Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Crypto exchange Bybit has confirmed that it’s the entity behind the recently submitted proposal asking the decentralized finance (DeFi) protocol ParaSwap to return fees associated with the biggest exchange hack in history.

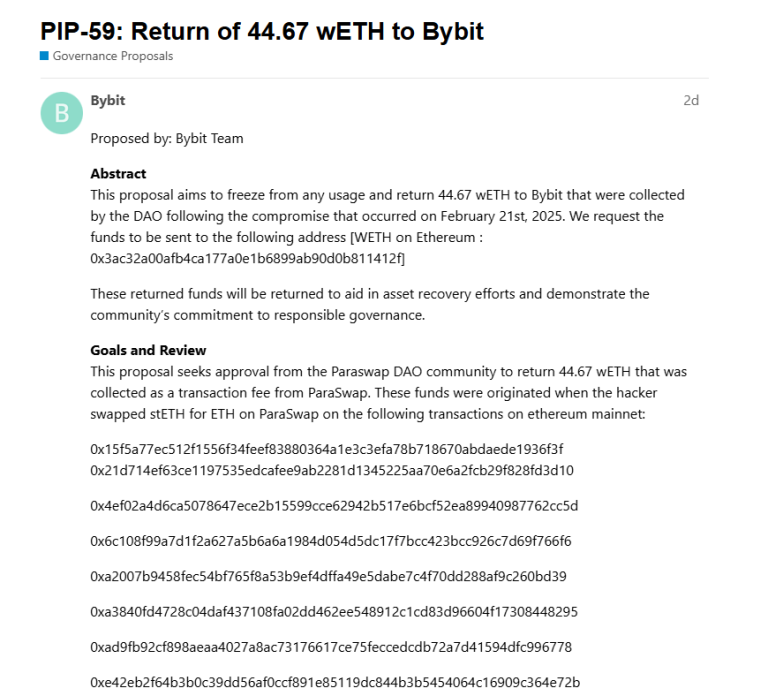

The Bybit Team posted the proposal on ParaSwap’s decentralized autonomous organization (DAO) forum on 3 March.

It seeks the DAO’s approval for 44.67 wETH (currently $97,255) to be frozen and sent to the exchange. These funds are transaction fees that came from the Bybit hacker swapping stETH for ETH. The exchange included a list of transactions for reference.

The funds would be “returned to aid in asset recovery efforts and demonstrate the community’s commitment to responsible governance,” the proposal reads.

Bybit went on to cite the ethical and reputational implications, noting that the DAO would maintain its “integrity and responsible governance practices” by returning the funds.

Furthermore, it would support wider industry efforts to alleviate the impact of crypto-related cybercrime.

Finally, the source of the funds could potentially expose stakers and DAO participants to risk, Bybit argued.

The proposal has since sparked a heated discussion. It produced a range of opinions, from returning the full amount, over returning some of it, to not returning any.

Some members proposed that DAO keeps 10% bounty, while others wondered if Bybit would pursue other entities, seeking to recuperate the fees.

Others argued that, while returning the fees could be an act of solidarity, ParaSwap collected the fees through legitimate transactions. “Do we want to set a precedent where ParaSwap (and DeFi more broadly) becomes responsible for CEX security failures,” ‘Cay’ asked.

‘Argonaut’ argued, however, that Paraswap shouldn’t profit from crime if it can prevent it, and that this is not a minor scammer but “an issue that affects our industry as a whole.”

The discussion continues.

You might also like

Preparing for Laundry Week

Hackers, likely the infamous Lazarus Group, North Korea’s state-backed cybercrime organization, hacked Bybit on 21 February. They took $1.46 billion in liquid-staked Ether (ETH) and MegaETH (mETH).

The blockchain analytics firm EmberCN reported that the attackers laundered some 89,500 ETH (18% of the stolen sum) within just two and a half days after the hack.

On 4 March, Bybit CEO Ben Zhou stated that 77% of the stolen funds was still traceable. However, 20% has gone dark, and 3% has been frozen.

He argued that the next week will be critical for tracking and freezing funds. The team expects the hackers to move assets through exchanges, OTC desks, and peer-to-peer platforms.

Speaking of which, cross-chain DEX Chainflip announced a protocol upgrade to prevent hackers responsible for the Bybit hack from using its platform to launder stolen assets.

Notably, February 2025 saw a 20x month-over-month increase in losses compared with January. Yet, the majority of the $1,528,342,400 lost to hacks in February 2025 was the result of this single incident, according to the latest report by major blockchain security platform Immunefi.

You might also like