Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

ABC Labs, the team behind Reserve, has launched the Reserve Index Protocol to offer twelve Decentralized Token Folios (DTFs).

The Reserve Protocol is a platform that enables anyone to create yield-bearing, decentralized, and asset-backed currencies, RTokens, as an alternative to inflation-prone currencies.

The press release shared says that the new Reserve Index Protocol provides “a first-of-its-kind, build-your-own ETF-like experience to crypto” to investors and institutions, via its “one-click, easy-to-use” solution.

Thomas Mattimore, CEO of ABC Labs, commented that:

“We built the Reserve Index Protocol to become a ‘decentralized BlackRock,’ which we believe will open up the floodgates of creativity. Plus, by partnering with some of the premier index creators in the world, people can now easily get one-click exposure to this growing industry alongside trusted brand names.”

Twelve index-based DTFs are available starting today. These include the Bloomberg Galaxy Crypto Index; CoinDesk DeFi Select Index; MarketVector Token Terminal Fundamental Index through partnership with Re7 Labs; the Virtuals Index by Virtuals Protocol; the RWA Index and Large Cap DeFi Index by MEV Capital; the Alpha Base Index by Altcoinist.com; the Clanker Index from proxystudio, the BTC/ETH DCA Index and the Imagine the SMEL curated by Steakhouse Financial; the DeFi Growth Index by Today in Defi; the Base MemeIndexer by DTF, and the Clearstar Labs AIndex by Clearstar Labs.

Martin Leinweber, Director of Digital Asset Research & Strategy at MarketVector Indexes, said that the integration into Reserve’s DTF platform subsequently makes regulated, professional-grade indexes more accessible while also preserving the transparency that institutional and retail investors demand.

Furthermore, the Reserve Index Protocol revealed its new incentive mechanism, giving creators more control over dividing fees from native tokens they launch on the Protocol. The team argues that this approach enables DTF creators to form teams, raise capital, and offer liquidity incentives, among other advantages.

You might also like

The Largest DTF Platform by TVL

“’DTFs’ are like ETFs but in DeFi,” says the website.

DTFs bundle related tokens into broad crypto indexes or emerging thematic narratives, says the press release, such as DeFi, real-world assets (RWA), AI, DePIN, DeSci, GameFi, and memes. This way, they work to simplify the investment process.

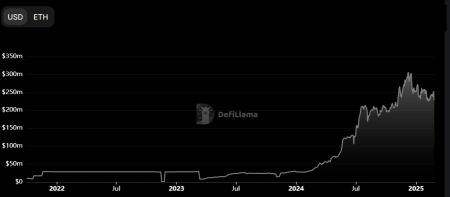

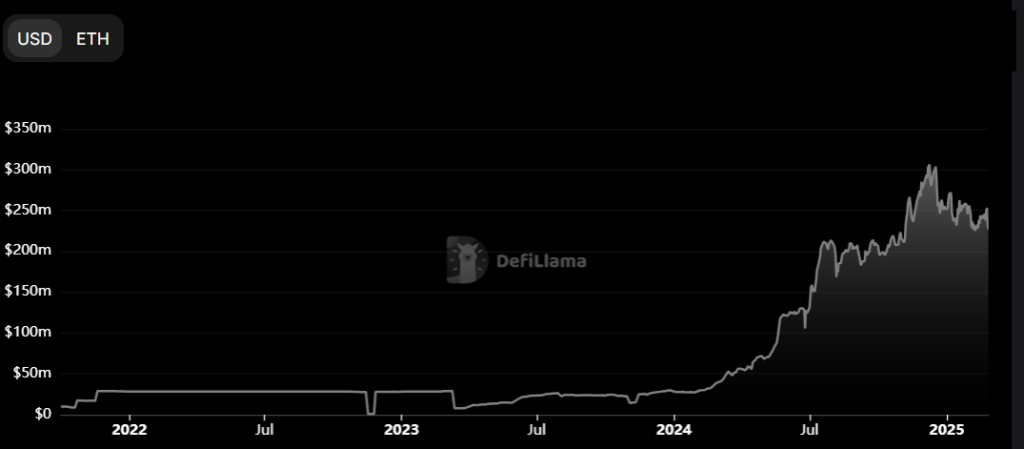

Currently, Reserve is the largest DTF platform by TVL. It boasts $226.82 million compared to the second-placed $113.03 million by Enzyme Finance. These two accounts for a large chunk of the total Indexes TVL, now standing at $672.1 million.

Notably, anyone can create a new DTF, but anyone can also mint or redeem its tokens 24/7 – not just authorized participants and market makers. Like an ETF, each DTF unit is redeemable 1:1 for its underlying basket of assets.

Redemption occurs via a smart contract, but the underlying tokens remain in the contract, so there is no need for a centralized custodian.

This also means that DTFs can be governed by a decentralized body instead of a centralized investment company. They can have no governance at all.

According to Connor Milner, Partnerships at Re7 Labs, “While ETFs revolutionized thematic investing, DTFs are completely redefining it. We’ve barely scratched the surface of what’s possible with onchain indexes, unlocking potential that was previously unimaginable.”

You might also like