Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Cryptocurrency investment products recorded a major spike in inflows last week, reaching $2.2 billion, the highest inflow recorded since July.

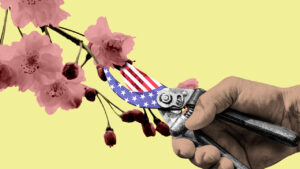

U.S. Election Optimism Drives Inflows

According to CoinShares’ Digital Asset Fund Flows Weekly Report, this surge was attributed to growing optimism about a potential Republican win in the upcoming U.S. elections and has sparked renewed interest in digital assets.

This is because the political climate in the U.S. has significantly impacted crypto investment dynamics.

“We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming U.S. elections, as they are generally viewed as more supportive of digital assets,” James Butterfill, head of research at CoinShares, stated.

This political sentiment contributed to the largest weekly inflows into crypto products since July, when $1.3 billion in inflows were recorded in one week.

The report revealed that the United States led this surge, with inflows of $2.3 billion. Australia is another country that recorded inflows of $1.4 million in that same period.

Meanwhile, countries like Canada and Sweden saw heavy outflows of 19.9 million and $18.2 million, respectively.

The report suggested that profit-taking in regions like Canada may have contributed to the outflows, especially amid the bullish market conditions in the U.S.

Bitcoin Takes the Lead in Inflows

Bitcoin continued to dominate the crypto market, securing $2.13 billion of the total inflows for the week.

CoinShares also reported that Ether-based products saw inflows of $58 million, while short-Bitcoin inflows reached $12 million, marking the largest inflows in this segment since March 2024.

The total assets under management (AUM) in crypto investment products approached the $100 billion mark, with BlackRock’s iShares Bitcoin exchange-traded fund (ETF) seeing $1.19 billion in inflows during the week.

This highlights the growing interest in Bitcoin ETFs, particularly in the U.S. market, where investors have been closely watching regulatory developments.

However, multi-asset crypto products did not fare well, with outflows amounting to $5.3 million. This decline ended a 17-week streak of consecutive inflows into these products.