Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin has long been hailed as a potential hedge against geopolitical and fiscal instability, often compared to gold as a store of value.

However, despite its decentralized nature and limited supply, Bitcoin continues to trade like a risk asset, moving in tandem with equities rather than diverging as a safe haven, according to Garrison Yang, co-founder of Web3 development studio Mirai Labs.

In a recent interview with Cryptonews.com, Yang argued that Bitcoin’s correlation with traditional financial markets remains strong, posing challenges to its hedge narrative.

The Challenge of Breaking Correlation

For Bitcoin to establish itself as a true hedge against macroeconomic instability, Yang said that it must break its correlation with U.S. equities and other risk assets.

Currently, Bitcoin’s price movements are heavily influenced by investor sentiment in traditional markets, particularly the stock market.

This correlation undermines the thesis that Bitcoin functions as a digital form of gold, as both assets often react similarly to economic shocks rather than serving as counterbalances.

“It’s unlikely to become a hedge until proven to be an effective one, and the truth is that we actually haven’t seen that (even with gold),” Yang said.

He added that Bitcoin would need to undergo a significant paradigm shift—such as being adopted as a globally recognized, functional currency backed by Bitcoin itself—to truly detach from the broader financial system.

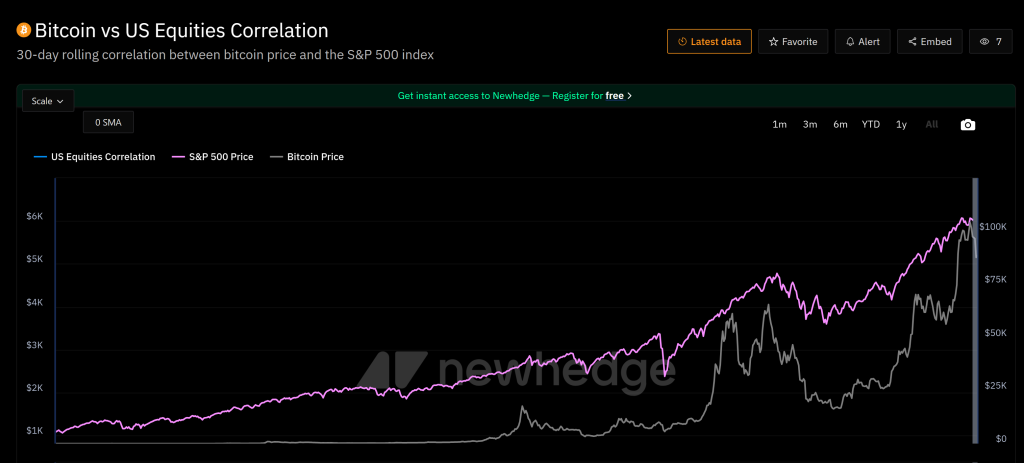

Data from Newhedge also shows that the 30-day rolling correlation between Bitcoin and the S&P 500 has been increasing.

The S&P 500 price (in purple) and Bitcoin price (in gray) show a strong upward trajectory, with Bitcoin experiencing higher volatility.

The blue line at the bottom represents the correlation, which fluctuates but has recently been near its highest levels.

According to Yang, this heightened correlation suggests that Bitcoin is still largely treated as a speculative investment rather than a hedge against economic turmoil.

Macroeconomic conditions play a crucial role in this trend. As global markets navigate inflation, interest rate shifts, and geopolitical uncertainties, Bitcoin has continued to react similarly to equities.

“Bitcoin’s correlation with US equities has actually never been higher. I expect this trend to generally continue, especially as volatile macro headlines continue.”

Bitcoin ETF Volatility Another Factor Shaping Price Movements

The recent volatility in Bitcoin ETFs has added another layer of complexity to Bitcoin’s price movements.

Starting from February 18, Bitcoin ETFs saw an eight-day streak of outflow during which investors pulled over $3.2 billion from these funds as digital asset prices fell.

The trend shifted on February 28, when spot Bitcoin ETFs finally recorded a net inflow of $94.34 million. However, the funds have seen continued outflows since.

Yang said ETF outflows peaked last week but have since stabilized. He added that this could be a temporary pause rather than a sign of a major trend reversal.

“There is absolutely a “fair value” price that comes into play the closer we get to Bitcoin’s previous high.”

A key factor to consider is Bitcoin’s price appreciation since the launch of spot ETFs.

Bitcoin surged from the $50,000 range to over $100,000, marking an impressive 12-month return for traditional financial participants.

Given the nature of institutional investors, profit-taking was to be expected.

Unlike crypto-native investors who often have long-term holding strategies, traditional finance players operate with different risk-return expectations, leading to periodic sell-offs as Bitcoin approaches key price milestones.

Despite the impact of ETFs on short-term price action, Yang argued that Bitcoin’s market price ultimately dictates ETF flows rather than the other way around.

The Bond Market’s Role in Bitcoin’s Trajectory

Yang also mentioned the importance of the bond market in assessing Bitcoin’s future performance.

A broader shift towards “risk-off” assets, such as long-term bonds, could cause equities to decline by 10-15%, potentially dragging Bitcoin down to the $70,000 range.

This scenario would align with historical patterns where capital flows into safer assets leading to declines in speculative markets.

“Increase in bond prices would be a negative impact on risk assets (representing investors moving money into safer assets).”

Given the high correlation between Bitcoin and the stock market, a significant downturn in equities would likely trigger parallel declines in Bitcoin.

Furthermore, recent political events have influenced Bitcoin’s short-term price action.

Former U.S. President Donald Trump’s tweet about a potential Crypto Strategic Reserve led to a brief rally, while tariff-related news had a more sustained impact on Bitcoin’s price.

On March 6, Trump signed an executive order to establish a strategic reserve for Bitcoin, making the US one of the few countries in the world to create a national stockpile of blockchain assets.

“The Reserve will be capitalized with Bitcoin owned by the federal government that was forfeited as part of criminal or civil asset forfeiture proceedings,” White House AI and crypto tsar David Sacks said in a post on X.

While Trump’s proposal stirred market interest, investors remain skeptical about the feasibility of such a reserve.

Unanswered questions about the source of funding, potential assets included, and legal hurdles make it difficult for traders to position themselves with confidence.

In contrast, economic policies such as tariffs have a more tangible impact on market sentiment, directly influencing Bitcoin’s correlation with equities, Yang said.

March FOMC Meeting to Define Bitcoin’s Long-Term Trajectory

Looking ahead, the Federal Open Market Committee (FOMC) meeting in March is expected to be a critical event for Bitcoin’s long-term trajectory.

The market is currently pricing in three rate cuts for 2025, aligning with the administration’s strategy to weaken the dollar, reduce demand, and lower inflation, Yang said.

However, uncertainty remains regarding the Fed’s stance. If the Fed takes a hawkish approach, maintaining higher interest rates despite macroeconomic conditions, Bitcoin could face a substantial correction.

Conversely, a more dovish policy stance with aggressive rate cuts could fuel renewed bullish momentum.

The broader crypto market’s performance will also hinge on whether Trump’s push for lower interest rates is successful.

While lower rates generally support risk assets, Yang stresses that market expectations play a key role.

With three rate cuts already priced in, any deviation from this expectation—such as fewer cuts than anticipated—could still trigger a correction.

“If the market decides to price more aggressively on cuts and we get less than expected, we would still get a correction even though Trump is successful in lowering rates.”