Your browser does not support the <audio> element.

WESTERN CHAINS used to dominate casual dining and drinking in China. The arrival of a Kentucky Fried Chicken in a Chinese city was once regarded as a developmental milestone. Today China is home to 10,000 KFCs (whose owner, Yum China, was spun off from its American parent in 2016), more than twice the number in America. Starbucks has 7,000 coffee shops and McDonald’s boasts 6,000 burger joints. The foreigners’ cash and cachet made it hard for locals to compete.

Now the tables are turning. Starbucks’s Chinese sales fell by 8% in the first quarter, year on year, and Yum China reported a drop of 3%. Yet even as they lose their appetite for foreign chains, Chinese consumers cannot get enough of domestic ones. Tastien, which fills hamburgers with local delicacies such as Peking duck or mapo tofu rather than beef, has opened 1,600 new shops in the past six months, bringing its total to 7,000. Wallace, another burger-flipper, now has more than 20,000. Cotti, a two-year-old coffee-shop chain, plans to have that many by the end of 2025, up from 6,000 last October. An older caffeine-pedlar, Luckin, opened 8,000 in 2023, doubling its network. Mixue hawks its bubble tea through 36,000 outlets.

Investors are licking their lips. Mixue, which also sells ice cream and churned out 2.5bn yuan ($350m) in net profit in the first nine months of 2023, may soon seek a $1bn initial public offering (IPO) in Hong Kong. A rival tea-seller, Chabaidao, raised $330m when it listed there in April. Another, Chagee, is said to be preparing for an IPO in America. According to local media, the privately held Tastien is valued at 7bn yuan.

A big reason for the sudden popularity of domestic chains is their lower prices. Rather than forgo lattes as China’s economic prospects sour, consumers are trading down. Luckin is selling coffee at a promotional price that is one-third that of an equivalent beverage at Starbucks (it is also lacing some coffees with baijiu, a local firewater). Mixue and Cotti offer similarly cheap (though less boozy) fare.

Another explanation has to do with geography. Many homegrown chains come from places other than China’s rich megalopolises such as Shanghai. Cotti and Wallace opened their first outlets in Fuzhou, a “tier-2” city in the south-east. Tastien was founded in Nancheng, an inland railway hub likewise considered second-tier. Those are also the places where such chains are expanding most aggressively, in part because Western rivals have historically ignored them. About half of Tastien’s outlets are in second- and third-tier cities. Luckin’s rapid growth has been driven by its expansion in these relative backwaters, according to Nomura, a bank. Starbucks, by contrast, has barely ventured beyond the biggest cities in the past two years.

This has allowed the locals to take advantage of perkier consumer sentiment in such places. According to McKinsey, a consultancy, 30-somethings living there are less gloomy about their prospects than their metropolitan coastal counterparts. UBS, a bank, recently found that residents of smaller cities intended to spend more on dining, cosmetics and sportswear than those in larger conurbations.

Can the feast last? Foreign rivals are catching on. Between January and March about 60% of new Chinese KFCs and Pizza Huts (also owned by Yum China) opened in cities that are no bigger than third-tier. Many of the 4,000 new restaurants that McDonald’s is planning to open by 2028 are expected to be in smaller towns.

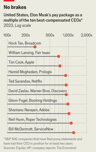

Potentially more worrying, Chinese consumers’ belt-tightening mood may spread inland from the coasts. Overall growth in retail sales has already slowed to 2.3% in April, year on year, down from 3.1% in March and 5.5% in the first two months of the year. Despite its piping-hot growth, and a near-tripling of pre-tax profit last year to 3.1bn yuan, Luckin’s shares have lost half their value since October. Chabaidao’s share price is down by more than 40% relative to what investors just paid at its IPO. Not the sort of bubble investors had in mind. ■

To stay on top of the biggest stories in business and technology, sign up to the Bottom Line, our weekly subscriber-only newsletter.