence and is making Bitcoin stronger and more investable.

Bitcoin Tests Key Resistance as Bulls Push Higher

The price is at $67,655 and still within the ascending channel on 4h. It is testing immediate resistance at $68,060. If it breaks above that, it could go to $69,000 and $69,980. But the RSI is at 72.92, so it’s overbought and might pullback or consolidate.

On the flip side, key supports to watch are $66,105, $65,220 and $64,550. 50 EMA is at $64,550. As long as price is above that, the trend is strong. In the short term if it’s still overbought, it might pullback to the pivot at $66,910 before it goes again.

–

You might also like

Another Meme Coin Gaining Attention: Memebet (MEMEBET)

Memebet (MEMEBET) is quickly emerging as a notable player in the meme coin space, with a unique focus on utility. Designed for use in a crypto casino, MEMEBET allows users to place bets using popular meme coins.

This innovative concept has caught the attention of analysts, leading to heightened interest in the project.

So far, Memebet has raised over $471,000 in its presale, signalling strong investor confidence.

Its goal is to be the first crypto casino to fully integrate meme coins, offering a fresh take on crypto betting and meme coin utility.

Crypto analysts have started to notice MEMEBET’s potential, with some speculating on a 100x growth. In this video, Crypto Chester provides a detailed analysis and highlights why MEMEBET could be one of the top three meme coins to watch.

Buy & Bet $MEMEBET for Airdrop Rewards!

Hurry, with just around 2 days until the next price increase, you can still grab $MEMEBET at $0.0259. Join the presale and secure your place for a chance at airdrop rewards!

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.