Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

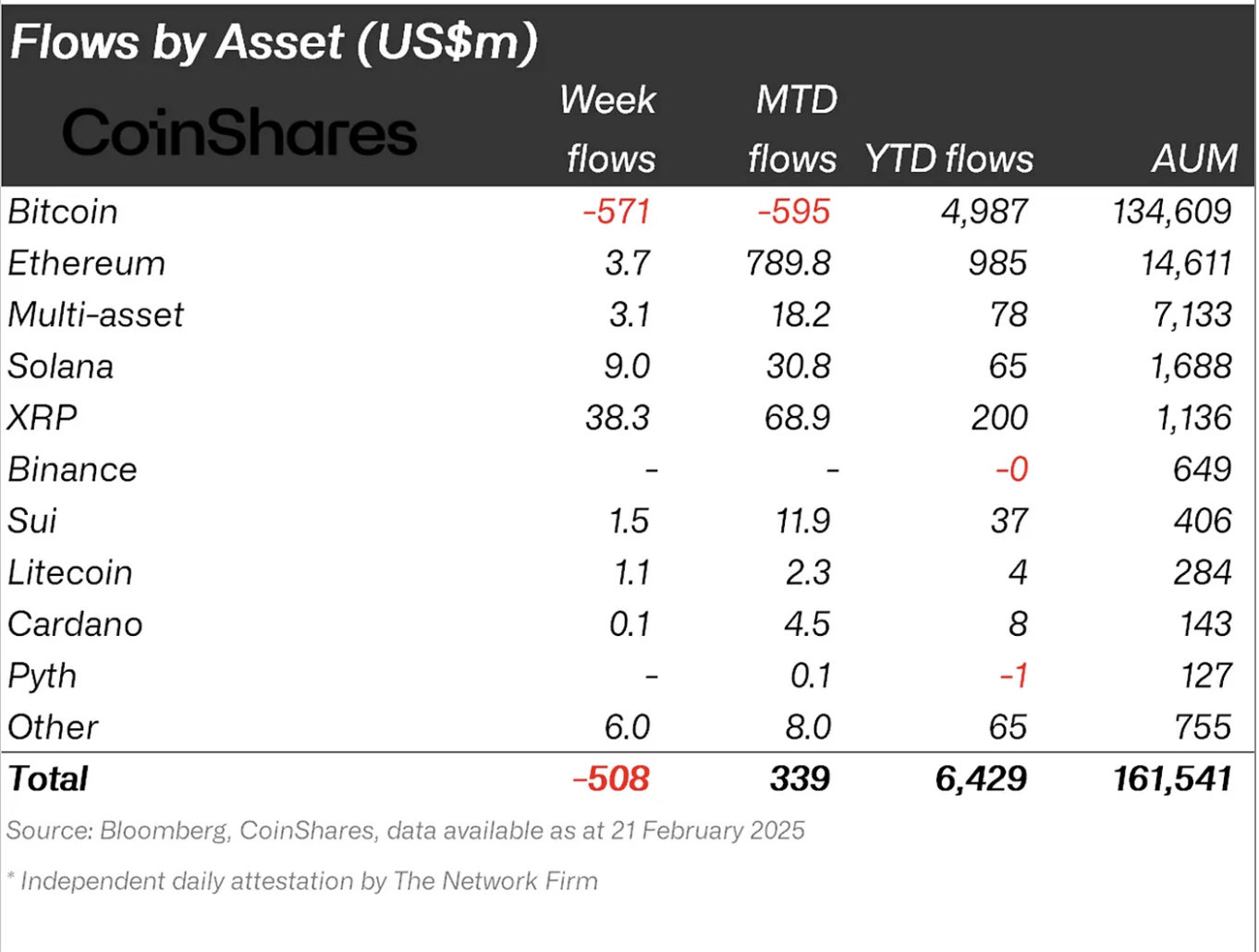

Crypto investment products saw significant outflows last week, totaling $508 million, as investors reacted to ongoing economic and regulatory uncertainties.

According to the report from CoinShares, it marked the second consecutive week of outflows, bringing the two-week total to $924 million. These figures follow an 18-week streak of inflows amounting to $29 billion.

The uncertainty stems largely from the recent presidential decisions, which have introduced concerns about potential trade tariffs, inflation policies, and shifts in monetary strategy.

Bitcoin Faces Heavy Selling Pressure Amid XRP’s Boom Because Of ETF Prospects

Bitcoin experienced the most outflows, with investors withdrawing $571 million. As the $2.8 million inflows into short Bitcoin products indicated, some traders even increased their short positions.

Despite Bitcoin’s struggles, altcoins managed to buck the trend and continue to attract investments. XRP led the charge, securing $38.3 million in inflows, bringing its total inflows since mid-November 2025 to $819 million.

This reflects growing investor confidence that the SEC will eventually drop its long-standing lawsuit against Ripple, XRP’s parent company. This is especially true since the SEC recently dropped all cases against Coinbase.

Other notable altcoins, including Solana ($8.9 million), Ethereum ($3.7 million), and Sui ($1.47 million), also saw inflows.

However, XRP’s continued inflows come as the SEC formally acknowledged a filing for a spot XRP exchange-traded fund (ETF).

In contrast to market optimism, Bloomberg ETF analysts James Seyffart and Eric Balchunas estimate that approval is just 65% likely, making it the least likely of the proposed crypto ETFs.

Litecoin (LTC) leads with a 90% approval probability, followed by Dogecoin (75%) and Solana (70%).

The SEC has until October 2025 to issue a final decision on the matter. The agency’s hesitation stems from XRP’s prolonged legal battle concerning its classification as either a security or a commodity.

Ripple Labs has been engaged in litigation with the SEC for over four years, with the agency accusing it of unlawfully selling XRP to retail investors in 2019.

A partial victory for Ripple in 2023 clarified that XRP is not a security when sold on exchanges but may still be considered an unregistered security when sold to institutional investors.

Despite the legal uncertainties, recent political changes in the U.S. have boosted optimism within the crypto sector.

The new SEC leadership, led by Chairman Mark Uyeda, has taken a more conciliatory approach, scaling back aggressive enforcement actions that characterized the previous administration.

Ripple’s Chief Legal Officer, Stuart Alderoty, has expressed optimism about a favorable resolution soon, which could clear the path for an XRP ETF approval.

In contrast to the booming optimism in the US market, according to Coinshares, the U.S. experienced the most negative sentiment regionally last week, with outflows totaling $560 million.

On the other hand, European markets remained resilient, with Germany and Switzerland recording inflows of $30.5 million and $15.8 million, respectively.

Market Sentiment Hinges on Regulation

While the broader crypto market grapples with regulatory uncertainty, the strong performance of altcoins like XRP suggests that investors are selectively optimistic.

Approving an XRP ETF would reignite optimism and potentially open the door for further mainstream adoption.

Legal experts remain divided on the likelihood of approval. Some, like George Georgiades of Borderless.xyz, believe the SEC can approve an XRP ETF despite pending legal actions.

Others, such as 1inch’s Orest Gavryliak, consider Bloomberg’s 65% approval odds overly optimistic, given the SEC’s historical reluctance to approve ETFs amid unresolved litigation.

For now, XRP’s trajectory remains closely tied to regulatory developments. If the SEC drops its lawsuit or clarifies XRP’s classification, the asset could see continued bullish momentum.