Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

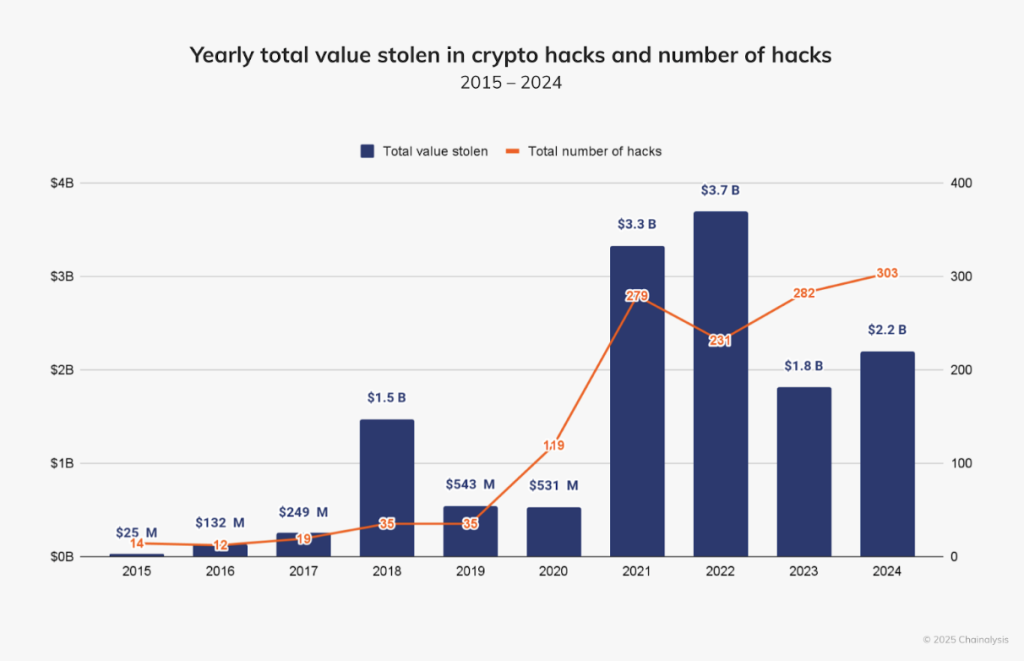

Crypto hacking remains a huge challenge, with the total value of stolen funds surging to $2.2 billion in 2024, a 21.07% year-over-year increase, reports blockchain analytics firm Chainalysis.

The number of hacking incidents also grew, rising from 282 in 2023 to 303 in 2024.

Chainalysis highlights while the year started with alarming intensity—$1.58 billion was stolen by July, an 84.4% increase compared to the same period in 2023—the upward trajectory slowed in the latter half of the year, suggesting a shift in dynamics.

Shift in Hacking Targets

Historically, decentralized finance (DeFi) platforms have been the primary targets due to their rapid development cycles and a focus on market growth over security. While DeFi still accounted for the largest share of stolen assets in Q1 2024, centralized services became the top targets in Q2 and Q3, reports Chainalysis.

Notable centralized platform hacks included DMM Bitcoin ($305 million in May) and WazirX ($234.9 million in July). This shift highlights the critical need for improved security measures, particularly around private keys, which emerged as the most exploited vulnerability in 2024. Private key compromises were responsible for 43.8% of stolen crypto.

Laundering Techniques Evolve

Chainalysis highlights that after compromising private keys, hackers often launder stolen funds through various mechanisms to obscure transaction trails. In 2024, private key hackers predominantly used bridges and mixing services to hide their activities. Those hackers employing other attack vectors leaned more on decentralized exchanges (DEXs).

The ongoing evolution of laundering techniques makes it difficult to trace and recover stolen funds, further complicating enforcement efforts, reports the analytics firm.

Chainalysis Acquires Security Firm Hexagate

On Wednesday, Chainalysis said it had acquired Hexagate, a Web3 security company specializing in detecting and mitigating real-time threats on blockchain networks.

Hexagate claims it has saved over $1 billion in customer funds by allowing organizations to respond swiftly to potential threats. Clients including Coinbase and Consensys, rely on Hexagate to safeguard their on-chain operations.