Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin faced a turbulent trading session, plunging 4.13% to $82,331.29 as traders reacted to President Donald Trump’s latest Executive Order. The order, which introduced a Strategic Bitcoin Reserve, initially sent Bitcoin tumbling by 5% before partially recovering.

With a high trading volume of $39.1 billion, market participants remain uncertain about whether the U.S. government will actively acquire Bitcoin.

The uncertainty surrounding this policy shift has fueled volatility, leaving investors questioning the long-term impact on Bitcoin’s price trajectory. Was this dip a buying opportunity, or does further downside loom?

- BTC struggled above $82,000 amid selling pressure and trade tensions.

- Trump’s Bitcoin Reserve order caused a 5% drop before recovery.

- Bitcoin is down 4.13%, trading at $82,331.29 with high volume.

Trade Tensions Keep Pressure on Bitcoin

Beyond the immediate impact of Trump’s Bitcoin Reserve Order, global trade tensions have continued to weigh on market sentiment. Recent shifts in U.S. tariffs on Canadian and Mexican imports have fueled uncertainty, prompting risk-averse behavior among investors. The temporary waiver of 25% tariffs on select goods under the US-Mexico-Canada Agreement (USMCA) has contributed to volatile price swings across financial markets, including crypto.

- Trade policy shifts are adding market volatility and uncertainty.

- Risk-sensitive assets, including Bitcoin, face increased selling pressure.

- Investors are moving cautiously amid unclear U.S. economic policies.

Given Bitcoin’s status as a hedge against traditional financial instability, some traders see these economic uncertainties as a potential long-term bullish catalyst. However, short-term price action suggests that bearish sentiment is still in control.

Inflation Data and Fed Policy: The Next Market Movers

The next big test for Bitcoin comes in the form of upcoming inflation data and the Federal Reserve’s interest rate policy. On March 12, the Consumer Price Index (CPI) report will be released, followed by the Producer Price Index (PPI) on March 13.

Market forecasts indicate:

- CPI to rise 0.3% in February, with an annual inflation rate of 2.9%.

- PPI data could further influence market expectations for Fed rate cuts.

- Traders anticipate up to 70 basis points of rate cuts by December.

The March 18-19 Federal Reserve meeting will be crucial in shaping Bitcoin’s direction. If inflation data exceeds expectations, the Fed may delay rate cuts or even consider further tightening, adding pressure on BTC and risk assets.

Conversely, if inflation slows, Bitcoin could regain momentum on renewed liquidity optimism.

Bitcoin’s Technical Outlook: Will Bears Push BTC to $80K?

From a technical standpoint, Bitcoin remains under selling pressure as it struggles to reclaim the $82,725 resistance level. The 50-period EMA suggests bearish momentum, with further declines possible if BTC fails to break back above $83,990.

- Key resistance: $82,725 and $83,990.

- Major support: $80,070, with downside potential to $78,196 and $76,198.

- A break below $80,070 could trigger further selling pressure.

Traders should watch for volume confirmation and market sentiment shifts before positioning for either a continuation of the downtrend or a potential reversal.

With economic uncertainty and Fed policy weighing on risk assets, BTC’s next move could be pivotal for the broader crypto market.

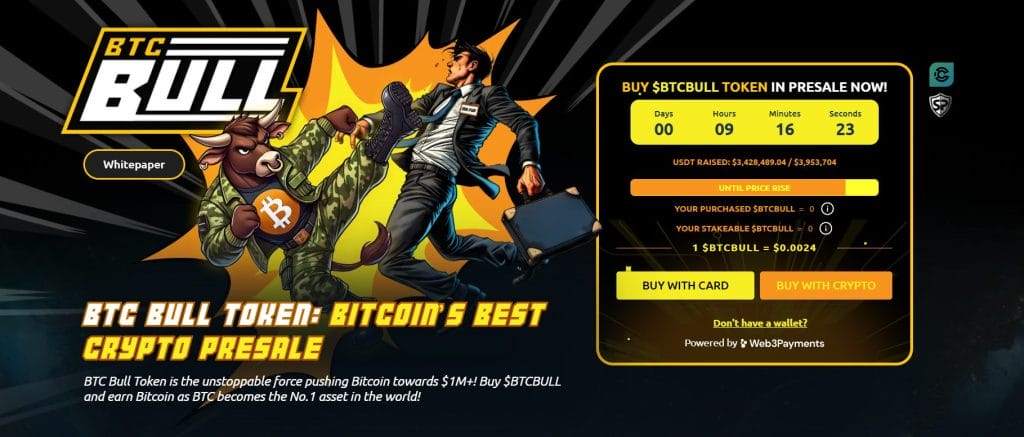

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is gaining traction as a community-driven token that rewards holders with real Bitcoin. Unlike conventional meme tokens, BTCBULL airdrops BTC automatically when Bitcoin reaches key price milestones, offering a strong incentive for long-term investors.

Staking & Passive Income Opportunities

BTC Bull features high-yield staking, allowing users to earn passive income with an impressive 154% APY. This staking system has already seen strong community participation, with millions of BTCBULL tokens staked.

- Current Presale Price: $0.0024 per BTCBULL

- Total Raised: $3.4M / $3.66M target

With investor interest surging, this presale offers an opportunity to secure BTCBULL at early-stage prices before the next price jump.