Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin (BTC) surged to a new all-time high of $97,000, gaining nearly 30% over the past two weeks. The rally reflects growing optimism around Donald Trump’s pro-crypto policies, including his plan to create a “crypto czar” role in the White House.

This position aims to streamline cryptocurrency regulations, positioning the U.S. as a leader in digital asset innovation. Trump’s victory in the U.S. elections and the Federal Reserve’s rate cuts have revived investor risk appetite.

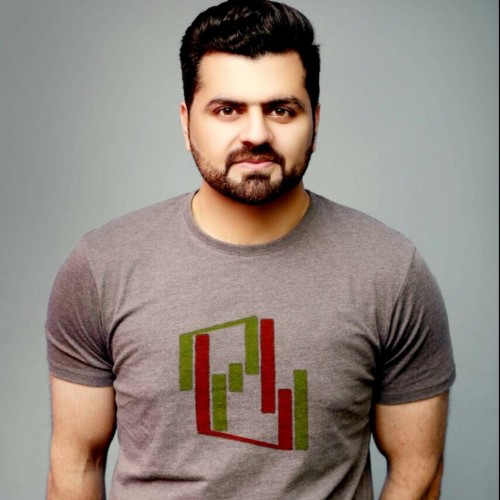

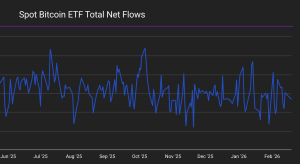

In addition, Bitcoin’s momentum is bolstered by BlackRock’s Bitcoin ETF, with strong trading volumes signaling increasing institutional interest. With Bitcoin’s market cap now at $1.86 trillion and global crypto market capitalization at $3.19 trillion, analysts forecast Bitcoin could reach $100,000 by the end of November.

Trump’s “Crypto Czar” Plan Explained

Donald Trump’s proposal for a “crypto czar” focuses on creating a streamlined framework for cryptocurrency policies.

This position would coordinate with Congress, the SEC, and federal agencies to simplify regulations and promote blockchain innovation.

Potential candidates include Brian Brooks, a former Coinbase executive known for his crypto-friendly stance.

Trump has pledged to remove SEC Chair Gary Gensler and appoint leadership more supportive of digital assets. The goal is to foster innovation, making the U.S. a global hub for blockchain technology.

The crypto industry has responded positively to these developments, viewing them as steps toward a friendlier regulatory environment that could accelerate adoption.

Bitcoin Ascending Triangle Breakout; What’s Next?

Bitcoin has broken out of an ascending triangle pattern, confirming a bullish move above $93,400. This breakout pushed BTC/USD toward $98,400, where resistance is slowing momentum.

The RSI at 68.79 indicates overbought conditions, suggesting limited immediate upside. A break above $98,400 could target $100,000, but consolidation near this level is likely.

On the downside, support sits at $96,350, with $94,850 providing additional safety if the price dips. The 50-period EMA at $93,327 aligns with the breakout zone, strengthening its importance as a support level.

These levels are crucial for traders as Bitcoin’s short-term direction hinges on a breakout above resistance or a pullback.

Key Points:

- Resistance: $98,400; next target: $100,000.

- Immediate support: $96,350; secondary support: $94,850.

- RSI signals overbought conditions at 68.

–

You might also like

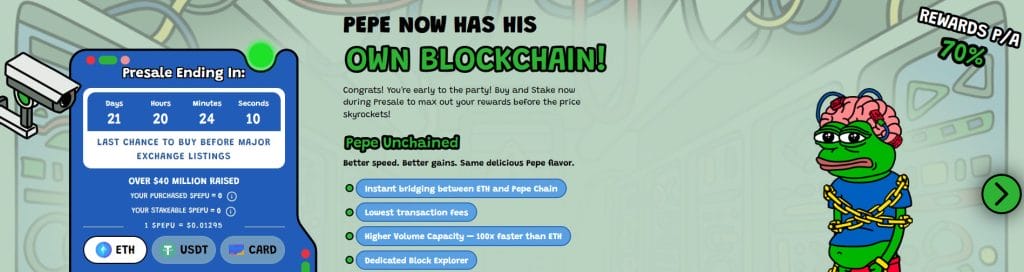

Portfolio Boost: Last Chance to Buy $PEPU Before Listing!

As meme coins surge, Pepe Unchained ($PEPU) stands out with its impressive presale performance and lucrative features.

Key Highlights

- Presale Ending Soon: With over $40 million raised, $PEPU is in its final phase at $0.01295 per token. Prices are expected to rise after tier-1 exchange listings.

- High APY Staking: Offering a massive 499% APY, over 321 million $PEPU tokens have been staked, showing strong investor trust.

- Smart Contract Security: Audited by Coinsult and SolidProof, ensuring a secure platform for investors.

Act Fast on the Presale

Only 21 days remain to secure $PEPU at presale prices before its listing on tier-1 exchanges. Don’t miss this opportunity!

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.