Your browser does not support the <audio> element.

Volatile weather is a peril of the high seas. Volatile markets are similarly treacherous for the container-ship industry, which carries 80% of the volume of internationally traded goods. A global pandemic, which kept people at home with little else to do but buy, buy, buy, sent container rates sky-high. In 2022 shipping lines’ return on capital exceeded 40%; the biggest earned profits that were three times the total for the previous two decades combined. Rates and returns tumbled as demand waned and shipping companies started to receive the new vessels ordered during the boom. Then attacks by Houthi rebels on ships in the Red Sea all but closed the Suez Canal. The disruption has sent rates back to records surpassed only during the pandemic. How long will the good times last this time?

On the surface, the answer should be: not long at all. Historically, value destruction has been the industry norm. Bernstein, a broker, reckons that between 2002 and 2019 shipping firms’ average return on capital of 4.7% trailed in the wake of its cost of capital, which averaged 10% or so. New ships take a couple of years to build. According to bimco, an industry association, in 2023 the global fleet added capacity of around 2.3m 20-foot equivalent units (the standard measure of container size), surpassing the previous annual record by 37%. Another 1m arrived in the first four months of 2024. In February worries about overcapacity led A.P Moller-Maersk, the world’s second-largest shipping line, to warn it could lose up to $5bn this year.

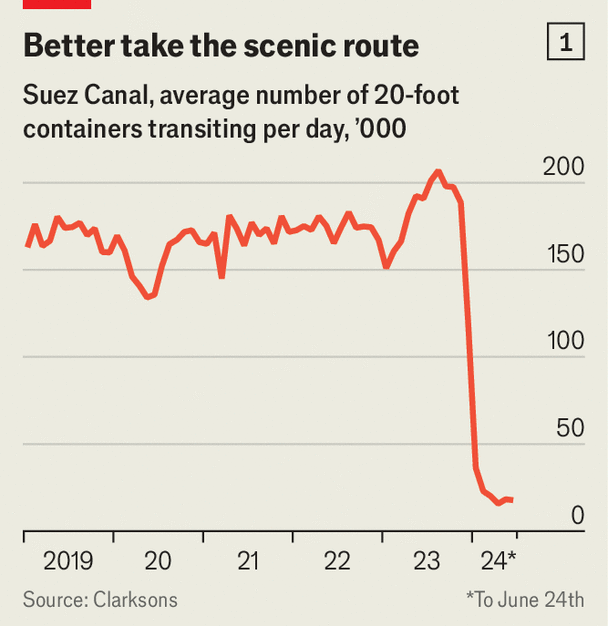

Now Maersk reckons it will instead make a pre-tax profit of perhaps $3bn. What changed? Stephen Gordon of Clarkson’s, a shipbroker, points to the disruption in the Red Sea as the main cause of surging demand. The Houthis show no sign of letting up. In recent days a sailor was killed, a vessel sunk and another abandoned in flames by its crew. The waterway once accounted for 30% of global container traffic but 90% of vessels that would have gone through the canal are now rerouting around Africa, adding at least a week or two to journeys from Asia to Europe and America (see chart 1). And longer journeys mean that more ships are needed to ferry the same volume of goods in a given period.

The Suez onslaught is happening just as other forces put the wind in shipping lines’ sails. The global economy has avoided recession and the peak season for container traffic has arrived early, as importers stock up for Christmas to evade disruptions, potential tariffs and further increases in freight rates, explains hsbc, a bank. The cost of sending a container from Shanghai to America’s west coast has doubled since late April. It is now more than four times what it was in early December and only 12% below the covid peak in February 2022 (see chart 2).

If the Red Sea remains rough until later this year, the extra demand could more or less soak up the growing fleet, whose capacity is poised to expand by 8% this year. If the Houthis stand back sooner, it would leave many of the new ships idle. What of future years? Vincent Clerc, Maersk’s chief executive, concedes that overcapacity is again one possible outcome. Already many of Maersk’s rivals are using the unexpected windfall to order new ships. But Mr Clerc remains optimistic that oversupply can be avoided if shipping firms delay taking vessels from lessors and scrap older ships sooner—not a bad idea as they green their fleets to meet emissions targets. Although things are likely to stay “volatile and unpredictable”, that could still mean “a decade of robust market conditions” for the industry. Spoken like an old salt. ■

To stay on top of the biggest stories in business and technology, sign up to the Bottom Line, our weekly subscriber-only newsletter.