Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Over seven million adults in the UK, accounting for 12% of the population, now own crypto assets, according to the Financial Conduct Authority’s (FCA) recent survey.

This marks a notable rise from 10% in 2022 and highlights growing public awareness of cryptocurrencies.

Breakdown of Crypto Ownership in the UK, Consumer Attitudes and Regulatory Challenges

The FCA’s findings show that crypto ownership and awareness has increased to 93%, with Bitcoin (78%), Ethereum (31%), and Dogecoin (30%) being the most recognized assets.

Bitcoin remains the most owned asset at 52%, followed by Ethereum at 42%, despite both seeing a decline in ownership since 2021.

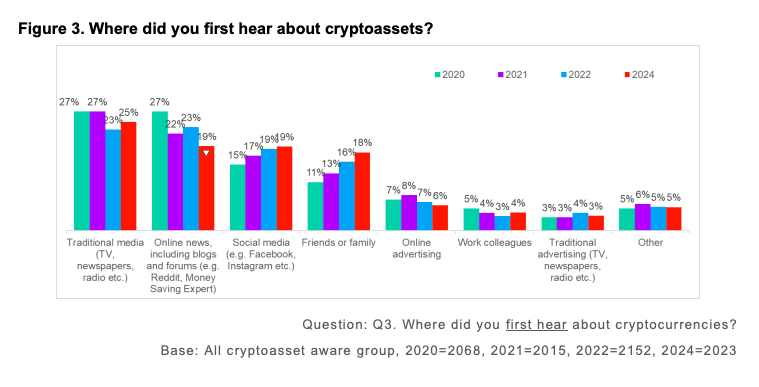

The FCA survey revealed that word-of-mouth remains the most influential factor for those entering the cryptocurrency space, with 32% of respondents saying they first heard about crypto assets through family and friends.

This was followed by 23% who were introduced to crypto via online news sources and 19% who learned about it through social media platforms.

FCA data about crypto awareness featured in the Crypto Assets Consumer Research 2024

Only 10% of crypto owners reported not conducting research before purchasing crypto, indicating a more informed approach to investing in these digital assets than in previous years.

Despite the increasing adoption, concerns about regulation and consumer protection remain.

A significant 27% of respondents said they would be more likely to invest in crypto assets if clearer regulations were in place. In comparison, 25% indicated that financial protection against potential losses would encourage them to invest more.

The survey also revealed that 33% of respondents mistakenly believed they could file complaints with the FCA if something went wrong with their crypto investments.

This misconception underscores the public’s desire for a more robust regulatory framework to safeguard consumer interests.

Matthew Long, the FCA’s Director of Payments and Digital Assets, emphasized the importance of consumer trust, stating, “Our research results highlight the need for clear regulation that supports a safe, competitive, and sustainable crypto sector in the UK.”

Crypto Staking, FCA’s Regulatory Oversight and Criticism

The survey also pointed to the growing trend of crypto staking and its associated risks.

The FCA has pledged to address these risks through its forthcoming regulatory framework, with consultations on stablecoins, trading platforms, and lending rules planned for 2025.

The FCA’s roadmap outlines a series of key dates for developing and introducing the UK’s crypto regime, with the final rules expected to be in place by 2026.

Over the past year, the FCA has intensified its scrutiny of the crypto sector.

This includes shutting down unregistered crypto ATMs, penalizing Coinbase $4.5 million for financial crime failings, and ensuring the integrity of crypto-backed investment products.

In 2023, nearly a third (30%) of the FCA’s financial crime specialists focused on crypto businesses.

The watchdog conducted 231 in-depth risk assessments and flagged 95 potential financial crime cases linked to crypto assets.

Despite criticism over its strict registration requirements, FCA officials defend their measures as essential to combating financial crime and maintaining market trust.