Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Boerse Stuttgart Digital, the digital asset brand of the Boerse Stuttgart exchange group, has joined forces with Fenergo, a provider of AI-powered solutions for transaction monitoring and compliance.

By integrating Fenergo’s AI solutions, Boerse Stuttgart Digital aims to simplify the onboarding process for financial institutions seeking to offer crypto services across Europe.

Simplified Compliance Processes

According to the exchange’s press release from Nov. 6, shared with CryptoNews, the new service will enable financial institutions to seamlessly onboard clients and comply with European stringent regulatory requirements such Know Your Customer (KYC) and Anti-Money Laundering (AML).

European FIs are increasingly seeking compliant solutions for entering the crypto market.

We’re thrilled to announce our latest partnership with Boerse Stuttgart Digital to accelerate onboarding of banks, brokers and asset managers. https://t.co/fM6kd7GaWo pic.twitter.com/ml7vJSKMN7— Fenergo (@Fenergo) November 6, 2024

By optimizing the underlying compliance processes for identity verification, Boerse Stuttgart Digital will be able to strengthen its position “as Europe’s fully regulated infrastructure partner for crypto and digital asset solutions.”

“In the race to implement their own crypto offerings, financial institutions require efficient trading and custody solutions that also ensure full regulatory compliance,” said Dr. Ulli Spankowski, Chief Digital and Product Officer of Boerse Stuttgart Digital.

“Our partnership enables banks, brokers, and asset managers to enter the crypto market, backed by an infrastructure that guarantees scalability, security, and regulatory compliance.”

Fenergo Supports LBBW’s International Growth

Headquartered in Dublin, Ireland, Fenergo helps financial institutions, asset management firms, and fintech companies digitally onboard and manage their clients. From initial customer verification to ongoing compliance monitoring, Fenergo’s software covers the entire customer lifecycle.

In addition to Boerse Stuttgart Digital, Fenergo is also working with other German financial institutions. One such example is Landesbank Baden-Württemberg (LBBW), one of Germany’s largest state-owned banks, which also provides cryptocurrency services to its corporate clients.

In September, LBBW selected Fenergo to implement a cloud-based client onboarding system to improve its compliance processes and operational efficiency. This partnership also aims to support LBBW’s international growth, particularly in Europe, the United Kingdom, and Asia, where the bank serves approximately 1,500 institutional and corporate clients.

KYC Costs: Germany Leads the Way

Fenegro’s “Global KYC Trends 2023” study found that German banks lead the world in terms of KYC review costs, with an average expense of $2,856 per client.

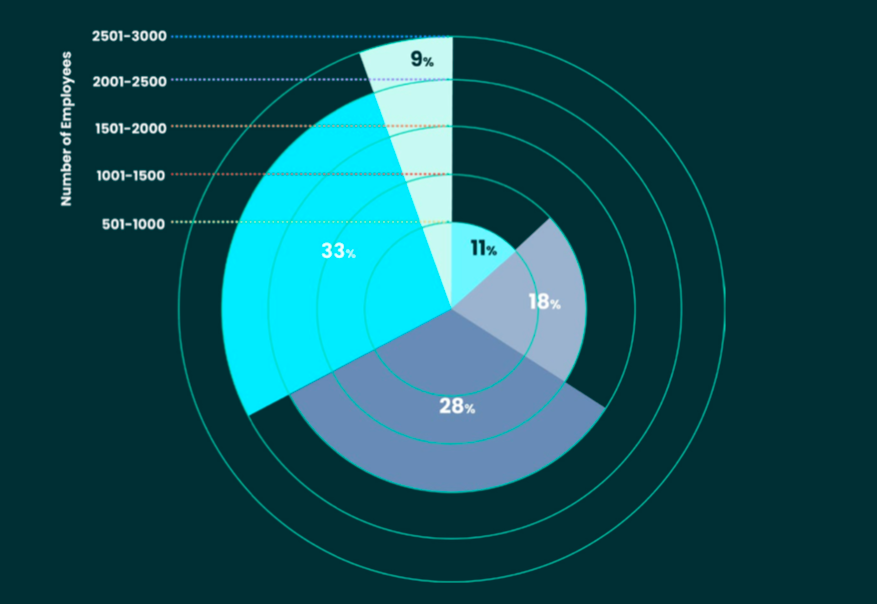

Furthermore, a significant portion of German banks (22%) dedicate over half of their total compliance budget to KYC procedures. To manage this complex process, many banks employ a large workforce, with 33% having between 2,001 and 2,500 employees dedicated to KYC tasks, significantly more than the global average of 1,566 employees per bank.