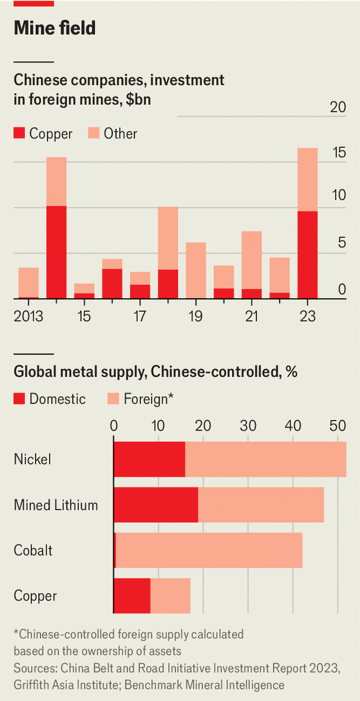

To decarbonise the global economy and build the data centres needed for ever smarter artificial-intelligence models, the world will need lots of minerals. China wants first dibs. Last year its companies ploughed roughly $16bn into mines overseas, not including minority investments.

That is the highest figure in a decade, up from less than $5bn the year before (see top chart). On October 8th a Chinese state-owned enterprise disclosed plans to invest more than $5bn in a copper mine in Afghanistan. The next day Zijin Mining, China’s most valuable listed miner, said it would spend $1bn on a gold mine in Ghana. On October 14th a group of Chinese firms committed $5bn to Zambian mining over the next five years. Chinalco, another Chinese state-owned company, reportedly wants a stake in the Philippines’ biggest copper mine.

Chinese miners control a large and growing share of the world’s minerals, including about half of nickel and mined lithium, more than two-fifths of cobalt and a fifth of copper. Most of that is dug up abroad (see bottom chart). In the past few years that has led to plenty of hand-wringing but not much meaningful action on the part of Western policymakers. There are signs, though, that is changing.

The latest spending spree by Chinese miners has tightened their grip on global minerals. Their focus has been to expand their share of copper, a critical element for electrification. In 2023 the metal accounted for around three-fifths of their overseas investment. Last year MMG, a subsidiary of China Minmetals, a state-owned company, said it would buy a copper mine in Botswana for nearly $2bn and invest $800m to more than double its output. At the same time, Chinese miners have kept investing in the minerals needed for electric-vehicle (EV) batteries. In May Ganfeng Lithium, which owns mines from Argentina to Australia, bought out its partner in one of the world’s biggest lithium mines in Mali.

All that investment has lifted a number of China’s miners into the big leagues. Zijin, which has assets from Serbia to Suriname, last year produced about three-fifths as much copper as BHP, the world’s most valuable miner, and has ambitions to become a top lithium producer, too. Its market value has soared by 500% over the past five years, to more than $60bn, surpassing Vale, a Brazilian mining giant. CMOC, a Chinese state-backed miner that has been acquiring large cobalt projects in the Democratic Republic of Congo, is now the world’s biggest producer of the metal.

Some of what China’s mining giants dig up abroad stays there, and even finds its way to Western buyers. CMOC, through its metals-trading arm in Geneva, sells cobalt to companies like Electra Battery Materials Corporation, a Canadian firm that is building a refining facility in Ontario.

A growing share of China’s overseas mining output, though, is woven into the country’s expanding foreign supply chain for products such as batteries, EVs and solar panels. And much of the ore is shipped back home. In the first nine months of this year China imported 12% more copper, 21% more cobalt and 20% more bauxite than it did in the same period last year.

All this ore feeds China’s vast production base for industrial metals, which far surpasses any other country’s. When it comes to refined minerals, China accounts for around 60% of the global supply of battery-grade lithium, 65% of nickel, 70% of cobalt and 90% of rare-earth elements such as neodymium. Some Chinese miners have stretched further down the supply chain; Zijin now produces copper foil. These metals are then fed into Chinese factories, which manufacture around half the world’s EVs and four-fifths of its lithium-ion batteries and solar panels.

Muddling through

As China’s hold on global mining strengthens, the West—and America in particular—is becoming ever more anxious about its deepening reliance on its strategic rival. America imports more than half the minerals it needs, and China is among its most important suppliers. Politicians eager to boost American manufacturing at home realise that their ambitions may be hampered by a lack of access to the metals all those new factories will require. On the campaign trail Kamala Harris has called for a stockpile of minerals to ensure America’s “economic and national security”, an idea that has won bipartisan support.

A stockpile will not do much to relieve America’s reliance on Chinese minerals. Somewhat more usefully, America and a group of its allies, through the Mineral Security Partnership, are trying to co-ordinate their support for critical-minerals projects around the world. Speeding up the construction of new mines at home would be even better. On October 24th America’s federal government approved a big lithium mine in Nevada—only the fourth new site for critical minerals in America since 2002. That same day it approved tax credits for some mining firms to encourage them to boost the production of critical minerals.

That is a start, but more will be needed if America wants to shake its reliance on Chinese minerals. The Society for Mining, Metallurgy and Exploration, an industry association, has called for a new federal agency to co-ordinate the various minerals programmes scattered across government departments, replacing the Bureau of Mines, which Congress abolished in 1996. That decision, it says, is one reason for America’s “unsustainable dependency on foreign countries” for the minerals it needs. As Chinese miners dig faster and farther afield, their grip will only get harder to loosen. ■

To stay on top of the biggest stories in business and technology, sign up to the Bottom Line, our weekly subscriber-only newsletter.