Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Crypto investments saw a significant influx of capital last week, marking the largest inflows in five weeks, according to the CoinShares’ Digital Asset Funds Weekly Report published on Aug. 26.

The asset manager revealed that digital asset investment products saw inflows totalling $533 million for the week from Aug. 18 to Aug. 24, largely driven by remarks made by Federal Reserve Chairman Jerome Powell at the Jackson Hole Symposium on Aug. 23.

Crypto Assets Fund Flows Surge on Positive Outlook

In his speech, Powell discussed the progress made in reducing inflation and cooling the labor market while avoiding a sharp increase in unemployment. Overall, the speech conveys confidence in the Fed’s ability to achieve its dual mandate of price stability and maximum employment.

Powell’s suggestion that the first interest rate cut could occur in September sent a positive signal to the digital asset market, leading to a strong preference for Bitcoin (BTC). The cryptocurrency saw inflows of $543 million, underscoring its sensitivity to interest rate expectations.

Ether (ETH), on the other hand, experienced outflows of $36 million. However, newly launched spot Ether exchange traded funds (ETFs) continued to attract inflows, totaling $3.1 billion in the month since their debut. This was partially offset by outflows from the Grayscale Ethereum Trust (ETH), which amounted to $2.5 billion.

Blockchain equities also saw positive inflows for the third consecutive week, totaling US$4.8 million.

Regionally, the United States accounted for the majority of inflows, receiving $498 million. Hong Kong and Switzerland also saw notable inflows of $16 million and $14 million, respectively. Germany, however, experienced minor outflows of $9 million, making it one of the few countries with net outflows year-to-date.

Spot Bitcoin ETFs Reach New August High

The combined value of the spot Bitcoin ETFs reached a new August high of approximately $58.4 billion on Friday, Aug. 23, following a week of consistent positive inflows.

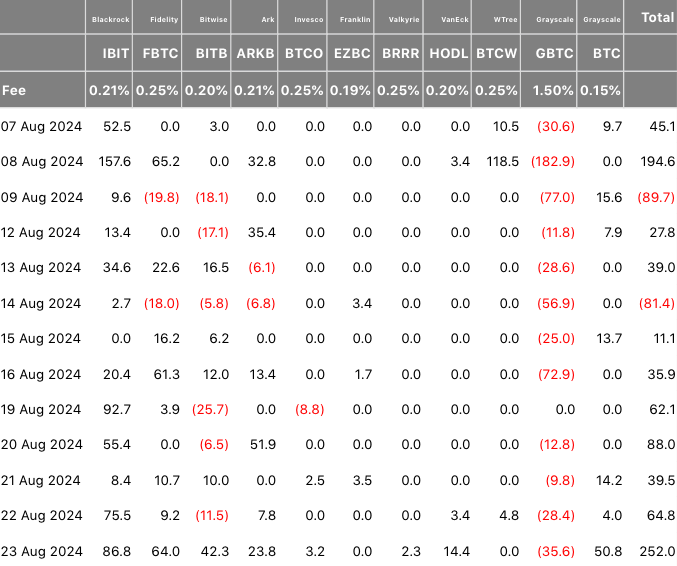

Inflows on Friday were particularly strong, totaling $252 million, the largest since July 22. BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot Bitcoin ETF by total asset value, continued to lead the pack with the highest net inflow of $86.8 million. Fidelity Wise Origin Bitcoin Fund (FBTC) followed closely with $64 million in inflows. While Grayscale Bitcoin Trust (GBTC) experienced an outflow of $35.6 million, its smaller Bitcoin Mini Trust (BTC) saw a $50.8 million inflow.

Other spot Bitcoin ETFs also saw notable inflows, including Bitwise’ BITB ($42.3 million), Ark and 21Shares’ ARKB ($23.8 million), and VanEck’s HODL ($14.4 million). Invesco’s BTCO and Valkyrie’s BRRR recorded smaller inflows, while the remaining funds saw minimal changes.