ARK Invest capitalized on Monday’s significant market downturn by acquiring Coinbase (COIN) shares for the first time in months.

Cathie Wood’s investment firm purchased $17.8 million worth of Coinbase stock, marking its initial buy since June 6, 2023, when it invested $21.6 million.

The acquisition came as COIN dropped 7.3% to $189.47 amid a market-wide sell-off that saw substantial losses in both crypto and global stock markets.

The crypto company’s shares are now trading at $189, a level last seen five months ago.

ARK Invest Buys the Dip

ARK Invest often buys shares during price dips, with the strategy of selling them once prices recover.

The firm seeks to maintain a balanced portfolio, ensuring no single holding exceeds 10% of any of its exchange-traded funds (ETFs).

The strategy has led to significant selling of COIN in recent months.

Post-purchase, COIN now represents 8.55% of ARK’s Innovation ETF (ARKK), 6.73% of its Next Generation Internet fund (ARKW), and 9.72% of its Fintech Innovation ETF (ARKF).

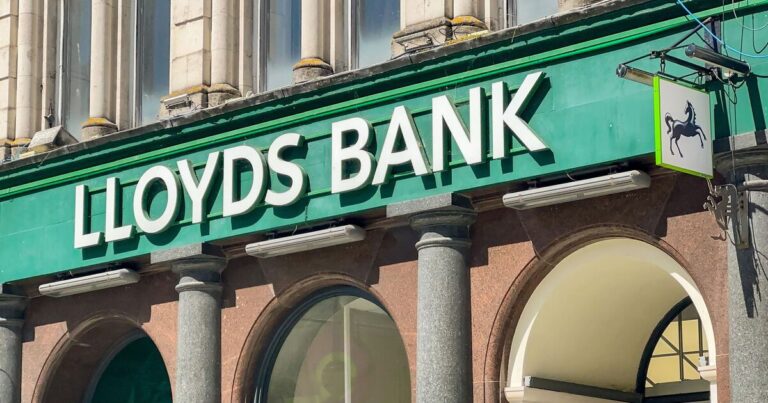

As reported, Bank of America (BAC) has recently upgraded its rating on Coinbase shares from underperform to neutral, raising its price target for Coinbase to $217 from $110.

Aside from Bank of America, investment banking firm KBW has also increased its Coinbase price target.

In a research analysis, KBW raised its Coinbase price target from $160 to $230 while maintaining its market performance rating.

It is worth noting that ARK Invest also made other major acquisitions during the dip on Monday, including 12,426 shares of Tesla (TSLA) valued at $2.5 million and 176,963 shares of Amazon (AMZN) worth $28.5 million.

Additionally, Ark Invest purchased 681,885 shares of Robinhood (HOOD) for $11.12 million, 12,545 shares of Meta (META) valued at $5.96 million, 25,316 shares of AMD (AMD) amounting to $3.4 million, and 52,239 shares of Palantir (PLTR) for $1.26 million.

Amid market turmoil on Monday, Ark Invest made significant trades across its ETFs, including ARKK, ARKQ, ARKW, ARKG, ARKF, and ARKX. Key purchases were:

Tesla $TSLA : 12,426 shares ($2.5M)

Amazon $AMZN : 176,963 shares ($28.5M)

Coinbase $COIN : 93,797 shares ($17.78M)

Robinhood…— Mr Chart Norris (@kholov23) August 6, 2024

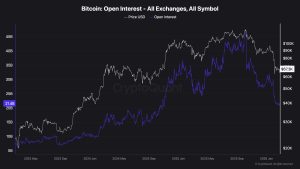

Crypto Market in Turmoil

ARK’s return to buying came at a tumultuous time for the broader crypto industry.

On Monday, Bitcoin plummeted to $50,000, marking its lowest level since February 2024.

Other major cryptocurrencies also suffered significant losses.

Ethereum (ETH), Binance Coin (BNB), Cardano (ADA), and Solana (SOL) have all declined by around 15% over the past day.

As reported, digital asset investment products saw outflows amounting to $528 million last week, marking the first downturn in four weeks.

The exodus is believed to be a response to mounting concerns over a potential recession in the United States, compounded by geopolitical uncertainties and consequent widespread liquidations across various asset classes.

For one, the Bank of Japan’s (BOJ) decision to raise interest rates for the first time in 17 years due to concerns over the Yen’s purchasing power decline against the US Dollar has triggered apprehension within risk-on asset markets, prompting widespread sell-offs.

Additionally, escalating tensions in the Middle East, particularly between Israel and neighboring nations, have added to the prevailing market unease, with fears of further escalation prompting precautionary measures among concerned countries.