Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

All metrics point to a massive surge in price, acceptance, reputation, and mainstream adoption for Bitcoin (BTC) this year, crypto insiders argue.

According to Jeff Park, the head of alpha strategies at Bitwise Asset Management, the “world is literally on the brink of max chaos” and “max retardation.” The exec suggests that we are about to see massive events, particularly in the US, that will cause an avalanche globally.

Among these events, he named deglobalization, new and increasing tariffs, as well as the debt ceiling. The US federal debt limit was reinstated on 2 January at $36.1 trillion. Furthermore, House Republicans aim to raise the debt limit by $4 trillion to increase government spending amount to finance its bills.

Additionally, per Park, there are unprecedented tax cuts, gold run tail risk, and the looming yield curve control (YCC) to take into account. The above-noted House Republican budget plan released last Wednesday also provides for up to $4.5 trillion in tax cuts.

Meanwhile, YCC is a monetary policy action when a central bank buys as many government bonds or other financial assets as necessary to target interest rates at a certain level.

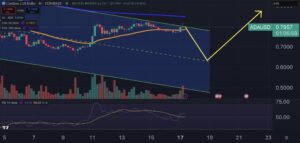

Moreover, the analysts noted that the BTC implied volatility (IV) percentile (the percentage of days the volatility was lower than the current level) is the lowest it’s been in the entire year.

BTC IV is 49.7, meaning that 5% of the time the IV was lower in the last year than the current level, according to Market Chameleon. This current IV is -6.6% below its 20-day moving average (53.2) indicating implied volatility is trending lower.

Deribit currently shows the index at 50.1, as seen in the chart below.

All the factors mentioned above, Park said, present a “generational opportunity.”

You might also like

BTC Set for ‘Massive Leaps’ into Mainstream This Year

Park also shared a tweet by Bitwise CEO Hunter Horsley.

The CEO states that he has never been more optimistic about BTC and that people underestimate the jump Bitcoin will make into the mainstream in 2025.

In early February, Bitwise’s chief investment officer Matt Hougan told Cryptonews he believed BTC would surge “dramatically higher” in 2025, and that the era of the four-year cycle may be over. “I think 2025 flows will be bigger than 2024, [and] 2026 will be bigger than 2025. I think 2027 will be bigger than 2026,” Hougan said.

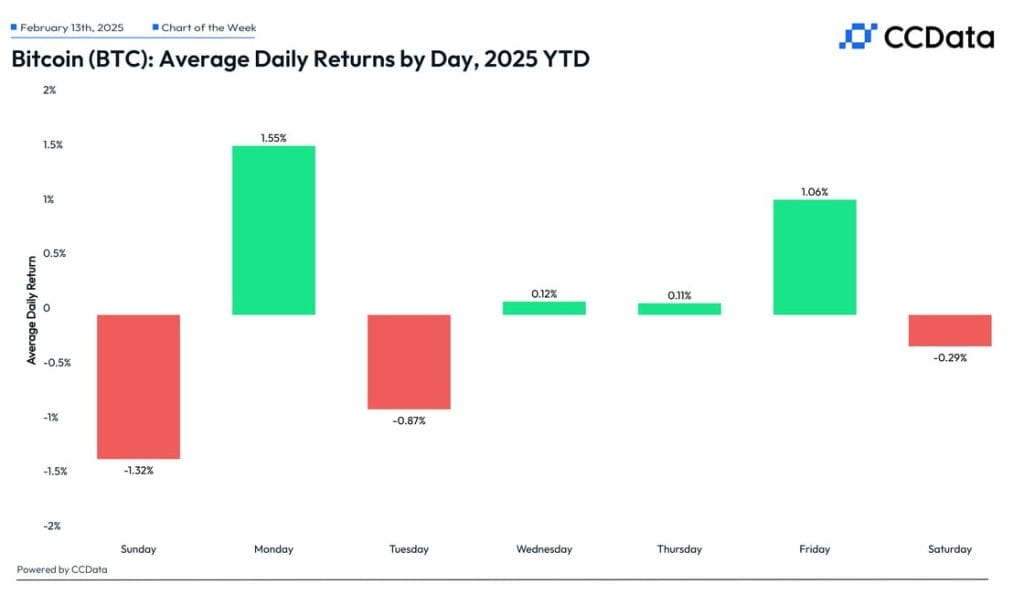

Meanwhile, according to the latest CCData report shared with Cryptonews, Bitcoin saw more days with positive returns than negative, signaling a resilient market.

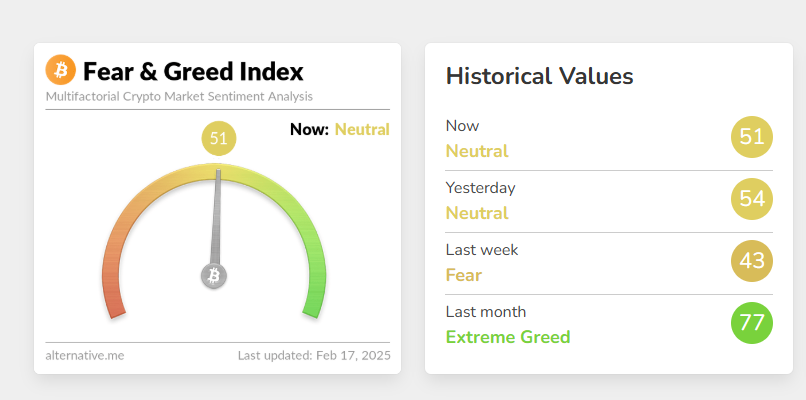

At the same time, the Crypto Fear & Greed Index currently measures a score of 51 – neutral. As the data show, last week this measure stood at ‘fear’ (43), but last month it was at ‘extreme greed’ (77).

As for the price, BTC trades at $96,230. At the time of writing, it’s down 1% in a day, 1.5% in a week, and 7% in a month.

However, it’s up 86% over the past year. It hit its all-time high of $108,786 on 20 January, falling 11.5% since.

Meanwhile, Japanese tech giant Metaplanet bought an additional 269.43 BTC, worth some $25.9 million, as it continues to build its BTC reserves. Its total Bitcoin holdings now stand at BTC 2,031.41. The company pivoted to “Bitcoin-first, Bitcoin-only” strategy last year.

You might also like