Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Key Takeaways:

- The incident underscores how attackers can leverage seemingly secure third-party wallet infrastructure to manipulate high-value transactions.

- A carefully injected piece of malicious code in a trusted environment enabled a diversion of assets, raising alarm bells about hidden risks in digital asset management.

- This case highlights the evolving threat landscape where even robust security measures may require continuous reassessment to counter emerging tactics.

- The event serves as a catalyst for reexamining current protocols and encouraging stronger collaboration among cybersecurity experts to mitigate future risks.

- Enhanced monitoring, rapid forensic investigations, and strategic security upgrades are essential for defending against similar breaches.

Bybit has released a forensic report on Wednesday, February 26, 2025, detailing the mechanics of a $1.5 billion security breach that was first confirmed last week.

The attack targeted Bybit’s Ethereum multisignature cold wallet and has been linked to a vulnerability in Safe{Wallet}’s infrastructure, according to a forensic report by security firm Sygnia.

The investigation, launched immediately after unauthorized transactions were detected on February 21, 2025, found that malicious JavaScript code was injected into Safe{Wallet}’s AWS S3 bucket, altering transaction details during the signing process.

The attacker manipulated a transaction, moving funds from a Bybit cold wallet to a warm wallet before diverting them to an external address.

The compromised cold wallet was drained, and the funds were dispersed across multiple addresses, making immediate recovery efforts significantly challenging.

How the Bybit Hack Happened

Forensic analysis of Bybit’s signing hosts revealed how the breach was executed.

Investigators found that all signing hosts had cached malicious JavaScript resources from Safe{Wallet}, which had been altered two days before the attack, on February 19, 2025. The timing suggests premeditation.

The malicious script activated only when transactions came from specific contract addresses, including Bybit’s multisig contract and another address suspected to belong to the hacker.

The forensic team analyzed internet archives of Safe{Wallet}’s JavaScript resources and discovered that a legitimate version of the script had been replaced with the compromised one on the same day.

Two minutes after the wallet was drained, Safe{Wallet}’s AWS S3 bucket was updated to restore the original, non-malicious JavaScript file.

This swift modification suggested an attempt to cover tracks, making it harder for investigators to pinpoint when and how the attack was staged.

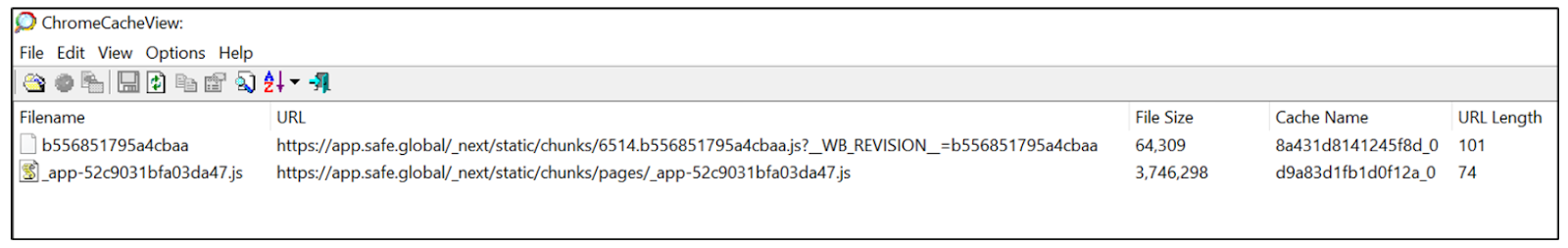

Despite this, forensic analysis of Chrome browser artifacts across all three signers’ machines provided irrefutable evidence of the injected code’s presence during the attack.

Inside the Exploit and Recovery Efforts of the Bybit Hack

Blockchain records show the attack was planned in advance. On February 18, 2025, the hacker deployed a malicious contract containing code designed to facilitate unauthorized withdrawals.

Later that day, the attacker deployed another contract with backdoor functions designed to exploit Bybit’s multi-signature wallet.

These contracts remained dormant until the attacker successfully manipulated the signing process, upgraded Bybit’s contract, and rerouted the funds.

When the unauthorized transaction was executed on February 21, the exploit was fully operational, allowing the hacker to drain 401,347 Ether and substantial amounts of wrapped and staked Ethereum assets.

The stolen funds were then systematically laundered through multiple wallet addresses, making direct tracing difficult.

Blockchain forensics traced initial movements to a cluster of addresses, which investigators suspect belong to the threat actor.

Despite this, the ongoing nature of the investigation means the full extent of asset dispersion remains unclear.

Bybit’s security infrastructure itself showed no signs of direct compromise, further solidifying the conclusion that the vulnerability may lie within Safe{Wallet}.

Chainflip, a cross-chain decentralized exchange (DEX), is implementing a protocol upgrade to block the laundering of stolen funds.

The 1.7.10 upgrade enhances security by allowing broker operators like SwapKit and Rango DEX to block suspicious ETH and ERC-20 deposits.

You might also like

A Reflection on Resilience

This event urges us to recognize that even the most robust systems can be caught off guard by unforeseen breaches.

The detailed report offers a window into how minor vulnerabilities can spiral into significant setbacks.

Reflecting on this case invites readers to reassess their approach to securing digital assets.

It sends a clear message that persistent care in our defenses is not a luxury but a necessity.

Consider this moment an opportunity to reaffirm your commitment to remaining adaptable in today’s dynamic digital industry.

Frequently Asked Questions (FAQs)

The investigation reveals that even well-regarded multi-signature and cold storage systems can be undermined by vulnerabilities in integrated third-party services. This breach emphasizes the need for a holistic security review that includes every component in the transaction chain, from infrastructure to code injection points.

The incident suggests that augmenting multi-signature protocols with continuous real-time monitoring and independent security audits can help detect unusual transaction patterns early. Additionally, implementing strict access controls and validation measures for third-party integrations is critical for reinforcing these systems

Key takeaways include the importance of proactive vulnerability assessments and updating legacy systems. Platforms should also invest in collaboration with cybersecurity experts and deploy advanced forensic tools to swiftly identify and neutralize potential threats before they escalate.

The sophisticated nature of this breach indicates that state-linked actors are continuously evolving their techniques. Their ability to exploit subtle weaknesses should prompt the industry to adopt more agile security frameworks and invest in international collaboration to share threat intelligence and defensive strategies.

Immediate actions include reassessing and tightening access controls, regularly updating and patching integrated systems, and instituting rigorous transaction verification protocols. Users are also advised to review their security practices and consider multi-layered defenses to safeguard against unauthorized access.