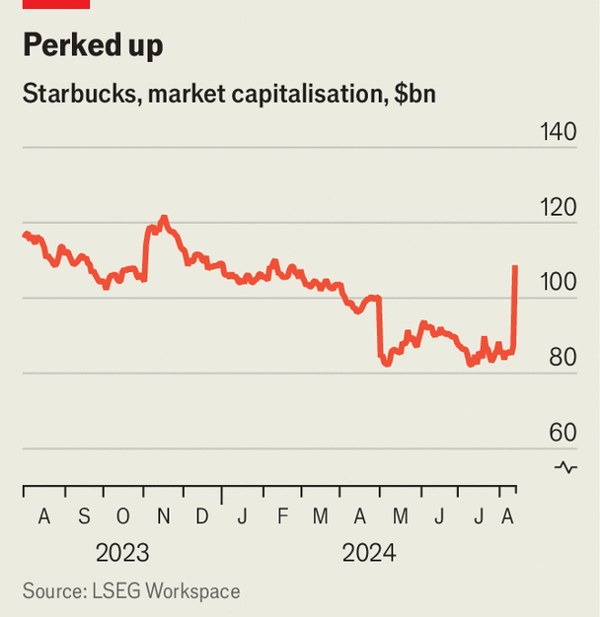

Chief executives like to measure their worth in hard currency. One yardstick is their pay. Another is the market’s reaction when they move jobs. Howard Schultz has twice returned to the helm of Starbucks, the coffee giant he built up from a handful of trendy shops in Seattle. Shareholders greeted him cautiously both times. But they have given a rapturous welcome to Brian Niccol, the current boss of Chipotle Mexican Grill, a chain of canteen-like restaurants, who was named Starbucks’ next chief executive and chairman on August 13th. Since then, its market value has risen by $19bn (see chart), adding the equivalent of roughly ten Cheesecake Factories or one Domino’s Pizza.

Starbucks’ surging share price also reflects the disastrous 512-day tenure of Laxman Narasimhan, its departing boss. He inherited a business struggling with an excessively long menu and inefficient stores. In the 2006 film “The Devil Wears Prada”, Anne Hathaway is tasked with collecting a “no foam skimmed latte with an extra shot” for a stony fashion editor played by Meryl Streep. Today that would pass for an easy order. Most drinks are cold and customised. Food now makes up a fifth of sales. After tapping into the Starbucks app, Ms Hathaway might abandon hope after seeing the wait time. She would not be the first. Sales in America declined by 2%, year on year, during the most recent quarter, despite the average order costing 4% more. Critics dismissed Mr Narasimhan’s response (the “triple shot reinvention with two pumps” strategy) as a verbose laundry list. Starbucks needed a well-caffeinated visionary. In Mr Narasimhan it got a sugary management consultant.

Mr Niccol, by contrast, is well-suited to the challenge. Some consider him the industry’s finest. When he took over at Chipotle in 2018, the company was still suffering after an outbreak of E. coli at its stores in 2015. Since then, the firm’s sales have doubled and its market value has increased eight-fold, briefly surpassing that of Starbucks in May. Analysts credit Mr Niccol with increasing the efficiency of Chipotle’s stores. Given the complexity of Starbucks’ menu, Mr Niccol’s old job, where each burrito would be customised, has lots in common with his new one.

But transforming Starbucks will be tough, not least because America’s previously indefatigable consumer is showing signs of lassitude. According to a University of Michigan survey published on July 26th, consumer sentiment is at its lowest since November. The day Mr Niccol’s appointment was announced, Home Depot slashed its profit guidance, saying that more consumers were delaying home renovations. At least for now, Starbucks should avoid the slump. According to figures from HundredX, a data provider, lower-income customers are planning to curtail their spending more than others. But Starbucks, like Chipotle, relies far less on them than fast-food chains like McDonald’s.

Starbucks’ business in China poses a more vexing problem. Since 2019 its footprint has doubled in size, to 7,306 stores, without any meaningful increase in revenue. Sales in the country declined by 14%, year on year, during the most recent quarter as the business faced stiff competition from cheaper local rivals such as Luckin Coffee. Starbucks’ gloomy prospects in China have been clear since the start of Mr Narasimhan’s tenure, but only a few weeks ago did he broach the possibility of shaking up the business through “strategic partnerships”. Mr Niccol should split off the business and focus his attention on America. It could follow the lead of Yum! Brands, which owns Pizza Hut and Taco Bell, which spun off its Chinese operation in 2016. It is a move Mr Niccol knows well—he ran Taco Bell at the time.

Mr Niccol must do all of this under the watchful eye of Starbucks’ owners. Earlier this year Elliott Management, a notorious activist, bought a position in the company and began lobbying for change. Starboard Value, another such firm, has also taken a position. And there is another activist Mr Niccol must avoid displeasing: Mr Schultz. The coffee guru looms large over the business, and remains one of its biggest shareholders. Earlier this year he wrote a public letter saying the firm needed a “reset”, and was proved correct. He will not go away anytime soon. ■