Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

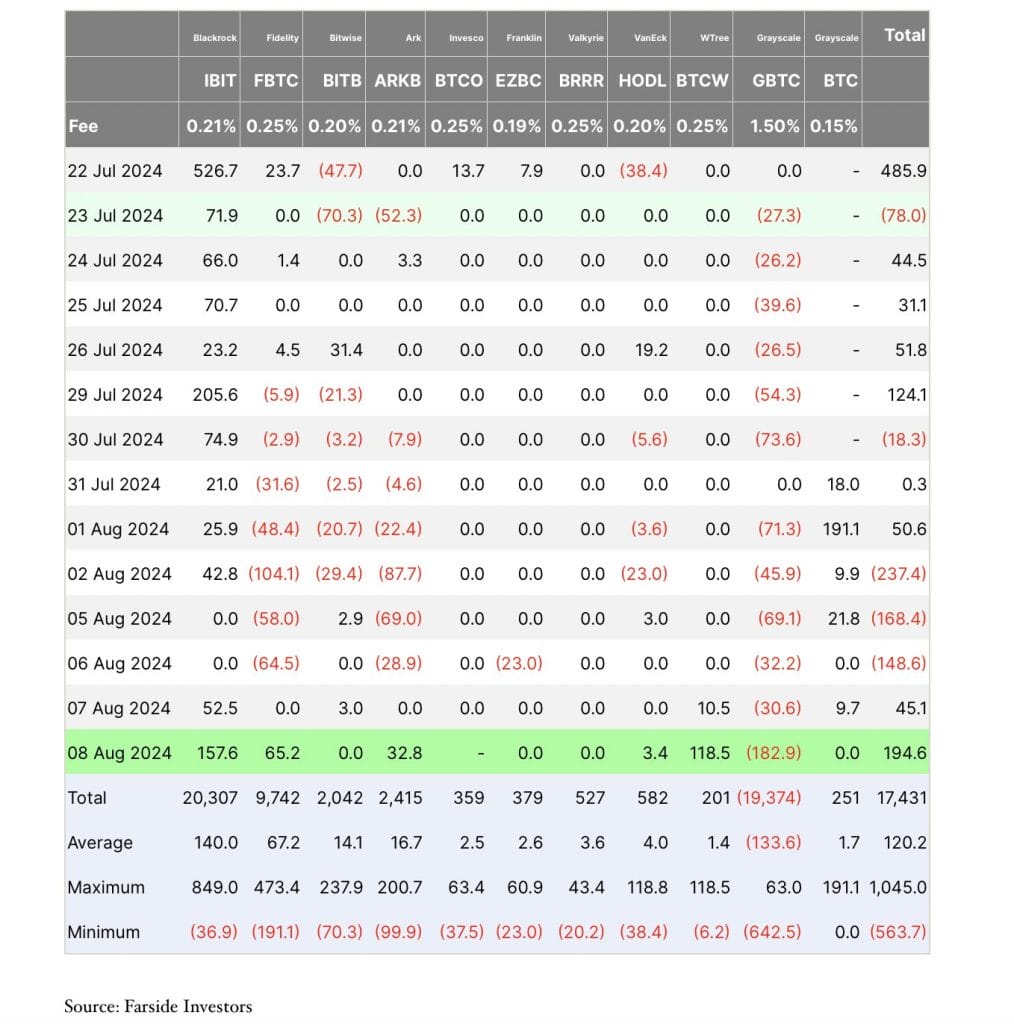

Bitcoin spot exchange-traded funds (ETFs) saw $194.6 million in inflows on Thursday, according to data shared by Fireside Investors.

BlackRock iShares Bitcoin ETF trading under the ticker symbol “IBIT” continues to lead the pack seeing $157.6 million with over $22 billion in assets under management (AUM). The Fidelity Wise Origin Bitcoin trading under the ticker symbol “FBTC” saw $65.2 million in inflows. The Grayscale Bitcoin trust continues to see outflows.

Earlier this week, Bitcoin price experienced volatility dropping down from around $61,000 down to $49,000. On Friday, Bitcoin is trading around $60,000 after the sell-off.

Global stock markets also experienced a rebound clawing back losses experienced earlier this week.

Japan’s Nikkei slumped more than 12% on Monday, recording the worst loss since 1987. The market has bounced back since then but some volatility remains.

Trading volumes for Bitcoin ETFs surged past $1 billion on August 5 during the market downturn, triggering heightened trading activity across the digital assets sector.

According to Alex Thorn, head of research at asset manager Galaxy Digital, the “extremely elevated” trading volumes following the market drawdown were particularly pronounced in Bitcoin ETFs.

Crypto Market Volatility Triggers Trading Frenzy

On Tuesday, Binance, the largest cryptocurrency exchange in the world, recorded a net inflow of $1.2 billion in 24 hours, marking one of the highest net inflow days this year. The huge inflows and activity indicate strong investor confidence in the sector despite volatility.