Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

According to the second annual ‘Global Survey on Crypto and Web3’ by MetaMask’s parent company, Consensys and YouGov, trends observed in the cryptocurrency ecosystem in 2024 show a continued shift toward the ownership mentality.

The report found that the industry is moving towards a “more equitable online landscape facilitated by crypto, blockchain, and Web3.” Notably, rather than the attitude of entities in the space, it’s that of individuals that’s changing.

The users are increasingly engaging with Web3 through investing, purchasing non-fungible tokens (NFTs), trading, staking, app development, and much more. This demonstrates that people in the crypto ecosystem are no longer “merely users but active contributors, builders, and owners of the ecosystem.”

This ownership mentality is rapidly growing. The survey respondents signaled a growing desire to own a stake in their online presence and related data and be compensated for that contribution. Moreover, they distrust social media in terms of data privacy and contributions to the internet.

YouGov interviewed 18,652 people aged 18-65 across 18 countries in North and South America, Europe, Africa, and Asia.

The Future of Money

Perhaps unsurprisingly, the report found emerging markets lead the way in blockchain adoption. On the other hand, several nations in Europe, east Asia, and the Americas remain more skeptical. However, both groups see blockchain as the ‘future of digital ownership’ or ‘the future of money.’

“In fact, said the report, “future of money remains the concept most frequently associated with crypto for the second year in a row.”

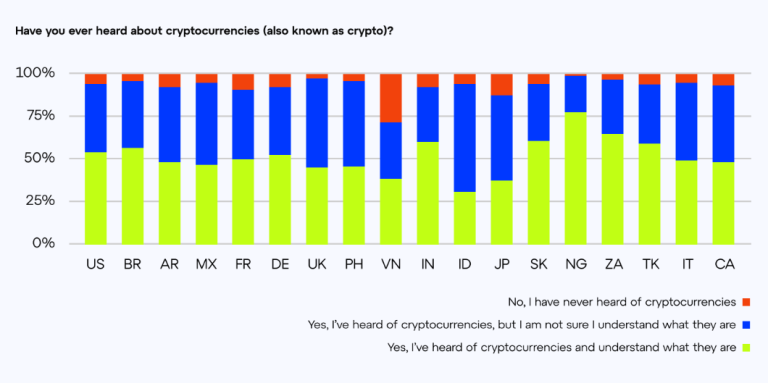

Notably, 93% of all people surveyed are aware of cryptocurrencies, up from 92% in 2023.

Source: Consensys

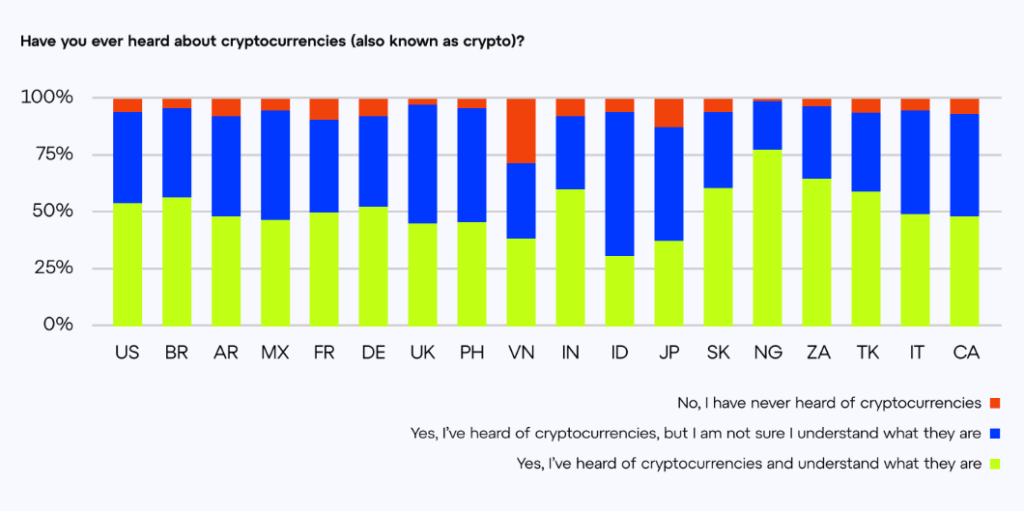

At the same time, over half of the respondents in Nigeria (84%), South Africa (66%), Vietnam (60%), the Philippines (54%), and India (50%) said they owned a crypto wallet in 2024.

The US saw the highest wallet ownership in the Americas (43%), and Turkey had the highest level in Europe (44%).

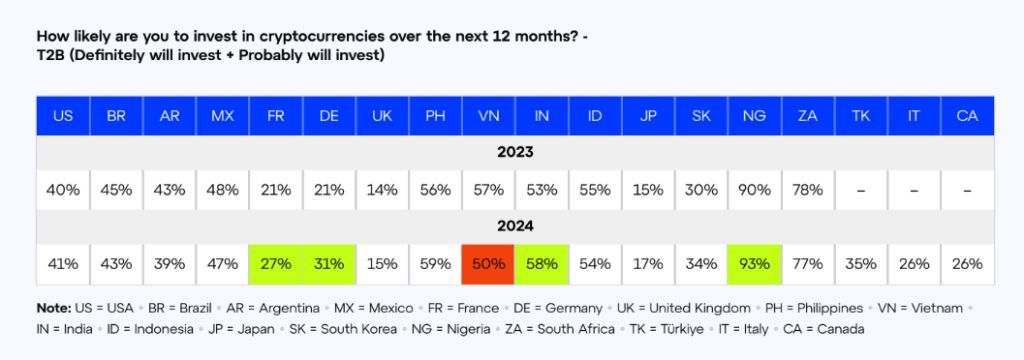

Furthermore, compared to the 2023 report, there is a notable rise in plans to invest among the respondents in the more crypto-skeptic countries, including France (+6) and Germany (+10).

Source: Consensys

Potential Solutions: Blockchain and Decentralization

Both the 2023 and the 2024 reports found that people want more control and ownership over their privacy, data, and identity online.

Individuals’ attitudes towards their online identities and the personal data they contribute to the internet are rapidly changing.

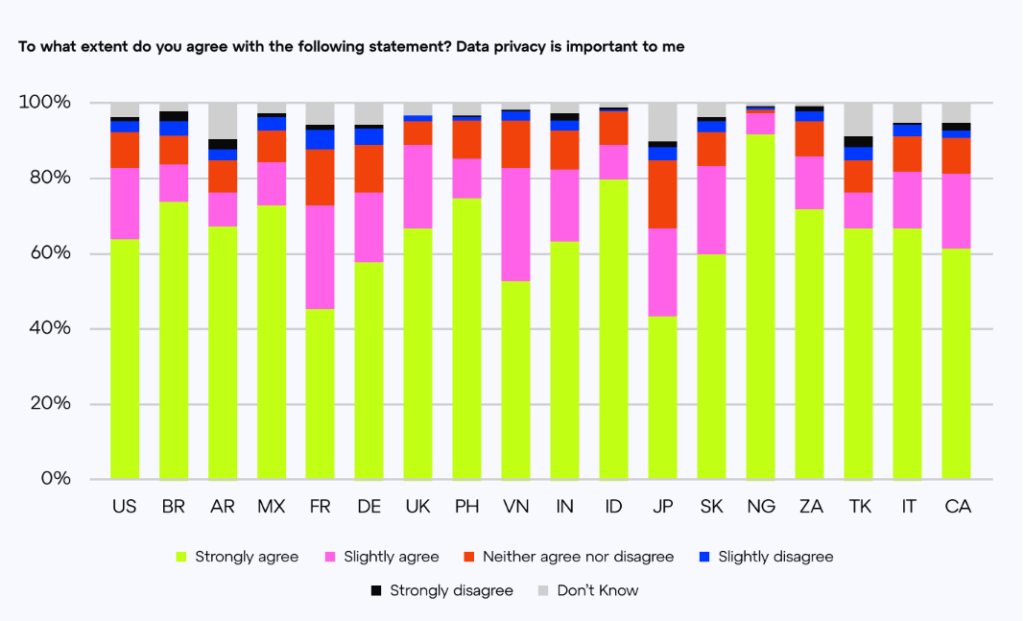

Data privacy is a top concern for 83% of the respondents worldwide. Also, 71% say they want more control over their online identity and a share of profits from the data they provide.

39% responded that they are adequately compensated for the value they add to the internet.

Source: Consensys

According to the report, “the desire for more privacy, control, and ownership emphasizes the potential for Web3, a new decentralized, transparent, and blockchain-based internet that is not controlled by centralized entities.”

Decentralization can give individuals control over their own data and privacy, which the current iteration of the Internet is unable to do.

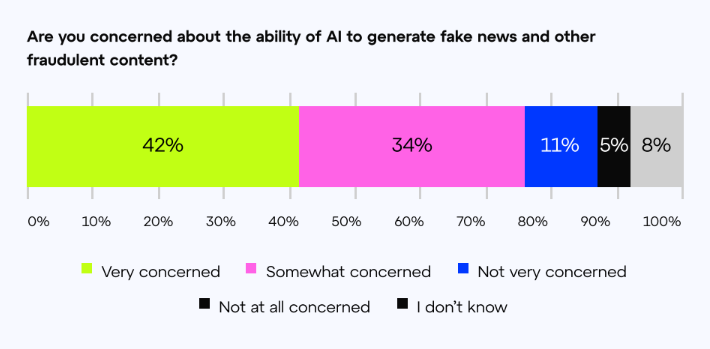

Also, over 75% are concerned about AI generating malicious content.

Source: Consensys

At the same time, less than half of the respondents said they trusted existing big tech platforms, and 82% think they have too much power.

These Web2 giants also don’t adequately compensate users for the value they generate when using the internet.

Meanwhile, most respondents think the current financial system needs to change. Nearly half think it should be improved. Significantly more people this year than last say it should be completely rebuilt (18%).

Over a third think social media platforms and international banking/money transfer systems would benefit from decentralization.

Many respondents argue that blockchain may be able to address the issues mentioned above. These include data privacy, online value creation, confidence in TradFi, AI fraud, risk, and malicious content.