Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Singapore-based Bitcoin mining company Bitdeer has just announced the successful testing of its latest Bitcoin mining chip, SEAL03, following tape-out.

The company’s latest chip achieved its performance target the SEALMINER technology roadmap outlines it, says the press release shared with Cryptonews.

“An exceptional power efficiency ratio of 9.7J/TH – while running at low voltage, ultra power-saving mode – was indicated in the SEAL03 chip’s verification and prototype tests,” the team claims.

Notably, SEAL03 will be integrated into the upcoming SEALMINER A3 series mining machines. Bitdeer plans to start mass production in the second half of this year.

However, the next chip design is already in progress. The team is doing the R&D work on the upcoming SEAL04 chip, according to the company’s product release roadmap.

Bitdeer Chief Business Officer Matt Kong said that SEAL03 achieved a most critical performance milestone following prototype testing. The R&D commitment is “making possible innovative solutions that are setting new performance benchmarks that will benefit the wider mining ecosystem,” he commented.

Additionally, the chip uses an advanced process node, in partnership with Taiwan Semiconductor Manufacturing Company (TSMC).

TSMC, which supplies semiconductors to the likes of Nvidia and Apple for AI use, recently reported combined revenue for the first two months of 2025 of $16.8 billion. This is a 34% rise in two months compared with the 34% growth during the full-year of 2024.

Also, it announced a $100 billion investment in boosting chip manufacturing in the US, specifically building new chip manufacturing plants.

You might also like

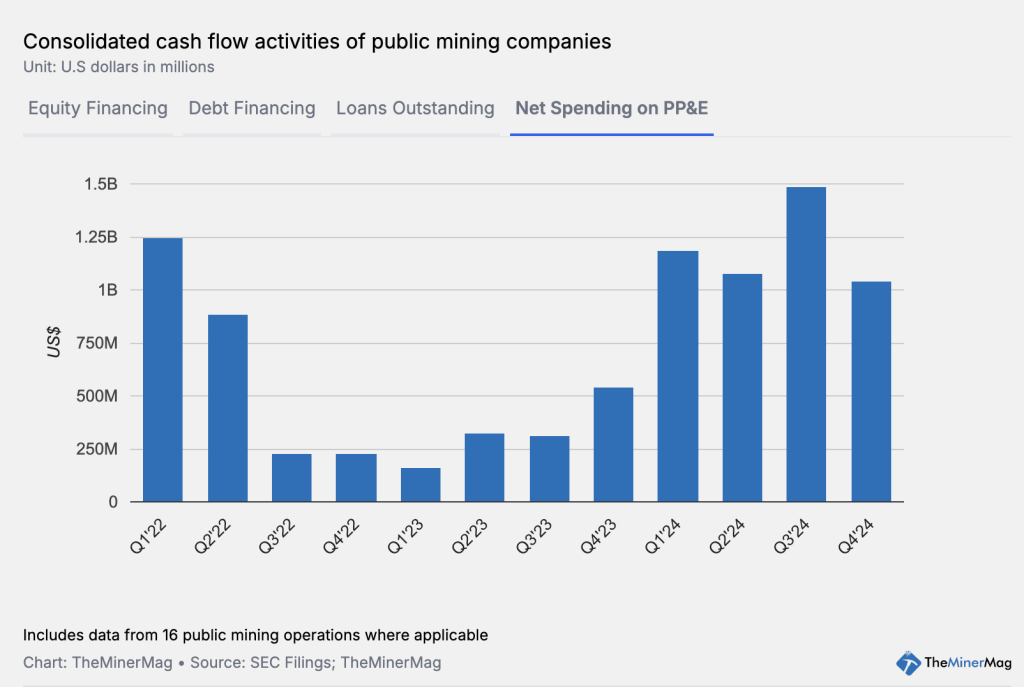

Large Public Miners Put $5 Billion Into Bitcoin Supply Chain

The US-listed mining companies significantly increased their investments into the supply chain supporting their mining activities.

The cash flow statements of ten major US-listed mining companies for 2024 show a total spending of $4.6 billion on general property, plant, and equipment, according to the latest Miner Weekly report by BlocksBridge Consulting.

These companies include Bitdeer, Cipher, CleanSpark, Core Scientific, HIVE, Hut 8, IREN, MARA, Riot, and Terawulf.

Per the data tracked by TheMinerMag, the total spending rises to $4.95 billion with the addition of several others companies that disclosed earnings until September last year.

“This represents a fourfold increase compared to the $1.2 billion spent in 2023, following the bear market of 2022,” the report noted.

Meanwhile, the companies that provided a breakdown of deposits and purchases for bitcoin mining hardware, spent over $3 billion on it in 2024. Not all companies provide this clear breakdown though.

Furthermore, in 2024 – and almost all in Q4 – the ten major mining companies liquidated about $100 million worth of older-generation miners. The reason is the difficulty generating profits.

Lastly, according to the report, “the total spending on and trading of mining-related property, plant, and equipment offers insight into how much bitcoin mining is supporting a broader supply chain network in the US and globally.”

It cited a report by the economic research firm Perryman Group, commissioned by the Texas Blockchain Council and the Digital Chamber of Commerce, which estimated that Bitcoin mining created 31,000 jobs and generated $4.1 billion in gross product annually for the US economy.

Meanwhile, in late February, Bitdeer invested $4 million in BTC despite the market downturn. It said it bought 50 BTC at an average price of $81,475 per coin. This brought its total holdings to over 640 BTC. Read more about it below.

You might also like