Bitfarms, a global vertically integrated Bitcoin mining company, has reported a 34% month-on-month (MoM) increase in earnings in its recent production report. The increase is primarily attributed to recent fleet upgrades and expansion.

Bitfarms CEO Ben Gagnon said that the company has earned 62% more Bitcoin since the Bitcoin halving event in April.

Bitfarms’ 109% YoY Hashrate Surge: What’s Fueling Their Bitcoin Mining Success?

#Bitfarms Provides July 2024 Production and Operations Update

– Earned 253 BTC in July 2024

– 24.6 BTC/average EH/s

– Added 111 BTC, bringing Treasury to 1,016 BTC

– All five warehouses and eight hydro containers have been fully energized in Paso Pe

– Baie-Comeau expansion to 22… pic.twitter.com/gBfei3OYvd— Bitfarms (@Bitfarms_io) August 1, 2024

In its July report released on August 1, Bitcoin mining company Bitfarms announced a 34% month-on-month (MoM) increase in earnings for July, following recent fleet upgrades and expansion efforts.

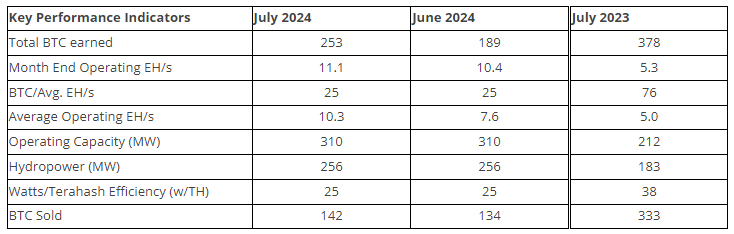

The company mined 253 BTC in July, valued at approximately $16.2 million at current market prices, up from 189 BTC (about $12.1 million) in June.

The company noted a 62% increase in Bitcoin mined per month since the April halving event, reflecting its operational expertise and improved efficiency.

Ben Gagnon, CEO, expressed confidence in Bitfarms’ growth trajectory, stating,

“As we continue to execute on the fleet upgrade program, we are gaining market share and driving increasing amounts of Bitcoin mined month-over-month.”

Bitfarms attributed the earnings boost to its increased mining hashrate.

Although in July, Bitcoin difficulty increased by 8.4%, impacting mining efficiency, Bitfarms earned 253 BTC during the month, up from 189 BTC in June but down from 378 BTC in July 2023.

The company’s operational hashrate reached 11.1 EH/s by the end of July, a 109% year-over-year increase and a 7% month-over-month rise. The average operational hashrate was 10.3 EH/s, up 36% from June.

The company also saw an increase in its HODL, adding 111 Bitcoin in July. Jeff Lucas, the Chief Financial Officer, stated,

“Being fully funded reduces our near-term capex requirements and allows us to apply a greater amount of excess cash flow from operations to building our HODL.”

Financially, Bitfarms sold 142 BTC out of the 253 BTC earned, generating $8.6 million in proceeds. The company’s Treasury now holds 1,016 BTC, valued at $67.2 million based on a BTC price of $66,100.

Bitfarms’ $240 Million Bet: Will It Offset the Post-Halving Earnings Drop?

In a bold move to counteract the financial impact of the recent Bitcoin halving, Bitfarms has committed $240 million to triple its hashrate by adding 88,000 new miners. This significant investment comes in the wake of a 29% year-over-year drop in earnings and a 6% decrease from the previous month, post-halving.

Despite these financial challenges, Bitfarms has demonstrated positive momentum through strategic expansions and operational improvements.

In Québec, Bitfarms is progressing with its expansion at the Baie-Comeau site. According to its report, the facility is set to increase its capacity by 12 MW, reaching a total of 22 MW, with this upgrade expected to be operational by September 1, 2024.

In Paraguay, the Paso Pe site is energized and hashing, while construction at the Yguazu site continues, with four new warehouses under development.

Despite these advancements, Bitfarms is facing challenges in meeting its target hashrate of 12 EH/s.

CEO Emiliano Gagnon highlighted that the current hashrate is below expectations due to overheating issues with a batch of approximately 3,000 T21 miners, which account for about 700 PH/s of the company’s capacity.

To address these issues, Bitfarms is collaborating with its hardware provider, Bitmain. The problematic miners are being replaced at Bitmain’s expense, with new machines expected to arrive and be installed within three weeks.

The recent investment and operational strategies reflect Bitfarms’ commitment to overcoming the financial setbacks caused by the Bitcoin halving. The company’s focus on expansion and resolving hardware issues positions it for potential growth and recovery. However, its ongoing tussle with Riot Platforms remains an issue for the company.

Notably, Bitfarms recently adopted a new ‘poison pill’ strategy following the Ontario Capital Markets Tribunal’s termination of its initial plan to fend off a hostile takeover attempt by rival Riot Platforms.