Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The Boerse Stuttgart Group, the second-largest exchange in Germany, has completed its blockchain tests conducted as part of the European Central Bank (ECB) initiative.

As part of the ECB’s blockchain tests, the Boerse Stuttgart Group was the first to pilot the settlement of exchange transactions involving blockchain-based securities against central bank money.

Partner banks such as Commerzbank, Deutsche Bank, DZ Bank, LBBW, Bankhaus Metzler, and V-Bank participated as trading and settlement participants, connected to the Stuttgart Stock Exchange’s DLT-based settlement solution. This system was also integrated with the traditional Euro payment system through a connection with the Deutsche Bundesbank’s Trigger solution.

Efficiency Gains and Reduced Costs

According to the press release shared with CryptoNews, the exchange’s settlement solution for tokenized securities has proven highly efficient, even for secondary market transactions.

The new system significantly streamlines and accelerates the settlement of securities transactions, reducing the time required “from two days to a few minutes.” This efficiency gain is expected to lead to cost savings for both investors and financial institutions: “The tests showed that settlement processes can be fully automated, step-by-step, and directly between trading participants – efficiently, securely, and without counterparty risk,” as per the press release.

The tests encompassed a wide range of tokenized securities, including bonds, funds, and stocks, demonstrating the versatility of the technology.

“Blockchain technology is a game-changer for the digitalization of the European capital market. With the successful completion of the ECB blockchain tests, we have taken a significant step forward in the EU,” said Matthias Voelkel, CEO of the Boerse Stuttgart Group.

Voekler also added that its Swiss-based tokenized securities exchange, BX Digital, which is set to launch in 2024, will use the exchange’s own blockchain-based settlement solution.

Unlike previous ECB tests, the Boerse Stuttgart Group conducted a comprehensive evaluation of their blockchain-based settlement solution. Instead of relying solely on individual transactions, they tested the system under a variety of scenarios, including both routine and exceptional circumstances.

To ensure a thorough assessment, the group involved several key players, such as the broker EUWAX AG and the crypto custodian Boerse Stuttgart Digital Custody.

EU’s DLT Pilot Regime Faces Adoption Hurdles

While Germany itself offers supportive laws for the issuance of tokenized securities (and German institutions remain actively involved in the ECB’s DLT settlement trials), trading and settlement activities are primarily governed by European Union regulations, like the DLT Pilot Regime.

This regulation was agreed in May 2022 – and it applied a year later, in May 2023.

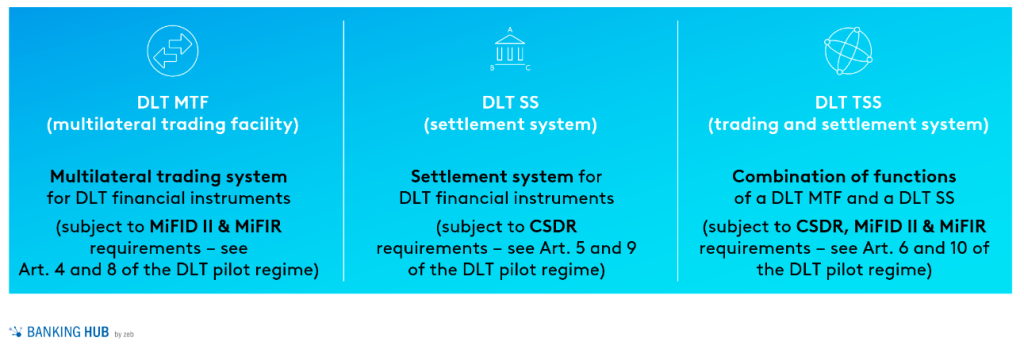

The DLT regime sets out a legal framework for the trading and settlement of transactions in crypto assets that qualify as financial instruments (under MiFID II) – seeking to facilitate an environment for safe experimentation.

Verena Ross, Executive Director of the European Union’s Securities and Markets Authority (ESMA), highlighted the main challenges hindering the introduction of the DLT pilot regime in a letter to EU regulators in April 2024.

According to the letter, the DLT Pilot Regime, a relatively new regulatory framework, faces several challenges hindering its adoption. These include limited availability of cash settlement providers, uncertainty regarding custody services, interoperability issues between DLT and traditional systems, investor protection concerns, and restrictions on the types of financial instruments that can be traded. Additionally, market participants seek clarity on the duration of the pilot regime.

In response, Mairead McGuiness, European Commissioner for Financial Services, reiterated the importance of the DLT regime and noted the growing interest from the financial industry. In addition, the Commission will address these challenges and has clarified that there is no fixed end date for the pilot regime.