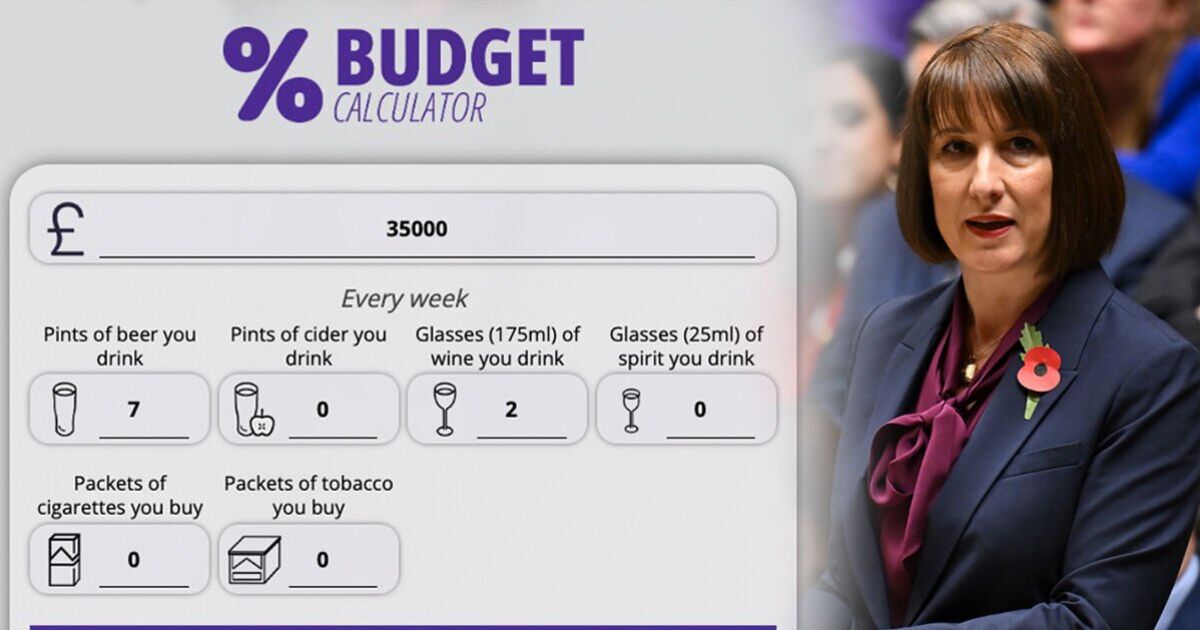

A new tax calculator shows you could benefit – or lose out – in Labour’s Budget, after government unveiled its plans for the economy, including taxation and spending, on Wednesday.

The Chancellor Rachel Reeves announced today that taxes will increase by an eye-watering £40 billion, blaming the tough measures on a £22billion black hole Labour claims they inherited from the previous Tory government.

The majority of the £40bn will come from a £25bn hike in employers’ National Insurance contributions, a move that has brought concern from some business owners.

The amount firms will pay on their employees’ NI contributions will rise to 15% from April 2025 from the current 13.8%.

Additionally, the Chancellor announced the threshold for paying contributions will fall from £9,100 per year to £5,000. This was a “difficult choice”, Reeves said, as Labour argues it must make tough fiscal decisions to get the economy back on track.

As expected, income tax and national insurance rates have been frozen, but so too have the tax thresholds. The freezing of the personal allowances means that people who are due to receive a pay rise will see the amount of tax they pay increase, something known as ‘fiscal drag’.

The cost of smoking is increasing, with cigarette duty rising by the Retail Price Index (RPI) inflation rate – currently at 2.7% – plus an additional 2%.

Duty on packets of rolling tobacco are set to increase by an additional 10%.

It’s good news and bad news for drinkers, with the duty on draught products such as beer and cider falling by 1.7%, which works out as 1p per pint.

Wine and spirits are on the rise though, increasing by the RPI, which works out at around 1p for a small glass of wine or measure of whisky.

Despite speculation that the Chancellor was set to restore the 5p that was cut from fuel duty by the previous government, fuel duty is set to remain at the current levels for the foreseeable future.

Find out how much better or worse of you could be following the Chancellor’s Autumn Budget using out interactive tax calculator below…

It comes as think tanks suggested workers could lose out. The Office for Budget Responsibility (OBR), the government spending watchdog, warned that most of burden from the increase will be passed on to workers because of lower wages.

Consumers could also be impacted because of higher prices, it said.

Among the other key announcements was a £22.6 billion boost to the day to-day health budget. The capital budget will also see a £3.1 billion over this year and next year, as per The Standard.

Half of the increase in the government’s spending will also be funded by a £32 billion (1% of GDP) a year increase in borrowing, the OBR said.

You can get a more detailed look at the announcements made in the Budget here.