Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The XRP price surge has the altcoin dominating the “best crypto to buy” conversation with after overcoming a 4-year-long headwind, winning the SEC Lawsuit.

The front-running altcoin jumped 13% during Wednesday’s trading session, hitting a peak of $2.56 and reaffirming bullish 2025 XRP price forecasts.

XRP took Solana’s place on the podium in December to become the Third largest cryptocurrency, now speculators are eyeing Ethereum’s spot.

Claim to the Throne: Could XRP Flip Solana?

The prospect that XRP could flip Ethereum is not new—while fundamentals continue to stack in XRP’s favor, Ethereum has been slacking.

Since Trump’s reelection in November XRP has grown over 300% in market share. Over the same period, Ethereum has lost over 35%.

The Trump administration’s push to establish the U.S. as the “crypto capital” with a more favorable regulatory environment has been a key factor in this divergence.

XRP stands as one of the biggest beneficiaries as a champion of institutional adoption, particularly as Ripple unveiled an institutional DeFi roadmap in February.

On the flip side, Ethereum’s recent Duncan upgrade, intended to improve scalability by slashing transaction fees by 95%, has inadvertently weakened its deflationary burn mechanism.

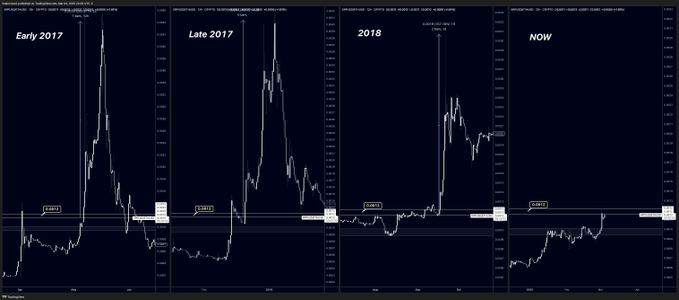

Technicals also favor XRP. The XRP/ETH pair is now testing a historically significant resistance level at 0.0012 ETH—a threshold that has consistently preceded explosive rallies in past cycles.

Pseudonymous X analyst Dom notes that XRP has “ONLY ever went parabolic” upon breaking this level, delivering gains of at least 160% in previous instances.

As of March 20th, XRP is attempting a decisive test of this critical level. If history repeats itself, even a partial rally of 80% would push XRP over Ethereum.

XRP Price Analysis: Is XRP About to Rally?

This retest comes as XRP faces a potential breakout of a descending triangle pattern that has guided price movements since mid-January.

While Trump’s announcement of XRP as a potential reserve asset reserve announcement sparked a false breakout last time, this one seems to have staying power.

The Relative Strength Index (RSI) has climbed back to a neutral 51, and the MACD line remains above the signal line—both indicators suggest dominant buying pressure.

If the breakout holds, it eyes an XRP price target of $3.90, marking a 60% gain from current levels.

However, with today’s session showing a sharp decline in what may be a “sell-the-news” event, holding the $2.40 support zone will be crucial to sustaining the breakout.

This New ICO Also Poses a Threat to Ethereum’s Dominance

While XRP takes the spotlight, Solana remains a threat to Ethereum’s dominance, with its trading volume now rivaling Ethereum and all its Layer-2 chains combined.

But Solana could be in for a boost with Solaxy ($SOLX), its first-ever Layer-2 scaling solution–attracting over $27 million in its ongoing presale.

Unlike Ethereum, which boasts several Layer-2 options, Solana has long lacked this capability—until now.

By processing transactions off-chain and finalizing them on Solana, Solaxy significantly reduces congestion and lowers transaction costs, while offering seamless interoperability across both blockchains.

To reward early adopters, Solaxy currently offers staking yields of 150%, though these rates will decrease as more users stake $SOLX.

You can keep up with Solaxy on X and Telegram, or join the presale on the Solaxy website.